Products available in SaxoTrader

Advanced features for that extra edge

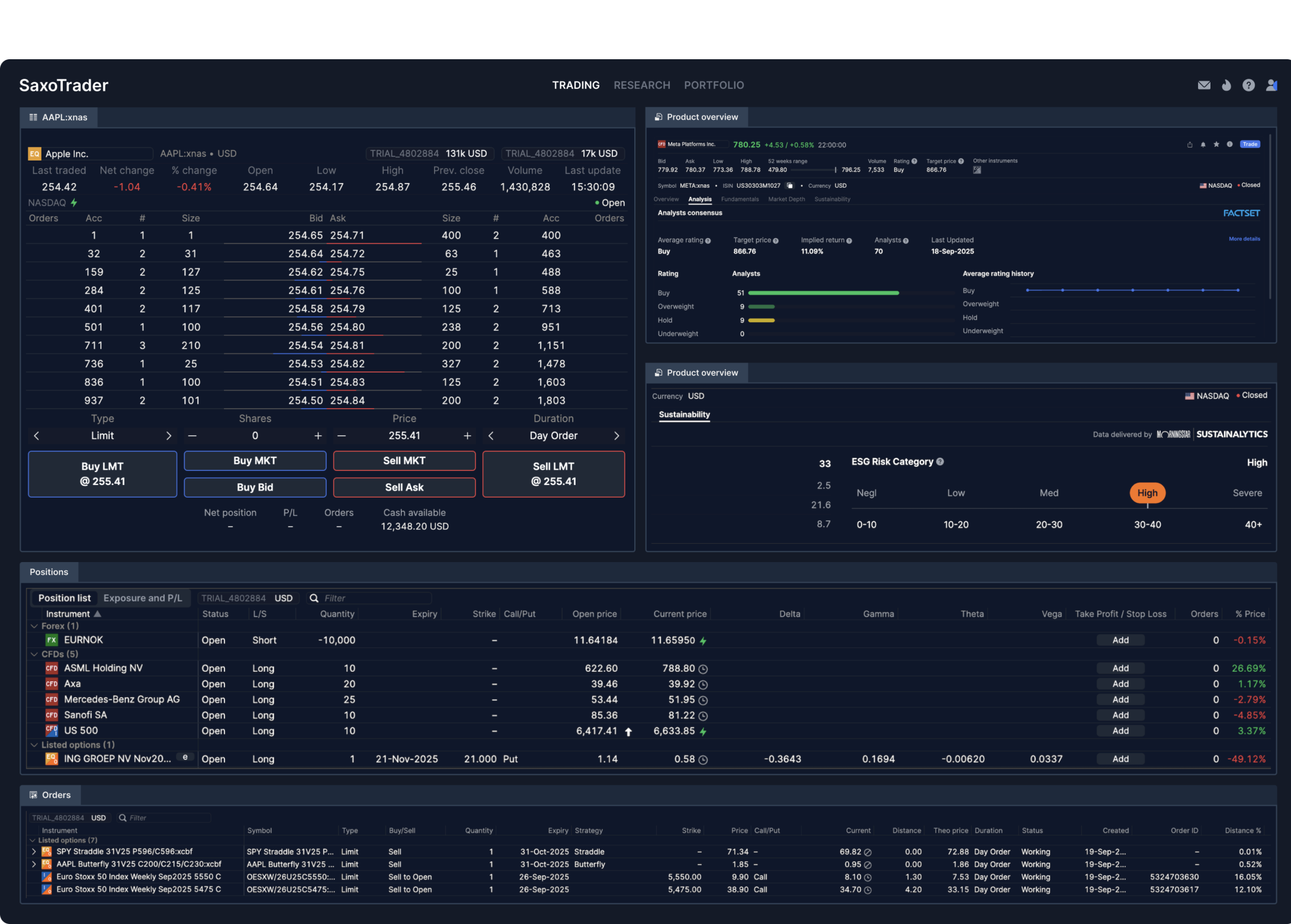

Set up a customisable workspace for up to 6 screens, with advanced features such as Depth Trader, time and sales data, and robust risk management.

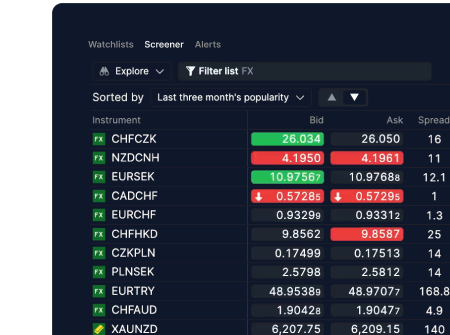

Explore the desktop versionTrack market liquidity and identify emerging trends with Level 1 tick data, or step up to Level 2 depth for deeper, more granular insights into order flow that enhance your trading strategies.

Monitor trades as they happen with time and sales data (desktop version only and subscription-dependent) for real-time information on timing, price, and volume, enabling you to trade with precision.

Use our Depth Trader tool (available in the desktop version) to place and manage orders in real time with Level 2 order book insights, enabling strategic and precise trading execution.

See more desktop featuresTake advantage of our portfolio-based margin model to net risk across product types and positions. This model is exclusively available to those who qualify for professional status, which allows you to waive certain protections to trade with greater flexibility.

Connect to our stable, fast, flexible, and fully documented infrastructure. Tailor your setup with OpenAPI, FIX API, and integrations such as TradingView and MultiCharts.

Explore third-party toolsBuild complex strategies fast in our multi-leg ticket, trade straight from a customisable option chain with live Greeks and implied volatility, then validate your positions in the risk graph (payoff diagram)—all with fast execution and deep probability and volatility analytics.

In the desktop version, you can also access the Options risk ladder (ORL)—a fast, model-based snapshot of your portfolio’s risk exposure for different values of the underlying spot. ORL outputs are hypothetical, based on a limited instrument set, and should not be relied on to manage potential margin events.

More reasons to join Saxo

To avoid extra currency conversion fees, choose from 24 different currencies and open up to 4 currency sub-accounts. The available currencies and number of sub-accounts that can be opened depend on your account type and country of residence.

Learn about sub-accountsWith Saxo, you’ll get an average execution speed of 0.009 seconds on market orders (January 2026 statistics) and no asymmetric slippage. Our fully customised orders offer you potential price improvements on every trade and an optimal balance between fill ratio and price level.

To protect you from being stopped out early, we trigger stop orders on the opposite side of the spread, based on a neutral price from a primary inter-bank venue.

We fully disclose our dealing practices and never trade against you in the market.

Retail CFD and FX traders covered by ESMA regulation are eligible for negative balance protection, which prevents you from losing more money than what’s in your account.

Read about ESMA protectionsWith tiered margin, the average margin requirement (“blended margin requirement”) increases with the level of exposure. As the level of exposure decreases, the margin requirement also decreases.

We use a tiered margin methodology for FX spot, forwards, and FX options.

Frequently asked questions

We have two platforms/apps available, depending on the products and tools you need.

SaxoTrader is our more advanced trading platform for web, mobile, or desktop. You get detailed analytics, complex charting, and all the sophisticated tools needed for trading. SaxoTrader has our full range of products, including products traded on margin and with leverage. With the desktop-only app, you can customise windows across multiple screens to allow for more comprehensive analysis and a setup that works for your strategy.

SaxoInvestor is our straightforward, all-in-one platform for web or mobile with a detailed portfolio overview, in-depth analysis, easy-to-use charts and tools, and plenty of inspirational content. SaxoInvestor includes stocks, bonds, mutual funds, ETFs.

With a Saxo account, you automatically get access to both platforms and can switch between the two.

On help.saxo, you can find an introduction to SaxoTrader with a platform walkthrough video and a downloadable platform guide. You can also check out our video guides for more tutorials and answers to questions about using our trading and investing platforms.

In the unlikely event of SCML going into liquidation, all our clients would have their share of the segregated money or segregated assets returned, minus administrators’ costs in handling and distributing these funds. Any shortfall of funds of up to GBP 85,000 may be compensated for under the Financial Services Compensation Scheme (‘FSCS’). The FSCS is the compensation fund of last resort for customers of authorised financial services firms.

See investment protection detailsThat depends on the account type you open.

For an individual account, these are the documents you’ll need to provide:

- Your national ID number from the country where you hold citizenship.

- Your tax ID number from your country of residence.

- A document as proof of identity (e.g., a passport, ID card, driver’s licence) and a selfie.

- A document as proof of residence (one that shows your home address, such as a residence permit, utility bill, or bank statement).

Most sign-ups for individual accounts are approved digitally within a few minutes. However, since we cannot compromise on security checks, the process can sometimes take longer. If all documents you provided meet requirements, we’ll process your application within 2 working days.

If you provide clear copies of all required documents, corporate accounts will generally be approved in about 1 week.