Outrageous Predictions

Switzerland's Green Revolution: CHF 30 Billion Initiative by 2050

Katrin Wagner

Head of Investment Content Switzerland

Saxo Group

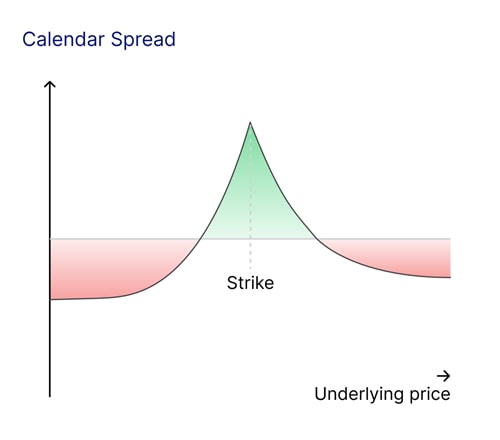

A calendar spread is a trading strategy that involves buying and selling options on the same underlying asset, with the same strike price but different expiration dates. Typically, a trader buys a longer-term option and sells a shorter-term option. This strategy can also be reversed, where the trader sells the longer-term option and buys the shorter-term option. The primary goal is to capitalise on specific market events or catalysts.

Traders use calendar spreads to take advantage of specific market dynamics around defined events. For example, stock prices often fluctuate significantly around earning announcements, but the exact magnitude is uncertain. Key economic data releases, such as inflation data or jobs reports, can cause volatility spikes, as can decisions by Central Banks on interest rates which have wide-ranging effects on financial markets.

These events often create significant differences in implied volatility between options with nearby and distant expirations, and calendar spreads allow you to capitalise on this elevated short-term volatility. The nearer-term option, often inflated due to an impending event, can be sold to capture premium. Meanwhile the longer-term option provides a hedge and exposure to broader market movements.

Implied volatility is rarely uniform across expirations or strike prices, however, which creates opportunity for traders to exploit volatility skews and kurtosis using calendar spread. Let’s delve into this further.

A volatility skew is the difference in implied volatility across strike prices, especially when the skew is more pronounced in one expiration compared to another. Meanwhile, volatility kurtosis is the "peakiness" or flatness of the volatility distribution, where very low delta options may become more elevated in shorter expirations due to their low premium. For example, if an upcoming event is expected to cause sharp short-term price swings but minimal long-term impact, a calendar spread can profit from this discrepancy.

To understand the mechanics of calendar spreads, traders should consider three key factors.

Options lose value as they approach expiration, a phenomenon known as time decay. Short-term options decay rapidly, especially as expiration nears, whereas long-term options retain more value, cushioning the impact of time decay.

Changes in implied volatility can significantly affect a calendar spread’s value. Increases in implied volatility benefit the long-term option more than it harms the short-term one, whilst a decrease in implied volatility can reduce the spread’s value, potentially diminishing profitability.

The choice of strike price determines the strategy’s risk and reward profile. At-the-Money options maximises time decay benefits but can be more sensitive to volatility changes. Meanwhile Out-of-the-Money or In-the-Money options alters the risk-reward balance and may require specific market expectations.

Let’s consider a scenario in the crude oil futures market.

Crude oil futures are set to expire in one week, while another contract expires in one month. An OPEC meeting is scheduled for the following week, with potential for significant price moves. Let’s say the crude oil price is USD 80 per barrel, with implied volatility differing across expirations:

Strategy:

The 1-week option is richly priced due to elevated implied volatility ahead of the OPEC meeting, whilst the 1-month option provides a hedge and retains value even after the meeting, assuming volatility stabilises. The trader aims to capitalise on the elevated 1-week implied volatility levels, which are much higher than the normalised level of 1 month, while maintaining some protection against delta, gamma, and vega.

If crude oil remains near USD 80 after the OPEC meeting, the 1-week option expires worthless, while the 1-month option retains significant value. If implied volatility drops sharply post-meeting, the spread’s profitability may diminish but can still benefit from time decay on the short option. A significant move lower or higher would see both options out of the money, resulting in a loss of the premium spent.

Modern trading platforms and tools can provide valuable insights to help you fine-tune your calendar spread strategies. For example, they can estimate implied volatility changes around specific events, analyse historical volatility trends for similar scenarios, and evaluate potential outcomes for different strike price and expiration combinations.

The term structure of volatility for a specific product is the market consensus estimate of future realised volatility for each given option expiration period. Variations in this term structure can imply moves in the underlying futures contract being priced in due to an upcoming event. The implied move or expected move on the day of the catalyst is called forward implied volatility. Whether this number is too high or too low is based on the trader’s expectations, possibly relying on past moves for similar catalysts.

Like any trading strategy, calendar spreads come with risks, and it is important to understand them before using this approach for the first time. Managing these risks effectively requires careful planning and continuous monitoring.

One key risk is unexpected price moves. If the underlying asset experiences a large directional shift, the spread can be negatively affected. Changes in implied volatility also pose a challenge, as a significant drop in longer-term implied volatility can reduce the strategy’s overall value. Additionally, liquidity issues can arise, particularly with thinly traded options, where wider bid-ask spreads may lead to higher transaction costs.

Calendar spreads offer a versatile and strategic way to navigate markets, especially during periods of heightened uncertainty. By balancing the interplay of time decay, implied volatility, and event-driven dynamics, traders can position themselves to profit from market inefficiencies.