Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Strategist

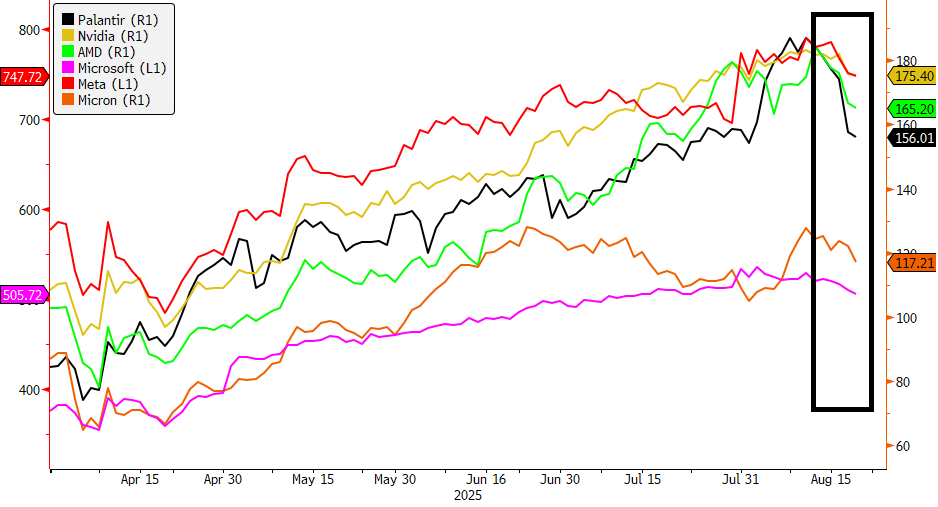

After an extraordinary rally since April, tech stocks have stumbled in recent days, reminding investors that markets may have run ahead of themselves in the AI boom story. The trigger was a blunt MIT report revealing that 95% of corporate spending on generative AI is yielding little to no measurable returns—a sobering statistic for a sector priced for perfection.

Adding to the caution, Sam Altman warned that valuations have become “insane” amid investor over-exuberance, further stoking fears that parts of the market are moving faster than the technology’s ability to deliver tangible gains.

The selloff underscores the fragility of the AI narrative: while capital expenditure on chips, models, and infrastructure has surged, evidence of broad-based monetization is still thin. Investors are beginning to differentiate between hype and hard returns—pushing the sector into what looks more like a “prove-it” phase than an outright bubble burst.

The easy phase, spending on GPUs and pilots, is over. The next phase of the AI cycle will be defined by proof, not promise. Tech giants have poured an immense wave of capital expenditure into AI, but monetization hasn’t yet caught up.

But returns are far smaller:

Enterprises are shifting from pilot projects to demanding productivity gains or new revenue streams. Companies that show real customer uptake, pricing power, or opex savings from AI will stand apart from those still peddling narratives.

Without measurable ROI, boardrooms may start tightening budgets.

While competition between AI models is fierce, the bottlenecks are shifting to infrastructure. Memory chips (HBM), advanced packaging, data-center space, and even electricity supply are increasingly scarce and increasingly valuable. It is estimated that the U.S. grid is under pressure: data centers could consume up to 12% of electricity by 2028, with 20GW of new load expected by 2030.

Utilities and power infrastructure firms delivering grid upgrades, data-center REITs and hardware firms specializing in cooling, power distribution, and packaging may capture more sustainable gains than speculative AI software plays in the near term.

The U.S. still dominates the AI landscape, but the China tech story is resurfacing and catching up. Models like DeepSeek, trained for a fraction of the cost (built at an estimated cost under US $6 million versus over $100 million for GPT‑4), triggered a global rethink of AI margins and monetization.

China also benefits from robust energy infrastructure including hydropower and nuclear, creating a structural advantage for AI expansion.

The U.S. AI trade remains dominant, led by Nvidia and the hyperscalers, but with valuations stretched, attention could rotate back to China’s cheaper but more efficient tech sector. Chinese tech giants like Alibaba, Tencent, Meituan, Baidu, and Xiaomi, often referred to as the “Terrific Ten”, offer valuation arbitrage and regained investor attention.

If U.S.–China tensions ease, capital could increasingly flow eastward, seeking AI exposure via cheaper, domestically scaling names.

The AI trade is not over, but it is entering a “prove-it” phase. Investors will reward quality infrastructure and platforms with clear monetization paths while punishing “AI-adjacent” hype.

For investors, the key is to distinguish between narratives priced for perfection and businesses delivering returns today. Dispersion, not collapse, is the story of the next AI chapter.