Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Strategist

Why defense is being discussed as “part of all portfolios”

Defense sits at the intersection of three forces that matter for long-term investing:

The year has started with a reminder that national security issues are no longer “somewhere else” or “some other time.”

This matters for investors because defense spending is often one of the first places governments try to “do something visible”—even when other parts of the budget are under strain.

NATO has raised the bar on European defense spending

For years, the shorthand was “2% of GDP.” Now the direction is clearer.

NATO’s Hague Summit commitments point to 5% of GDP by 2035, with at least 3.5% aimed at core defense and up to 1.5% toward security-related areas like protecting infrastructure, networks, and resilience.

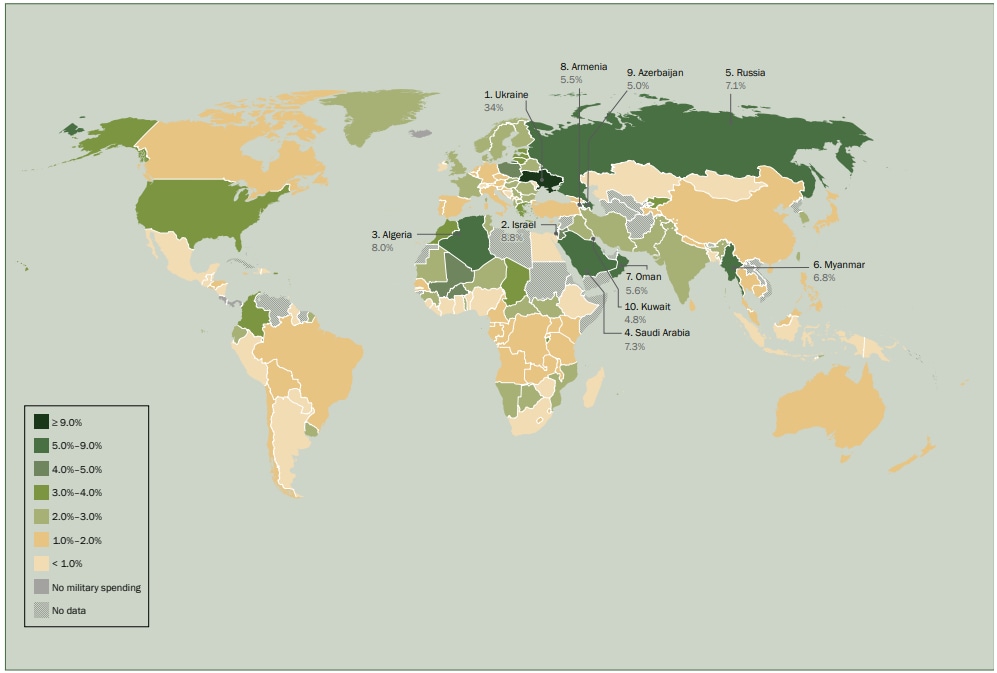

Chart 1: Military spending as a share of gross doemtic product, by country, 2024  Source: SIPRI Military Expenditure Database, April 2025

Source: SIPRI Military Expenditure Database, April 2025

President Trump has called for a $1.5 trillion US military budget for 2027 (up from $901 billion for 2026), but he has also signalled tougher expectations for contractors, pushing them to prioritise delivery and production over shareholder payouts in cases of underperformance.

This means demand can rise, but the sector may face more political scrutiny. That can create more headline-driven swings, especially in companies tied to programs that are delayed or over budget.

AI is changing defense faster than most people think

AI’s impact is practical and near-term:

But the risks are real: AI in security can become controversial quickly after accidents, misuse, or public backlash. That can slow projects, change rules, or redirect spending.

Mapping out the defense sector

This area is focused on protecting cities, bases, and critical infrastructure. It often includes sensors, air defense electronics, and command systems.

US: RTX, Lockheed Martin

Europe: Thales, Saab

What to watch: new orders, delivery timelines, and whether replenishment becomes a priority.

This area matters when governments want to rebuild stockpiles and shorten delivery times.

Europe: Rheinmetall, BAE Systems

US (more indirect, but still relevant): General Dynamics

What to watch: production capacity expansion, availability of key components, and political pressure on pricing.

This is where the “AI and data” angle often shows up most clearly. It is about seeing, connecting, and coordinating faster.

US: Northrop Grumman (space and strategic systems exposure), L3Harris (communications and defense electronics), Palantir (software and data tools linked to defense use cases; often more volatile)

Europe: Leonardo (defense electronics and platforms), Thales (sensors, electronics, and security systems)

What to watch: government contracts that move from pilots to real deployment, and any sudden political pushback around surveillance or AI.

This area supports maritime security, but projects can take longer and face delivery risk.

US: Huntington Ingalls (naval shipbuilding exposure), General Dynamics (submarine exposure via Electric Boat)

Europe: Rolls-Royce (defense propulsion exposure; not a pure-play defense company)

Risk note: capacity constraints and program delays are common here. The work can be large, but the timelines can be messy.

Japan has been on a path of higher security spending, and the investable names tend to reflect different parts of the ecosystem.