Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Saxo Group

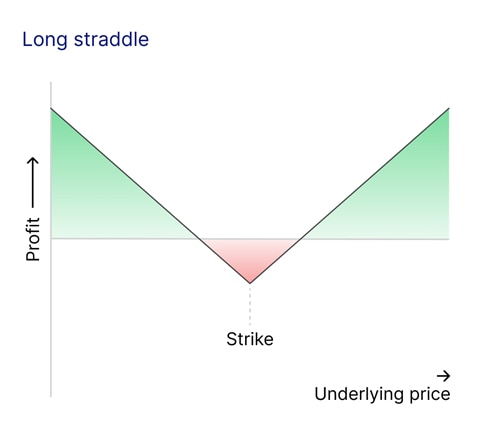

A straddle is a trading strategy that involves buying two options, both with identical strike prices and expiration dates:

This approach is based on the belief that the asset’s price will experience significant volatility, either upward or downward, but without clarity on the specific direction.

The key to a successful straddle is volatility. The strategy becomes profitable if the asset's price moves significantly in one direction. However, if the price remains relatively stable, the trader could incur a loss because the options may not generate enough value to offset their initial cost.

To set up a straddle, follow these steps:

Both options must have identical strike prices and expiration dates, ensuring alignment between the risks and rewards over the same timeframe. For example, if you’re trading Gold options, you might purchase call and put options with a one-month expiration period or select a timeframe that matches your expectations for price movement.

When setting up a straddle, the strike price plays a critical role. Investors typically choose one of the following:

Although ATM strikes are the standard choice for straddles, market conditions or specific volatility forecasts may prompt traders to select ITM or OTM strikes. Each option affects the risk-reward balance differently.

The expiration date of the Options determines how much time the trader has for the expected price movement to occur. Here are two broad approaches:

Traders must weigh the cost of longer expirations against the urgency of their expectations for price volatility.

When executing a straddle, the trader profits from substantial price movements in the underlying asset, whether upward or downward. The total cost of the straddle is the combined premium paid for the call and put options.

To determine the upper and lower breakeven points, add or subtract the total premium cost from the strike price. For example:

For the strategy to be profitable, the asset’s price must move beyond either breakeven point. If the price remains between USD 90 and USD 110, the trader incurs a loss equal to part or all of the premium.

Two key measures of volatility influence a straddle’s success:

If the price movement fails to surpass the breakeven points or if realised volatility underperforms relative to implied volatility, the strategy could result in a loss.

While a straddle is a popular strategy for profiting from volatility, other options strategies also aim to capitalise on price movements or volatility but with different risk and reward profiles. Here are three notable alternatives:

Strangle involves buying a call option and a put option, similar to a straddle, however the strike prices of the call and put are different. Typically, the call strike price is set above the underlying asset’s current price, while the put strike price is set below it. Straddles have tighter breakeven points, which means the underlying asset doesn’t need to move as far to become profitable, although, when a trader expects moderate volatility rather than extreme price swings, a strangle can be useful as it offers a lower-cost entry compared to a straddle.

An iron butterfly combines elements of a straddle and a spread strategy:

The profit potential of a straddle is unlimited because gains grow with significant price movement whereas, in contrast, the iron butterfly’s profits are capped due to the additional options that limit both the upside and downside. A trader might consider an iron butterfly instead of a straddle if you believe the underlying asset’s price will remain close to the strike price by expiration as it benefits from low volatility and time decay.

An iron condor involves both buying and selling call and put options at different strike prices:

The goal of an iron condor is to profit from low volatility within a defined range, whereas a straddle excels in high-volatility markets as it is designed to profit from large price movements. As such, in calm markets where the underlying asset’s price is likely to remain stable, an iron condor provides a way to profit from minimal price fluctuations and time decay.

Like any strategy, the straddle comes with its strengths and weaknesses. Traders should carefully weigh these factors before implementing it.

To better understand the mechanics of a straddle, it’s essential to consider option Greeks, which measure different risks associated with options pricing. Here’s how the key Greeks apply to a straddle:

The straddle is a versatile and powerful strategy for traders looking to capitalise on volatility without committing to a specific price direction. By carefully selecting strike prices, expiration dates, and monitoring market conditions, traders can position themselves to profit from significant price movements.

That said, the strategy is not without its challenges. Its high cost, reliance on volatility, and sensitivity to time decay mean that traders must conduct thorough analysis and manage risk effectively. For those anticipating unpredictable market behaviour, however, the straddle remains an excellent tool for navigating uncertainty and turning price swings into opportunities.