Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Saxo Group

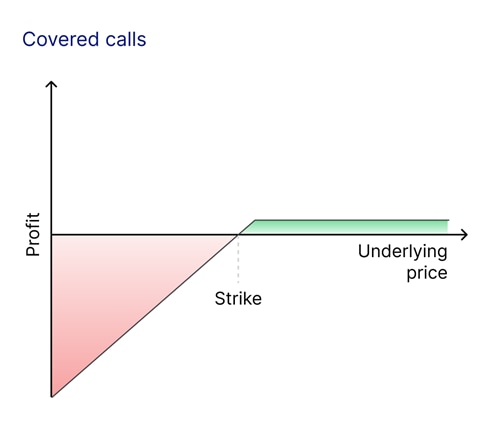

A covered call is an investment strategy that involves owning a futures contract while simultaneously selling a call option on that contract. By doing this, the trader grants another party the right, but not the obligation, to purchase the futures contract at a predetermined strike price within a set period. In return, the trader receives an upfront payment known as the premium, which provides an immediate source of income.

For example, consider a trader holding a long position in one Crude Oil futures contract, which represents 1,000 barrels of oil. If the current futures price is USD 75 per barrel, the trader might sell a call option with a strike price of USD 80 per barrel, expiring in 30 days. In exchange, they receive a premium of USD 1 per barrel, earning a total of USD 1,000 since the contract covers 1,000 barrels.

There are two primary reasons to use a covered call.

Selling call options generates extra income. If you are already holding a futures position and are open to selling it at a slightly higher price, this strategy can boost your returns.

The premium you collect acts as a cushion against minor price drops in the futures market. For instance, if Crude Oil futures fall from USD 75 to USD 74, the USD 1,000 premium offsets this loss.

Think of it as renting out a room in your house. You retain ownership of the property, but the rental money helps cover costs and adds to your income.

If we look at a crude oil example, we can explore different potential outcomes of the covered call strategy.

In the first scenario, if crude oil futures remain around USD 75 by the time the option expires, the buyer is unlikely to exercise their right to purchase the contract at USD 80, as they could buy it for less on the open market. As a result, the trader keeps the USD 1,000 premium and retains ownership of the long futures position, making this a clear win.

In the second scenario, if crude oil futures rise to USD 85 per barrel, the buyer exercises their right to purchase the contract at USD 80, as this price is lower than the market value. The trader sells the contract for USD 80,000 and keeps the USD 1,000 premium, earning a total of USD 81,000. While this means missing out on an additional USD 5,000 that could have been gained by selling at USD 85, it still secures a solid profit.

In the third scenario, if crude oil futures fall to USD 70, the call option expires worthless since no buyer would choose to purchase the contract at USD 80 when the market price is significantly lower. The trader keeps the USD 1,000 premium, which helps offset some of the loss in the value of the futures contract. However, because they still hold the contract, no loss is realised unless they decide to sell.

Here is a summary of the key elements of a covered call strategy.

First, the futures contract is essential, as you must own one to use this approach. The position is considered "covered" because your ownership ensures that you can fulfil your obligation if the option is exercised.

Next is the call option, which has two important components. The strike price is the price at which the buyer has the right to purchase your futures contract, typically set slightly above the current market price. The expiration date defines the period in which the buyer can exercise their option, often aligning with a predetermined schedule, such as the third Friday of a month.

Finally, the premium is the upfront payment you receive for selling the call option. This amount is yours to keep regardless of how the market moves, making it a key benefit of the strategy.

A call option buyer believes the futures price will rise significantly. Call options provide a way to profit from price increases without taking on the full risk of owning the futures contract outright.

For instance, the buyer of your crude oil call option could make a considerable profit if futures prices rise above USD 80. If they paid only USD 1,000 for the option, any price above USD 81 per barrel (strike price plus premium) represents a profit.

This potential for upside gain is what makes call options attractive to traders.

No investment strategy is without its pros and cons, and covered calls are no exception.

Here’s a balanced view of the potential benefits and drawbacks.

If you’re already holding a futures contract, you may wonder why you’d opt to sell a covered call instead of simply holding the position. Here are some reasons this strategy makes sense:

To better understand the versatility of a covered call, let’s compare it to an alternative strategy: protective puts.

Your choice between a covered call and a protective put depends on your market outlook and goals:

By blending these strategies, you can adapt to different market scenarios and align with your risk tolerance and financial objectives.

Covered calls are a suitable option for investors and traders who:

This strategy is particularly appealing for those who prefer steady, incremental gains over the unpredictability of high-risk trades.

A covered call is like finding a way to earn money from the assets you already own. Over time, the premiums collected from covered calls can build wealth in a controlled and sustainable way.