Outrageous Predictions

Switzerland's Green Revolution: CHF 30 Billion Initiative by 2050

Katrin Wagner

Head of Investment Content Switzerland

Saxo Group

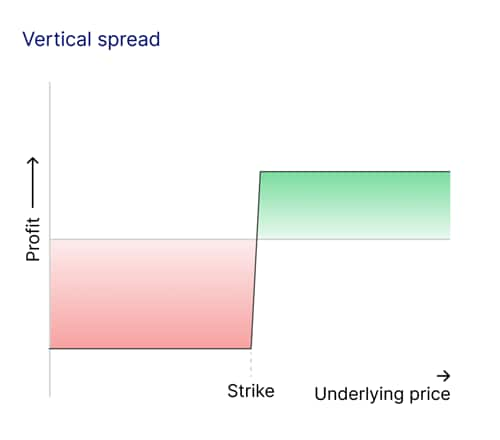

A vertical spread is an options trading strategy where you buy and sell two options of the same type (either calls or puts) with the same expiration date but at different strike prices. These spreads are popular with traders who have a directional view on the market and want to manage both risk and cost.

Vertical spreads come in two primary forms:

Vertical spreads are popular because they provide traders with a clear balance of risk and reward. Let’s break down the key advantages and disadvantages:

Let’s say WTI crude oil futures are trading at USD 75 per barrel, and you expect prices to rise in the next two months due to seasonal demand. You want to profit from this anticipated upward movement while limiting your costs. A bull call spread offers a balanced way to achieve this.

When deciding which type of vertical spread to use, several factors should guide your decision:

Vertical spreads can be a powerful tool for traders who want to align their market views with a disciplined risk-management approach. Whether you are bullish or bearish, spreads offer flexibility, affordability, and clear boundaries for gains and losses.

By carefully selecting strike prices, expirations, and the type of spread, you can tailor the strategy to your specific outlook and risk tolerance. Moreover, monitoring the Greeks can help you anticipate how changes in time, price, and volatility will affect your position, allowing for informed adjustments along the way.

For traders seeking a "middle ground" strategy—like booking a holiday that balances luxury with cost—vertical spreads may be an excellent choice.