Key points:

- The risk mix has widened: Geopolitics, policy credibility, macro uncertainty, and AI leadership rotation can all drive markets in 2026, often abruptly and with different winners/losers.

- Diversification is a fragility test: The goal isn’t to own everything; it’s to avoid a portfolio that relies on one assumption (oil stays calm, one rate path, one equity style, one AI cluster).

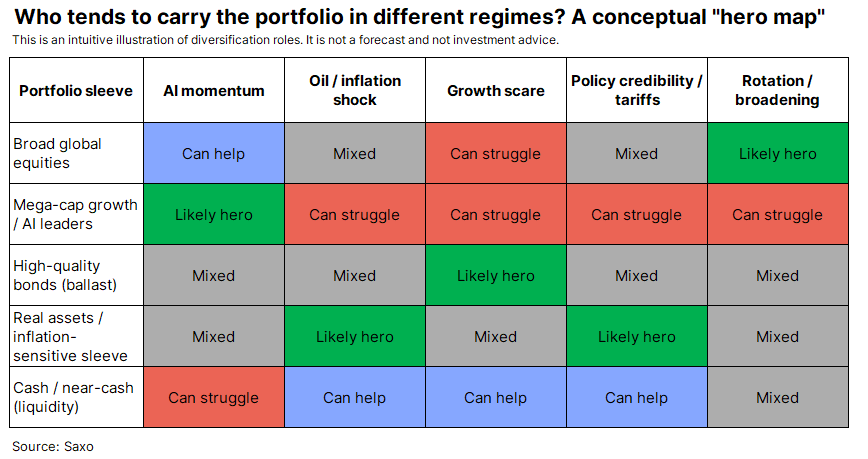

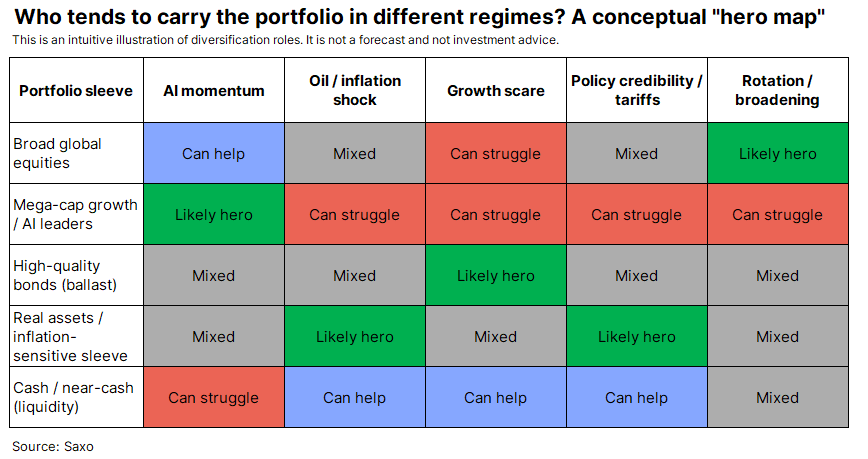

- Make it practical: We have come up with a list of potential shocks and a conceptual “hero map” to show why different sleeves matter in different regimes.

At the start of 2026, market attention has broadened beyond the usual “rates and earnings” story to a wider mix of geopolitical, policy, macro and market-leadership risks.

- Oil has been quick to react to political headlines, with markets weighing the risk of Iranian supply disruption against the possibility that Venezuelan exports could resume.

- Geopolitical focus has widened beyond the Middle East. Against the backdrop of heightened tensions linked to U.S. rhetoric on Greenland, a Belgian defence minister has reportedly called for a dedicated NATO operation to strengthen Arctic security.

- In Asia, tensions have escalated between China and Japan after China banned exports of “dual-use” items for Japanese military use, raising concerns about broader supply-chain and trade restrictions.

- Concerns about Federal Reserve independence have resurfaced amid an intensifying Trump–Fed feud, adding another layer of uncertainty to the rates outlook and risk sentiment.

- At the same time, the market’s internal leadership remains an active debate. As the AI rally matures, investors have increasingly started to look beyond expensive technology leaders toward more undervalued areas of the market, including parts of the infrastructure complex.

In our opinion, this is not an environment that rewards perfect forecasting. It rewards portfolios that can stay invested without needing to guess which risk becomes dominant next.

A simple uncertainty map: four shocks that can test portfolios

One way to cut through the noise is to group today’s risks into four “shock buckets.” The aim is not to predict which one will hit, but to make sure your portfolio is not overly exposed to any single bucket.

- Geopolitics / supply shocks: energy prices, shipping routes, supply chains and inflation expectations can move quickly when geopolitical risk rises.

- Institutional / policy shocks: uncertainty around central bank credibility, tariffs, and rule changes can reprice risk premia across currencies, bonds and equities.

- Macro cycle uncertainty: the growth/inflation mix can shift faster than investors expect, changing which sectors and styles lead.

- Market leadership rotation: AI leadership may broaden or rotate, and concentrated winners can become more sensitive to valuation and earnings surprises.

Vulnerabilities to watch — and how investors typically reduce them

This section is designed to be simple. It is not about finding the “perfect” portfolio. It is about spotting where you may be unintentionally fragile, and considering how investors commonly try to address that fragility.

1) Geopolitics / supply shocks

If geopolitical risk pushes energy prices higher or disrupts supply chains, portfolios can be tested through inflation surprises and sudden risk-off moves. In our opinion, the vulnerability here is often not “owning the wrong asset,” but owning a portfolio where everything reacts the same way to higher inflation.

Common portfolio vulnerabilities

- You hold assets that benefit from lower inflation and falling yields, but have no exposure that tends to hold up when inflation surprises higher.

- Your equity exposure is heavily concentrated in one region or a narrow set of global trade-sensitive sectors.

- Your portfolio is implicitly built on the assumption that energy stays calm and inflation keeps trending down.

How investors often try to reduce vulnerability

- They add a modest inflation-sensitive diversifier (many investors look at real assets as a category, such as gold or broad commodities).

- They aim for regional breadth in equities so one geopolitical theatre does not dominate outcomes.

- They consider a small allocation to defence-sector equities as a potential geopolitical hedge, since defence spending and procurement can be more resilient during periods of heightened security tensions.

- They keep enough liquidity to avoid forced selling if volatility spikes.

Risks to keep in mind

- Defence stocks can still fall in broad risk-off markets, and individual names can be exposed to valuation risk, contract timing, and political scrutiny.

- Inflation-sensitive assets can lag for long periods in calm markets and can be volatile.

- Regional diversification can underperform when one country dominates global returns.

2) Institutional / policy shocks (Fed credibility, tariffs, rule changes)

When institutional credibility or policy direction becomes a market variable, correlations can change quickly. We think this is where “accidental bets” show up, especially unintended rate-path exposure.

Common portfolio vulnerabilities

- Your portfolio only works if one interest-rate path plays out (for example, steady cuts with no inflation rebound, or rates staying high without a growth hit).

- Most of your bond exposure is long duration and you did not intentionally choose that sensitivity.

- Your equity exposure is heavily tilted toward tariff- or policy-sensitive areas without offsets.

- You have no “credibility hedge” in the portfolio—meaning if confidence in monetary policy independence gets questioned and risk premia rise, you do not own assets that investors often gravitate toward in that scenario.

How investors often try to reduce vulnerability

- They balance interest-rate sensitivity by mixing short/intermediate exposure with longer exposure instead of concentrating in one part of the curve.

- They diversify equity exposures across sectors and regions so policy shocks do not hit everything at once.

- They consider adding a gold/precious-metals diversifier as a potential hedge when policy credibility is questioned and investors look for assets perceived as stores of value.

- They keep a liquidity sleeve to manage periods when policy headlines drive sharp moves.

Risks to keep in mind

- Less duration can mean less upside if yields fall sharply and long-dated bonds rally.

- Gold can be volatile and can underperform for long periods, especially when real yields rise or when the US dollar strengthens.

- Broad diversification can feel “boring” in years when a single policy regime rewards one narrow theme.

3) Macro cycle uncertainty (growth vs inflation vs recession)

In macro turning points, the market can stop rewarding narratives and start rewarding earnings resilience. In our view, the biggest risk for everyday investors is a portfolio built for one macro outcome with no Plan B.

Common portfolio vulnerabilities

- Equities are essentially your only return engine, with little stabiliser if risk assets sell off.

- Your equity exposure is skewed toward high beta areas, with limited defensive balance.

How investors often try to reduce vulnerability

- They hold a ballast sleeve designed to stabilise portfolios in growth scares (often high-quality bonds are used for this role).

- They keep some liquidity to avoid being forced into poor timing decisions and to enable rebalancing when volatility rises.

- They diversify equity exposure so returns are not dependent on one style (all growth or all defensive).

Risks to keep in mind

- Bonds can disappoint when inflation is the dominant shock.

4) Market leadership rotation (AI broadening and concentration risk)

As the AI rally matures, we think the market will increasingly differentiate between “AI with receipts” and “AI with hype.” The practical point for investors is that leadership can rotate even when the long-term theme remains intact.

Common portfolio vulnerabilities

- Your top few holdings dominate outcomes, meaning the portfolio is more concentrated than you realise.

- Your equity exposure is heavily dependent on one factor: mega-cap growth continuing to lead.

- You own broad indices but underestimate how much performance is driven by a small group of large names.

How investors often try to reduce vulnerability

- They broaden equity exposure across sectors, regions and styles, and diversify within the AI theme rather than relying only on headline winners.

- They use a rebalancing discipline so winners do not quietly become unintended concentration.

Risks to keep in mind

- Broader exposure can lag if leadership stays narrow longer than expected.

- Rebalancing can feel uncomfortable because it requires trimming what has worked.

Illustration: different shocks, different “portfolio heroes”

We think it helps to visualise diversification as a team rather than a single bet. Different players step up in different matches. You do not need every sleeve to “win” every month. All you need is the whole portfolio to remain resilient across regimes.

Use the “Hero Map” grid (image below), alongside this idea:

- When markets are driven by AI momentum, concentrated growth leaders may do the heavy lifting.

- In an oil/inflation shock, inflation-sensitive diversifiers tend to matter more.

- In a growth scare, stabilisers and liquidity often become more valuable.

- In policy credibility or tariff shocks, breadth and balance usually matter more than precision.

- In rotation/broadening, diversified equity exposure can regain leadership.

The practical next step: a simple portfolio check

Once you understand the shock map, the next step is simply to locate where fragility might be hiding. Most investors can pull these five numbers from a portfolio view:

- Your overall equity percentage (your main risk dial).

- Your top five holdings as a percentage of the portfolio (concentration).

- Your largest single country/region exposure (geopolitical/policy concentration).

- Your bond rate sensitivity (short/intermediate vs long duration).

- Whether you have any inflation-sensitive diversifier at all.

If any of these are hard to find quickly, we think that is often where investors are most exposed without realising it.

Bottom line

At times like this, diversification is not a slogan. It is a way to stay invested without needing to be perfectly right.

In our opinion, the portfolios that hold up best over time are not the ones that guess the next headline correctly, but the ones that are designed so no single headline can decide the outcome.