Key points:

- China tech is now a real competitor: While U.S. giants face mounting questions around AI monetization and stretched valuations, Chinese firms are showing tangible earnings lift from AI and cloud.

- Restrictions are fueling innovation: U.S. export controls have forced China to double down on domestic chip development, backed by strong policy support and abundant capital.

- Two tracks, one narrowing gap: U.S. tech remains globally dominant, but China tech is catching up fast at home. The race is increasingly about frontier vs. efficiency, and the gap is clearly closing.

For years, the U.S. has been the uncontested leader in technology—commanding the world’s most advanced chips, deepest capital pools, and strongest platforms.

But China’s tech ecosystem is closing the gap. Alibaba’s latest earnings were a reminder that China’s giants are proving they can monetize artificial intelligence and cloud computing at home, even under the weight of U.S. restrictions.

The question for investors is no longer if China can catch up—it’s how far and how fast.

Why this matters

- Alibaba’s rebound is symbolic. Its cloud division grew strongly, powered by AI demand, and shows Chinese firms can monetize new technologies at scale.

- Chip restrictions bite, forcing innovation. U.S. export controls limit China’s access to cutting-edge GPUs, forcing local innovation. Ironically, that may accelerate China’s drive for self-sufficiency.

- Policy tailwinds in China. Beijing’s fiscal and regulatory support, together with a domestic market of 1.4 billion consumers, ensures scale that is hard to ignore.

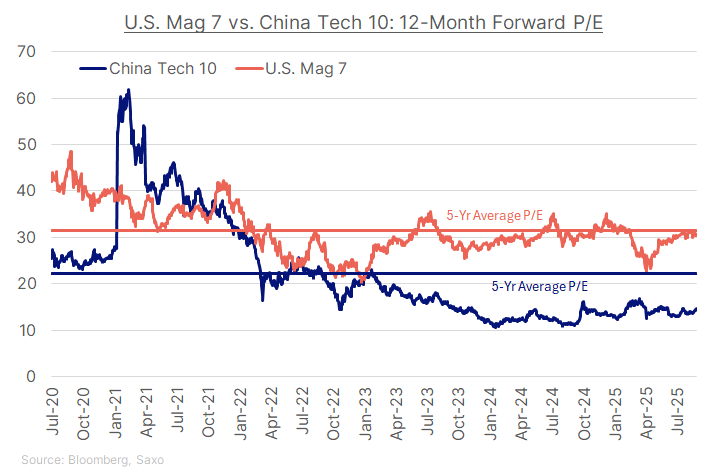

- Valuation gap remains wide. U.S. tech trades near 27x forward earnings, while China tech sits closer to 12x, offering room for re-rating if earnings revisions continue upward.

- U.S. policy uncertainty. From tariff risks to shifting regulatory stances on Big Tech, the American environment is less predictable.

China: From demographic to innovation dividend

China once rode a demographic dividend, with a vast pool of low-cost labor fueling manufacturing and export growth.

With the workforce now shrinking, the country is pivoting to an innovation dividend. That means AI, green energy, and advanced manufacturing are taking center stage.

For investors, it’s a structural shift that creates new opportunities.

China’s AI focus: Efficiency over sheer power

Unlike the U.S., which pushes the frontier with ever-larger models and more advanced chips, China’s strategy is different.

China isn’t competing to build the biggest or most powerful AI models. It is making AI more efficient, accessible, and deeply embedded across the economy. The key enablers for China’s AI strategy remain in place, such as:

- Data: The world’s largest dataset—over a billion mobile phone users—under central governance.

- Energy: Ten new nuclear plants built last year, ten more in the pipeline, securing long-term AI energy needs.

- Talent: The World Economic Forum notes that 47% of the world’s top AI researchers are now in China.

- Computing: U.S. chips are superior today, but China is rapidly narrowing the gap through Huawei and others.

- Regulation: Over 250 AI regulatory standards are already in place, balancing innovation with governance and security.

This creates an ecosystem where economics matter more than perfection, and good-enough domestic chips and efficient models can transform e-commerce, payments, logistics, and consumer services.

How China tech differs from the U.S.

Strengths:

- Efficiency-first approach that lowers costs for mass-market adoption.

- Open-source momentum (Meituan, Baidu’s Ernie) fosters faster diffusion.

- Policy alignment and infrastructure scale support rapid rollouts.

Weaknesses:

- Still dependent on lagging hardware compared to U.S. leaders like Nvidia.

- Global reach constrained by governance, trust, and compliance issues.

- Innovation often incremental rather than groundbreaking at the frontier.

China Tech 10 vs. U.S. Mag 7

Bloomberg’s China Tech Select 10 (comprising Alibaba, Baidu, BYD, JD.com, Meituan, Midea, NetEase, Tencent, Trip.com, and Xiaomi) provides a powerful foil to the U.S. Mag 7 of Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla.

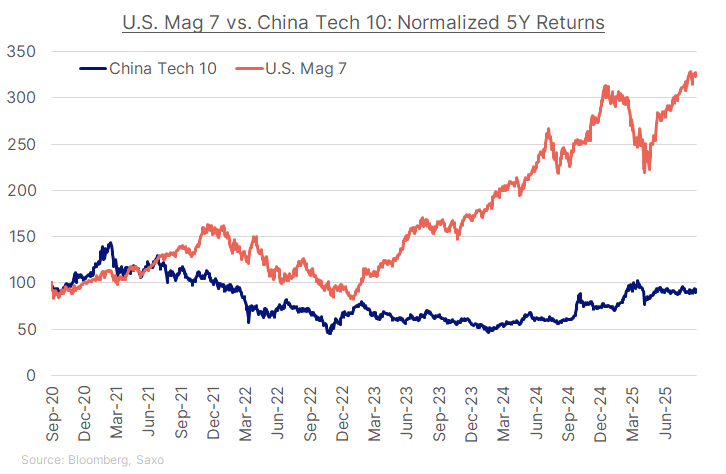

Performance gap:

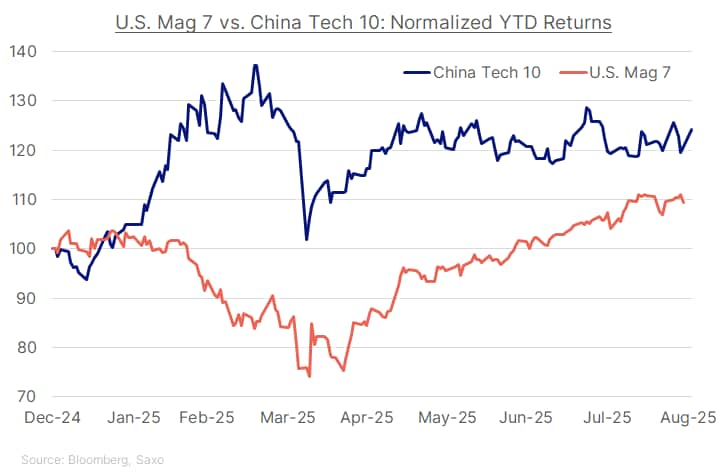

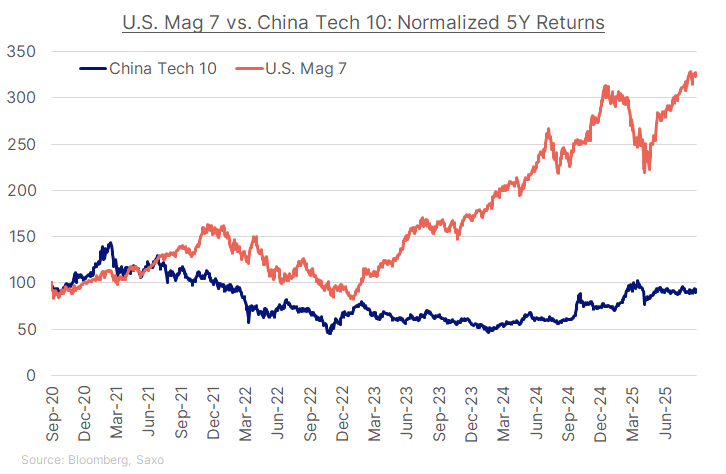

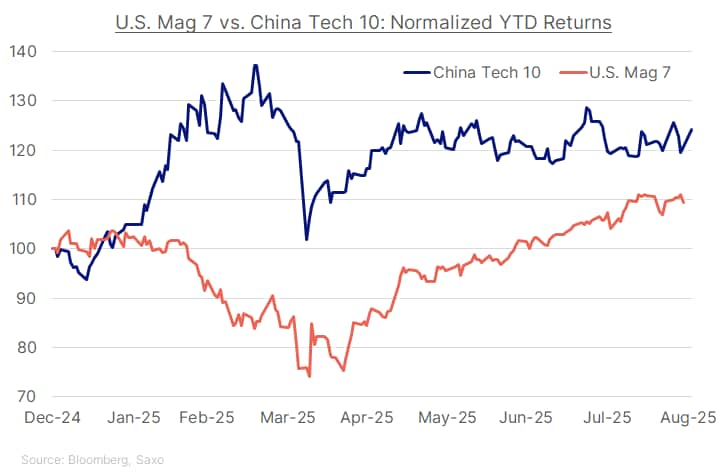

- YTD: China Tech 10 is outperforming, boosted by AI-linked gains in Alibaba and Tencent, and strength in EVs via BYD.

- 5-year: The U.S. Mag 7 has massively outperformed, driven by Nvidia’s dominance in AI chips, Apple’s ecosystem strength, and trillion-dollar cloud platforms from Microsoft, Amazon, and Alphabet.

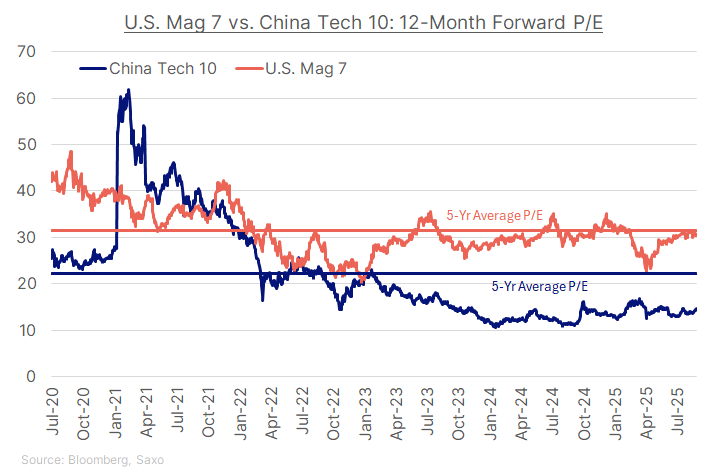

Valuation difference:

- U.S. Mag 7 trades around 30x forward earnings.

- China Tech 10 trades closer to 13x, reflecting policy risk and lower global reach, but also providing more room for re-rating if AI and cloud momentum sustain.

The contrast highlights a two-track story: U.S. tech is still the global benchmark at the innovation frontier, while China tech is catching up fast at home, with policy, scale, and valuation on its side.

The investor take

China’s pivot to innovation and AI is real, but not without limits. Domestic players can thrive within the firewall, but globally they face hurdles around trust, compliance, and chip access. Still, the building blocks – data, energy, talent, and governance – give China the capacity to keep closing the gap at home, even if the U.S. remains the global benchmark.

For now, U.S. megacaps like Nvidia, Microsoft, and Alphabet remain the leaders at the frontier of hardware and platforms. But with valuations stretched in the U.S. and improving in China, the smarter allocation may be to think in two tracks: U.S. tech for global leadership, and China tech for domestic scale.