Key points:

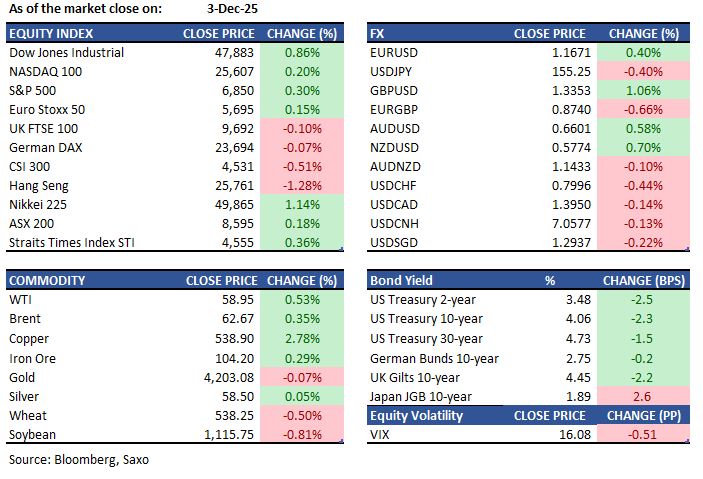

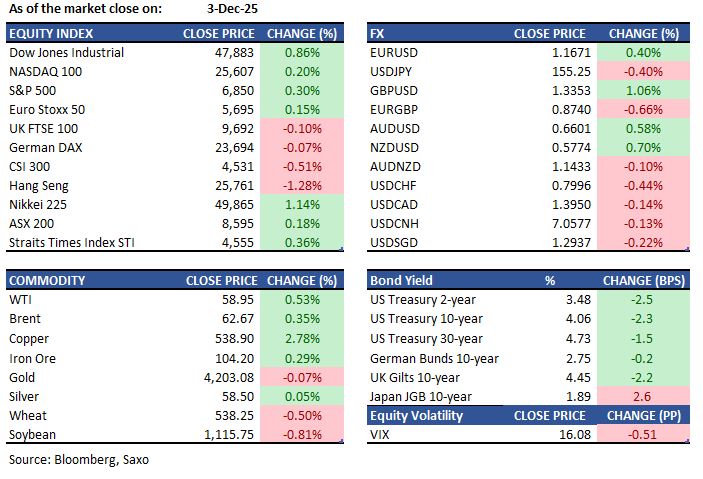

- Macro: US private sector jobs fell 32K in November; biggest drop since 2023

- Equities: Microsoft down 2.5% on weaker AI demand despite unchanged sales quotas

- FX: Dollar drops on weak private jobs data; GBP and NZD lead

- Commodities: Copper jumps 3.1% on supply fears; up 30% this year

- Fixed income: Treasuries rise on weak payroll data; Fed cut anticipated December 10

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- ADP said US companies shed payrolls in November by the most since early 2023, with private‑sector employment down 32,000 as firms with fewer than 50 employees cut 120,000—the largest one‑month drop since May 2020—while wage growth cooled, with job changers’ pay up 6.3%, the lowest since February 2021.

- US ISM Services PMI rose to 52.6 in November, marking the strongest sector growth in nine months and beating forecasts. Business activity and new orders expanded, with the backlog of orders hitting a high since February. However, tariffs and the government. shutdown continue to pressure demand and costs. Employment contracted at 48.9, while supplier deliveries slowed. Price pressures eased to a seven-month low.

Equities:

- US - S&P 500 closed around 6,850, its seventh gain in eight sessions, with nearly 350 stocks rising despite megacap weakness. After-hours, Salesforce rose 2% post-market on solid revenue outlook; Snowflake fell 7.9% post-market due to weak margin guidance. Nvidia’s Jensen Huang questioned whether China would accept H200 chips even if US curbs ease; Microsoft fell 2.5% on reports of softer demand for some AI tools despite saying aggregate AI sales quotas are unchanged; American Eagle jumped 15% on a beat and raised guidance while Macy’s fell on a disappointing profit outlook; iRobot surged 74% alongside other robotics names on talk of a possible executive order next year, and Marvell rose 8% after forecasting a 25% data‑centre revenue increase.

- EU - European stocks were mixed on Wednesday amid corporate updates and differing euro-US rate outlooks. The STOXX 50 rose 0.1% to 5,693, while the STOXX 600 also increased 0.1% to 576. ECB President Lagarde predicted stable inflation, but Lane warned of upside risks. Weak US labor data bolstered Fed rate cut expectations. ASML gained 2.6% following upgrades from BofA and JPMorgan. Inditex jumped 9% on strong earnings and an affirmed full-year outlook. Stellantis climbed 7.7% after a UBS upgrade, while Airbus rose 1.5%, maintaining its financial targets despite delivery adjustments. Conversely, financials such as Allianz, ING, and Santander fell between 1.3% and 2%.

- HK - Hang Seng Index fell 334 points, or 1.3%, to 25,761, ending a two-day rise as all sectors declined. Weaker sentiment followed reports of China’s slow services growth and financial woes at Vanke, prompting a 1.6% drop in the property sector. Fitch placed Vanke on “Rating Watch Negative.” Losses in financial, tech, and consumer stocks compounded amid fading stimulus hopes. Limited downside came from China's issuance of rare earth export licenses, boosting shipment prospects. U.S. futures rose on Fed rate cut optimism. Biggest laggards included PICC Property & Casualty (-4.1%) and SMIC (-1.8%).

Earnings this week:

- Thursday: Kroger, Dollar General, DocuSign, Ulta Beauty, Hewlett Packard Enterprise

- Friday: Victoria's Secret, MoneyHero

FX:

- USD fell alongside Treasury yields after private‑sector payrolls posted the biggest drop since early 2023, reinforcing expectations of a Fed rate cut next week. DXY fell below 99 level.

- GBP led G‑10 gains, triggering sizeable stops against the euro, with cable up about 1.1% to a 1.3353 high—its sharpest rise since May—and one‑month options sentiment the least bearish in over a month ahead of BoE policymaker Catherine Mann’s remarks later today.

- EURGBP slid 0.7% to a 0.8737 low—its steepest decline since August—with large stops filled below 0.8785 and more eyed beneath 0.8730, according to a Europe‑based trader.

- USDJPY fell 0.5% to 155.15 before recovering to 155.25, while USDCHF dropped 0.5% to 0.7994, as lower US yields and expectations of a BoJ rate hike next week supported the yen; the Japan Council of Metalworkers’ Unions is pushing for a monthly base‑pay increase exceeding last round’s record.

- AUD and NZD closed near session highs.

Commodities:

- Oil edged higher as US–Russia talks failed to yield a Ukraine deal, stoking concerns that Russian supply restrictions could persist, with WTI up 0.5% to settle near $59 within this week’s tight range after the Kremlin called talks with envoys Steve Witkoff and Jared Kushner “constructive” but confirmed no agreement.

- Silver traded near a record after ADP showed the biggest November payroll drop since early 2023, reinforcing bets on a Fed rate cut at its final 2025 meeting; silver hit an all‑time high of $58.9789 an ounce as gold rose 0.1% to $4,209.27 after a two‑day decline, with palladium and platinum also advancing.

- Copper rallied 3.1% to a record $11,145 a tonne on the LME as surging warehouse withdrawals and potential US tariffs stoked supply‑squeeze fears, with the benchmark up over 30% this year amid major mine outages.

Fixed income:

- Treasuries rose after weaker‑than‑expected ADP November private‑payrolls data in the US morning and, despite a mid‑session setback, closed near the day’s highs. Markets still price about a 90% chance of a quarter‑point Fed cut on 10 Dec., while Australian bonds gained for the first time in five days, tracking the move higher in US Treasuries. Japanese government bonds are likely to decline as traders eye a 30-year auction later on Thursday.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.