Akcie

23 000+ akcií na 50+ globálních burzách.

Počáteční marže a udržovací marže jsou navrženy tak, aby vás chránily před nepříznivými tržními podmínkami vytvořením rezervy mezi vaší obchodní kapacitou a úrovní marže pro uzavření pokynů.

Další informace o počáteční a udržovací marži získáte zde.

Chcete-li najít informace o FX marži, vyhledejte konkrétní instrument v náhledu naší platformy a otevřete si jeho přehled. Vpravo nahoře vyberte tlačítko Info (i) a přejděte na kartu Instrument.

Požadavky na marži se liší podle měnového páru a závisí na expozici v tomto páru. Požadavky na marži mohou podléhat předpisům stanovujícím povinná minima a mohou se měnit v závislosti na podkladové likviditě a volatilitě měnového páru. Z tohoto důvodu se ve většině případů na nejlikvidnější měnové páry (hlavní) vztahuje nižší požadavek na marži.

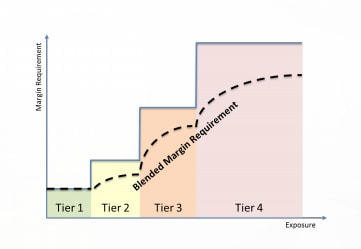

Saxo nabízí odstupňovanou metodologii marží jako mechanismus zvládání politických a ekonomických událostí, které mohou vést k volatilitě a rychlým změnám na trhu. S odstupňovanou marží se průměrný požadavek na marži (kombinovaný požadavek na marži = blended margin requirement) zvyšuje společně s úrovní expozice. Platí to i opačně – jak se úroveň expozice snižuje, klesá i maržový požadavek. Tento koncept je znázorněn níže:

Různé úrovně expozice (neboli stupně) jsou definovány jako absolutní částka v amerických dolarech (USD) napříč všemi měnovými páry. Každý měnový pár má specifický maržový požadavek na každém stupni.

Mějte na paměti, že maržové požadavky se mohou změnit bez předchozího upozornění. Společnost Saxo si vyhrazuje právo zvýšit maržové požadavky u velkých pozic, včetně klientských portfolií považovaných za vysoce riziková.

Ve výchozím stavu platí retailové sazby marží. Jako klient spadající pod regulaci Evropským orgánem pro cenné papíry a trhy (ESMA) se můžete rozhodnout pro reklasifikaci na profesionálního klienta, abyste mohli využívat nižší maržové požadavky. Pokud si chcete přečíst více o výhodách profesionálních účtů a o tom, jak se pro ně kvalifikovat, klikněte prosím zde.

Pokud chcete získat přehled informací o maržích pro profesionály, klikněte prosím zde.

Počáteční marže a udržovací marže jsou navrženy tak, aby vás chránily před nepříznivými tržními podmínkami vytvořením rezervy mezi vaší obchodní kapacitou a úrovní marže pro uzavření pokynů.

Další informace o počáteční a udržovací marži získáte zde.

Požadavek na marži u Forex opcí se počítá na měnový pár (k zajištění shody s koncepcí odstupňovaného účtování marže, stejně jako u Forex spotů a forwardů) a na datum splatnosti. V každém měnovém páru existuje horní limit požadavku na marži, který je nejvyšší možnou expozicí v rámci Forex opcí a pozic Forex spotů a forwardů, násobený převládajícím spotovým požadavkem na marži. Tento výpočet bere v úvahu také potenciální započtení mezi Forex opcemi a pozicemi Forex spotů a forwardů.

U strategií s omezeným rizikem, jako je například spread short call, se požadavek na marži pro portfolio Forex opcí vypočítá jako maximální budoucí ztráta.

U strategií s neomezeným rizikem, jako jsou například nekryté krátké opce, se požadavek na marži vypočítá jako nominální částka vynásobená převládajícím spotovým požadavkem na marži.

Pro výpočet marže Forex opcí jsou k dispozici odstupňované sazby marže, pokud se sazba marže klienta řídí převládajícím Forex spotovým požadavkem na marži, a nikoli maximální budoucí ztrátou. Převládající Forex spotové úrovně marže jsou odstupňované na základě nominálních částek v USD; čím vyšší je nominální částka, tím je potenciálně vyšší sazba marže. Odstupňovaný požadavek na marži se počítá na každý měnový pár. Při výpočtu marže u Forex opcí je převládajícím spotovým požadavkem na marži v každém měnovém páru odstupňovaná nebo kombinovaná sazba marže, která je určena na základě nejvyšší potenciální expozice v rámci všech Forex opcí a pozic Forex spotů a forwardů.

Prodáváte call spread na 10 milionů USDCAD s realizační cenou 1,41 a 1,42.

Aktuální spotová sazba je 1,40.

Požadavek na marži bude maximální budoucí ztráta ve výši 71 429 USD (10 milionů × (1,42 − 1,41) = 100 000 CAD / USD za 1,40).

Prodáváte put opci na 10 milionů USDCAD. Platí neomezené riziko pohybu dolů. Požadavek na marži se proto vypočítá jako nominální částka vynásobená převládajícím spotovým požadavkem na marži.

Převládající spotovou sazbu marže určuje potenciální expozice, což je 10 milionů USD.

Převládající spotovou sazbu tak představuje kombinovaná sazba marže v hodnotě 2,2 % ((1 % × 3 miliony USD + 2 % × 2 miliony USD + 3 % × 5 milionů USD) / 10 milionů).

Požadavek na marži je tedy 220 000 USD (2,2 % × 10 milionů USD).

Počáteční marže a udržovací marže jsou navrženy tak, aby vás chránily před nepříznivými tržními podmínkami vytvořením rezervy mezi vaší obchodní kapacitou a úrovní marže pro uzavření pokynů.

Další informace o počáteční a udržovací marži získáte zde.

Počáteční marže a udržovací marže jsou určeny k ochraně před nepříznivými tržními podmínkami tím, že vytvářejí rezervu mezi vaší obchodní kapacitou a úrovní vyrovnání marže.

Počáteční a udržovací marže CFD na jednu akcii se odvíjí od hodnocení (ratingu) akcie. Saxo definuje 6 různých ratingů akcií. Tento rating je odvozen od tržní kapitalizace, likvidity a volatility podkladového aktiva.

| Saxo Rating | Počáteční marže | Udržovací marže |

|---|---|---|

| 1 | 20% | 10% |

| 2 | 20% | 15% |

| 3 | 25% | 20% |

| 4 | 35% | 30% |

| 5 | 55% | 50% |

| 6 | 110% | 100% |

Chcete-li zjistit hodnocení instrumentu a hodnotu zajištění, vyhledejte konkrétní instrument v náhledu naší platformy a otevřete přehled produktu. Vpravo nahoře vyberte tlačítko Info (i) a přejděte na kartu Instrument.

Existují 2 různé požadavky na marži

CFD na index s počáteční marží 5 % lze obchodovat s pákou 20:1.

| Akciový index | Počáteční marže | Udržovací marže | |

|---|---|---|---|

| US 30 Wall Street | 5 % | 2,5 % | |

| US 500 | 5 % | 2,5 % | |

| US Tech 100 NAS | 5 % | 2,5 % |

| Denmark 25 | 10 % | 5 % | |

| EU Stocks 50 | 5 % | 2.5 % | |

| France 40 | 5 % | 2.5 % | |

| Germany 40 | 5 % | 2.5 % | |

| Germany Mid-Cap 50 | 10 % | 5 % | |

| Germany Tech 30 | 10 % | 5 % | |

| Netherlands 25 | 10 % | 5 % | |

| Norway 25 | 10 % | 5 % | |

| Spain 35 | 10 % | 5 % | |

| Sweden 30 | 10 % | 5 % | |

| Switzerland 20 | 10 % | 5 % |

| Australia 200 | 5 % | 2,5 % | |

| Hong Kong | 10 % | 5 % |

| Akciový index | Počáteční marže | Udržovací marže | |

|---|---|---|---|

| China 50 | 10 % | 5 % | |

| UK 100 | 5 % | 2,5 % | |

| UK Mid 250 | 10 % | 5 % | |

| Singapore | 10 % | 5 % | |

| Taiwan | 10 % | 5 % | |

| US2000 | 10 % | 5 % | |

| Japan 225 | 5 % | 4,5 % | |

Existují 2 různé požadavky na marži

Forexové CFD s počáteční marží 3,33 % lze obchodovat s pákou 30:1.

| Název instrumentu | Symbol | Počáteční marže | Udržovací marže |

|---|---|---|---|

| MĚNY | |||

| Euro / americký dolar | EURUSDEC | 3,33 % | 1,66 % |

| Euro / japonský jen | EURJPYRY | 3,33 % | 1,66 % |

| Euro / švýcarský frank | EURCHFRF | 3,33 % | 1,66 % |

| Euro / britská libra | EURGBPRP | 3,33 % | 1,66 % |

| Britská libra / americký dolar | GBPUSDBP | 3,33 % | 1,66 % |

| Australský dolar / americký dolar | AUDUSDAD | 3,33 % | 1,66 % |

| Index USD | USDINDEX | 20 % | 10 % |

Existují 2 různé požadavky na marži

Komoditní CFD s počáteční marží 10 % lze obchodovat s pákou 10:1.

| Název instrumentu | Symbol | Počáteční marže | Udržovací marže |

|---|---|---|---|

KOVY | |||

| Zlato | GOLD | 5 % | 2,5 % |

| Stříbro | SILVER | 10 % | 5 % |

| Platina | PLATINUM | 10 % | 5 % |

| Paladium | PALLADIUM | 10 % | 5 % |

| US Copper | COPPERUS | 10 % | 5 % |

ENERGIE | |||

| US Crude | OILUS | 10 % | 5 % |

| UK Crude | OILUK | 10 % | 5 % |

| Heating Oil | HEATINGOIL | 10 % | 5 % |

| Gasoline US | GASOLINEUS | 10 % | 5 % |

| Gas Oil | GASOILUK | 10 % | 5 % |

| US Natural Gas | NATGAS | 10 % | 5 % |

| Emise CO2 | EMISSIONS | 10 % | 5 % |

ZEMĚDĚLSTVÍ | |||

| Kukuřice | CORN | 10 % | 5 % |

| Pšenice | WHEAT | 10 % | 5 % |

| Sójové boby | SOYBEANS | 10 % | 5 % |

MĚKKÉ KOMODITY | |||

| NY Sugar no. 11 | SUGARNY | 10 % | 5 % |

| NY Coffee | COFFEE | 10 % | 5 % |

| NY Cocoa | COCOA | 10 % | 5 % |

MASO | |||

| Živý skot | LIVECATTLE | 10 % | 5 % |

Existují 2 různé požadavky na marži

Dluhopisové CFD s počáteční marží 10 % lze obchodovat s pákou 10:1.

| Počáteční marže | Udržovací marže | Produkt/nástroj |

|---|---|---|

| 20 % | 10 % | Německý vládní Bobl (5 let) Německý vládní Schatz (2 roky) |

| 20 % | 10 % | Německý vládní Bund (10 let) |

| 20 % | 10 % | Francouzský vládní OAT (10 let) |

| 20 % | 10 % | Italský vládní BTP (10 let) |

Ve výchozím stavu platí retailové sazby marží. Můžete se rozhodnout pro reklasifikaci na profesionálního klienta, abyste mohli využívat nižší maržové požadavky*. Pokud si chcete přečíst více o výhodách profesionálních účtů a o tom, jak se pro ně kvalifikovat, klikněte prosím zde.

Pokud chcete získat přehled informací o maržích pro profesionály, klikněte prosím zde.

Počáteční marže a udržovací marže jsou navrženy tak, aby vás chránily před nepříznivými tržními podmínkami vytvořením rezervy mezi vaší obchodní kapacitou a úrovní marže pro uzavření pokynů.

Další informace o počáteční a udržovací marži získáte zde.

Chcete-li zjistit hodnocení instrumentu a hodnotu zajištění, vyhledejte konkrétní instrument v náhledu naší platformy a otevřete jeho přehled produktu. Vpravo nahoře vyberte tlačítko Info (i) a přejděte na kartu Instrument.

Saxo Bank nabízí v souvislosti s obchodováním opčních kontraktů dva klientské profily marží1:

Výchozím nastavením klienta je základní profil, takže nemůže prodávat (vypisovat) opční kontrakty. Aby bylo možné vypisovat opční kontrakty, musí klient splňovat následující požadavky pro aktivaci pokročilého profilu.

| Strategie | Počáteční a udržovací marže |

|---|---|

Long straddle | Žádné |

| Výpisy naked call OTM | Akciové opceCena za call + Maximum((X % × podkladová cena) − částka OTM); (Y % × podkladová cena)) Částka OTM v případě call opce se rovná: Max(0; realizační cena opce − podkladová cena) Příklad: short 1 DTE 14.led 12,50 call za 0,08 Podkladová cena 12.30

|

| Nekrytý put – vypsání | Akciové opceCena za put + Maximum((X % × podkladová cena) − částka OTM); (Y % × strike cena)) Příklad: short 1 DTE 14.led 12 put za 0,06 Podkladová cena 12.30

|

| Bull Call Spread | Maximum ((Strike Long Call − Strike Short Call); 0) Příklad: Long DTE 14.led 12,5 Call za 0,10 a short DTE 14.led 13,5 Call za 0,02

|

Bull Put Spread | (Strike Short Put − Strike Long Put) − (cena Short Put − cena Long Put) Příklad: Short DTE 14.jan Put 12 put za 0,08 a long DTE 14.led 11 Put za 0,02

|

Short straddle | Pokud je short put počáteční marže > počáteční short call, pak |

Krátké (short) opční pozice u opcí amerického typu lze spojit s dlouhými (long) opčními pozicemi nebo krytými pozicemi v podkladovém výstupu za účelem vyrovnání vysoké míry expozice. Jako takové mohou být marže sníženy nebo dokonce odpuštěny. Snížení marže poskytujeme u následujících kombinací pozic:

Pozici Short Call je možné vyvážit dlouhou pozicí v podkladových akciích.

Spread pozice umožňuje opční long pozici krýt opční short pozici na opci stejného typu a stejného podkladového plnění. Pokud je dlouhá opce hlouběji v penězích (ITM) v porovnání s krátkou opcí (debetní spread), použije se k pokrytí hodnota dlouhé opce až do výše krátké opce bez dalších požadavků na marži.

Je-li kratší noha hlouběji v penězích (ITM) v porovnání s dlouhou nohou (kreditní spread), použije se k pokrytí plná hodnota dlouhé opce a k tomu další marže, která odpovídá realizačnímu rozdílu.

Poznámka: Pro obchodování ze Spread pozice se doporučuje nejprve zavřít krátkou nohu před zavřením dlouhé nohy, abyste se vyhnuli vysoké marži za nekrytou opční short pozici. Protože však rezervace marže spreadu nemusí stačit k pokrytí peněžní částky potřebné ke zpětnému odkupu opční short pozice, může se klient ocitnout v situaci, kdy nemůže obchodovat bez poskytnutí dalších finančních prostředků.

Pravidlo short straddle / strangle je v porovnání s pravidly Covered a Spread jiné, protože nohy short straddle se navzájem nekryjí. Short straddle / strangle kombinuje short call a short put. Protože jsou expozice short call a short put opačné vzhledem ke směru trhu, je požadována jen dodatečná marže nohy s nejvyšším maržovým požadavkem.

Po přiřazení nohy call v pozici strangle musí klient dodat podkladové akcie. Naopak při přiřazení typu put musí klient převzít dodání podkladových akcií. Akcie typu long je možné spojit se zbývající call nohou pro původní strangle. Tím vznikne covered call.

Pro některé nástroje, včetně akciových opcí, požadujeme marži, kterou pokryjeme potenciální ztráty související s držením pozice v daném nástroji. Akciové opce představují typ opce s plnou výší prémie.

Při získávání dlouhé pozice v opci s plnou výší prémie se částka prémie odečte z hotovostního zůstatku klienta. Hodnota otevřené dlouhé pozice opce bude k dispozici pro obchodování na marži pouze do výše uvedené v režimech snížené marže.

V následujícím příkladu klient zakoupí jednu opci Apple Inc. PROSINEC 2013 530 Call @ 25 USD (Akcie Apple Inc. se obchoduje za 529,85 USD.) Jedna opce je rovna 100 akciím, provize za nákup/prodej je 6,00 USD a směnný poplatek je 0,30 USD. Při hotovostním zůstatku 10 000,00 USD se v přehledu účtu klienta zobrazí toto:

Přehled zůstatků a pozic | ||

|---|---|---|

Hodnota pozice | 1 × 25 × 100 akcií = | 2 500,00 USD |

Nerealizovaný zisk/ztráta | – | |

Náklady na uzavření pozice | −1 × (6 USD + 0,30 USD) = | −6,30 USD |

Nerealizovaná hodnota pozic | 2 493,70 USD | |

Hotovostní zůstatek | 10 000,00 USD | |

Nezaúčtované transakce | −(2 500 USD + 6,30 USD) = | −2 506,30 USD |

Hodnota účtu | 9 987,40 USD | |

Není k dispozici jako maržový kolaterál | −1 × 25 × 100 akcií = | −2 500,00 USD |

Použito pro maržové požadavky | – | |

K dispozici pro obchodování na marži | 7 487,40 USD | |

V případě opce s plnou výší prémie se nezaúčtované transakce přidají k hotovostnímu zůstatku klienta během zpracování přes noc. Následující den, kdy se trh s opcemi posunul na 41 USD (spot na 556,50), objeví se v přehledu účtu toto:

Přehled zůstatků a pozic | ||

|---|---|---|

Hodnota pozice | 1 × 41 × 100 akcií = | 4 100,00 USD |

Nerealizovaný zisk/ztráta | – | |

Náklady na uzavření pozice | − 1 × (6 USD + 0,30 USD) = | −6,30 USD |

Nerealizovaná hodnota pozic | 4 093,70 USD | |

Hotovostní zůstatek | 7 493,70 USD | |

Nezaúčtované transakce | – | |

Hodnota účtu | 11 587,40 USD | |

Není k dispozici jako maržový kolaterál | −1 × 41 × 100 akcií = | 4 100,00 USD |

Použito pro maržové požadavky | – | |

K dispozici pro obchodování na marži | 7 487,40 USD | |

Hodnota pozice: Zvýšená z důvodu vyšší ceny opce.

Nerealizovaná hodnota pozic: Zvýšená z důvodu vyšší ceny opce.

Hotovostní zůstatek: Snížený o cenu opce. Nezaúčtované transakce mají nyní nulovou hodnotu.

Hodnota účtu: Zvýšená z důvodu vyšší ceny opce.

Částka nedostupná jako maržový kolaterál: Zvýšená díky nové hodnotě pozice.

Pozice short opce vystavuje svého držitele možnosti, že bude požádán k dodání podkladových výnosů, když jiný účastník trhu držící dlouhou pozici uplatní své právo na opci. Ztráty z pozice short opce mohou být významné, pokud se trh pohybuje proti pozici. Účtujeme tedy prémiovou marži, abychom zajistili, že je k dispozici dostatečná hodnota účtu k zavření krátké pozice, a doplňkovou marži k pokrytí pohybů podkladové hodnoty přes noc. Maržové požadavky jsou sledovány v reálném čase a odrážejí změny tržních hodnot a je možné spustit stop-out v případě, že celkový maržový požadavek pro všechny maržové pozice přesáhne hladinu margin callu klienta.

Obecný vzorec maržového požadavku u krátkých opcí je následující:

Prémiová marže zajišťuje, že je možné pozici short opce zavřít za aktuální tržní ceny a že odpovídá aktuální nákupní ceně, za kterou lze opci získat během obchodních hodin. Doplňková marže slouží k pokrytí změn v ceně podkladové hodnoty přes noc, kdy pozici opce nelze zavřít z důvodu omezených obchodních hodin.

Akciové opce

U opcí na akcie se doplňková marže rovná procentu podkladové referenční hodnoty minus sleva v částce, o kterou je opce OTM.

Maržové procenta nastavuje Saxo Bank a mohou se změnit. Skutečné hodnoty se mohou lišit podle opčního kontraktu a je možné je nakonfigurovat v profilech marží. Klienti se na příslušné hodnoty mohou podívat v podmínkách obchodování kontraktu.

Částka OTM call opce se rovná:

Částka OTM put opce se rovná:

Abyste dostali částku v zahrnuté měně, je třeba získané hodnoty vynásobit tržní jednotkou (100 akcií).

Předpokládejme, že FORM použil marži X ve výši 15 % a marži Y ve výši 10 % na akcie Apple.

Klient shortuje Apple PROSINEC 2013 535 Call za 1,90 USD (akcie Apple za 523,74 USD). Číselná hodnota opce je 100 akcií. Částka OTM je 11,26 akciových bodů (535 − 523,74) a z toho vyplývá doplňková marže 67,30 akciových bodů (6 730 USD). V přehledu účtu je prémiová marže vyjmuta z hodnoty pozice:

| Přehled zůstatků a pozic | ||

|---|---|---|

Hodnota pozice | −1 × 1,90 USD × 100 akcií = | −190,00 USD |

Nerealizovaný zisk/ztráta | – | |

Náklady na uzavření pozice | −(6 + 0,30 USD) = | −6,30 USD |

Nerealizovaná hodnota pozic | −196,30 USD | |

Hotovostní zůstatek | 10 000,00 USD | |

Nezaúčtované transakce | 190 USD − (6 USD + 0,30 USD) = | 183,70 USD |

Hodnota účtu | 9 987,40 USD | |

Není k dispozici jako maržový kolaterál | – | |

Použito pro maržové požadavky | −100 akcií × ((0,15 × 523,74) − 11,26) | −6,730,00 USD |

K dispozici pro obchodování na marži | 3 257,40 USD | |

Obchodník prodávající opce (vypisovatel) je na žádost povinen za udanou cenu prodat kupujícímu opce podkladový instrument (v případě call opce) nebo ho koupit (put opce) od držitele opce.

Pozice short opce může vést k významným ztrátám, pokud se trh pohybuje proti dané pozici. Saxo si účtuje premium, aby zajistil, že má klientský účet k dispozici dostatek finančních prostředků pro uzavření pozice short opce, a další marži, která pokryje veškeré změny v ceně podkladového nástroje přes noc.

Obecný vzorec marže u krátkých opcí je následující: Marže krátkých opcí = prémiová marže + doplňková marže.

Požadavek na marži se sleduje v reálném čase. Pokud ztráty klienta přesáhnou využití marže, může dojít k automatickému uzavření (stop-out) podle marže. To znamená, že Saxo se pokusí okamžitě ukončit, zrušit a uzavřít veškeré otevřené pozice nebo jejich části.

Obchodování na marži s sebou nese vysokou míru rizika, které může vést k významným ztrátám přesahujícím peněžní nebo schválený kolaterál na klientském účtu.

Obchodování na marži není vhodné pro každého. Ujistěte se, že plně rozumíte souvisejícím rizikům, a v případě potřeby využijte nezávislé poradenství.

Saxo Bank umožňuje použít určité procento investice do určitých akcií a ETF jako kolaterál pro maržové obchodování. Hodnota zajištění pozice v akciích nebo ETF závisí na hodnocení jednotlivých akcií nebo ETF - viz konverzní tabulka níže.

| Hodnocení | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Hodnota zajištění pozice | 75% | 50% | 50% | 25% | 0% | 0% |

Příklad: 75 % hodnoty pozice v akciích nebo ETF s hodnocením 1 lze použít jako kolaterál (místo hotovosti) pro obchodování s maržovými produkty jako jsou Forex, CFDs, futures kontrakty a opční kontrakty. Vezměte prosím na vědomí, že Saxo Bank si vyhrazuje právo snížit nebo zrušit použití investice do akcií nebo ETF jako kolaterálu v případě velmi rizikových pozic nebo akciových portfolií.

Chcete-li zjistit hodnocení instrumentu a hodnotu zajištění, vyhledejte konkrétní instrument v náhledu naší platformy a otevřete přehled produktu. Vpravo nahoře vyberte tlačítko Info (i) a přejděte na kartu Instrument.

Saxo Bank umožňuje, aby se podíl investice v některých dluhopisech používal jako kolaterál pro obchodování na marži.

Hodnota kolaterálu dluhopisové pozice závisí na hodnocení jednotlivých dluhopisů, jak je uvedeno níže:

| Definice hodnocení* | Procento kolaterálu |

|---|---|

| Nejvyšší hodnocení (AAA) | 95 % |

| Velmi vysoká kvalita (AA) | 90 % |

| Vysoká kvalita (A) | 80 % |

Příklad: 80 % tržní hodnoty dluhopisové pozice s hodnocením A lze použít jako kolaterál (namísto hotovosti) k obchodování maržových produktů, jako jsou forex a CFD nebo futures a opce.

Upozorňujeme, že Saxo bank si vyhrazuje právo snížit nebo zrušit použití dluhopisových pozic jako kolaterálu.

Chcete-li získat další materiály nebo požádat o rating a zpracování kolaterálu pro konkrétní nebo potenciální dluhopisovou pozici, odešlete e-mail na fixedincome@saxobank.com nebo se obraťte na vašeho relationship manažera.

Sazby zajištění se liší dle instrumentu a závisí na tržní hodnotě daných nástrojů. Úrovně zajištění mohou podléhat regulací stanoveným maximům a mohou se měnit v závislosti na likviditě a volatilitě podkladového aktiva. Z tohoto důvodu se ve většině případů na nejlikvidnější (hlavní) měnové páry vztahuje nižší požadavek na marži.

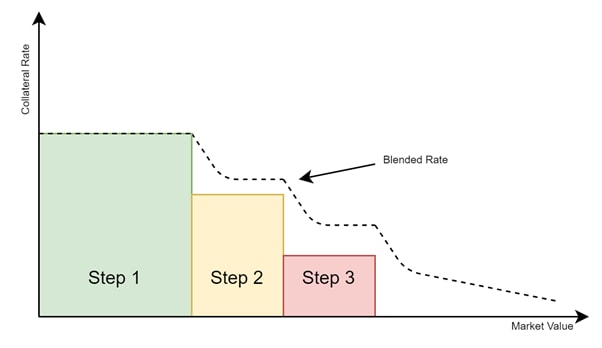

Společnost Saxo nabízí metodiku stupňovitého zajištění jako mechanismus řízení rizika likvidity a nižší než očekávané výkonnosti. U stupňovitého zajištění se průměrná míra zajištění ("Blended collateral rate") snižuje s tržní hodnotou instrumentu. Platí to i naopak: když tržní hodnota instrumentu klesá, průměrná míra zajištění roste. Tento koncept je znázorněn níže:

Různé tržní hodnoty (nebo úrovně) jsou definovány jako absolutní počet amerických dolarů (USD) ve všech nástrojích. Každý instrument má v každé úrovni určitou míru zajištění.

Vezměte prosím na vědomí, že míra zajištění může být změněna bez předchozího upozornění.

Společnost Saxo si vyhrazuje právo snížit míru zajištění pro velké pozice, včetně klientských portfolií, která jsou považována za vysoce riziková.

Koncentrační srážka je postavena na sazbách zajištění (collateral rates), kde je všem akciím přiřazena jak požadovaná marže (pro CFD a opce), tak hodnota zajištění.

Pokud jsou akcie použity jako kolaterál stejné jako podkladové aktivum pro pozici s pákovým efektem, bude odečtena dodatečná srážka. Dodatečná "koncentrační srážka" se bude rovnat maržovému požadavku pákové pozice.

Hodnota zajištění pro podkladové aktivum se bude rovnat hodnotě zajištění aktiva mínus maržový požadavek pozice s pákovým efektem.

Tím se využití marže stane citlivějším na cenové výkyvy podkladového aktiva. Koncentrační srážka je zavedena s cílem zohlednit nevyhnutelně rizikovější pozici, pokud je expozice soustředěna kolem jednoho podkladové aktiva a není diverzifikovaná.

Příklad

Klient s paušální marží chce nakoupit CFD v hodnotě 25 000 USD na určitou společnost a již má 10 000 USD v akciích stejné společnosti. Vzhledem k tomu, že podkladové aktivum CFD pozice je stejné jako akcie použité pro zajištění, bude odečtena srážka za koncentraci. Pokud mají akcie společnosti rating 1, výpočet využití marže bude následující:

| Portfolio, CFD a akcie ve stejném podkladovém aktivu | Hodnota (USD) |

| CFD | 25,000 |

| Akcie | 10,000 |

| Požadavek na marži, 10% | 2,500 |

| Snížení hodnoty zajištění, 25 % hodnoty akcií ve společnosti | 2,500 |

| Koncentrační srážka = požadavek na marži pro CFD | 2,500 |

| Hodnota zajištění v akciích po srážkách | 5,000 |

| Využití marže = požadavek na marži / hodnota zajištění akcie | 50% |

Pokud by se podkladové aktivum pro CFD pozici lišilo od akcií klienta, pak by se uplatnilo využití marže ve výši 33 %.