Margininformasjon

Initiell margin og vedlikeholdsmargin er til for å beskytte deg mot ugunstige markedsforhold, ved å skape en buffer mellom handelskapasiteten din og nivået for marginavhengig tvungen avslutning.

- Initiell margin: En handelsmarginkontroll ved ordreplassering før handelen foretas, dvs. at ved åpning av en ny posisjon må det være tilstrekkelig marginsikkerhet tilgjengelig for å oppfylle kravet til initiell margin for hele marginporteføljen.

- Vedlikeholdsmargin: En kontinuerlig kontroll av marginen, det vil si minimumsbeløpet av kontanter eller godkjent marginsikkerhet som må opprettholdes på kontoen for å opprettholde en åpen posisjon. Vedlikeholdsmarginen brukes til å beregne marginutnyttelsen, og en tvungen avslutning vil skje så snart du ikke oppfyller kravet til vedlikeholdsmargin.

Du kan lese mer om initiell- og vedlikeholdsmargin her.

Marginkrav varierer mellom forskjellige valutapar og avhenger av eksponeringen i det aktuelle valutaparet. Marginkravene kan være underlagt myndighetsregulerte minimumsverdier og kan endres i henhold til valutaparets underliggende likviditet og volatilitet. Av denne grunn krever de mest likvide valutaparene (de store) i de fleste tilfeller lavere margin.

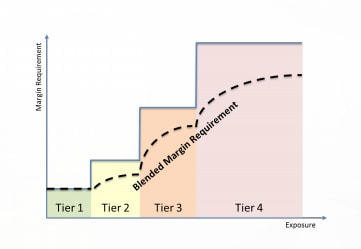

Saxo tilbyr nivåbaserte marginer som en mekanisme for å håndtere politiske og økonomiske hendelser som kan føre til at markedet blir volatilt og endrer seg raskt. Med nivåbasert margin øker det gjennomsnittlige marginkravet («Blended Margin Requirement») med eksponeringsnivået. I motsatt fall vil marginkravet reduseres når eksponeringsnivået reduseres. Dette konseptet er illustrert nedenfor:

De ulike eksponeringsnivåene angis som et absolutt beløp i amerikanske dollar (USD) på tvers av alle valutaparene. Hvert valutapar har et spesifikt marginkrav for hvert nivå.

Vær oppmerksom på at marginkrav kan endres uten forvarsel. Saxo forbeholder seg retten til å øke marginkravene for store posisjonstørrelser, inkludert klientporteføljer som anses for å ha høy risiko.

Marginsatser for ikke-profesjonelle vil som standard gjelde. Som kunde regulert under ESMA (Den europeiske verdipapir- og markedstilsynsmyndigheten) kan du velge å endre kategori til kvalifisert profesjonell for å dra nytte av lavere marginkrav. Hvis du vil lese mer om fordelene med profesjonelle kontoer og hvordan du kvalifiserer deg, kan du klikke her.

Hvis du ønsker en oversikt over margininformasjon for kvalifiserte profesjonelle, kan du klikke her.

Initiell margin og vedlikeholdsmargin er til for å beskytte deg mot ugunstige markedsforhold, ved å skape en buffer mellom handelskapasiteten din og nivået for marginavhengig tvungen avslutning.

- Initiell margin: En handelsmarginkontroll ved ordreplassering før handelen foretas, dvs. at ved åpning av en ny posisjon må det være tilstrekkelig marginsikkerhet tilgjengelig for å oppfylle kravet til initiell margin for hele marginporteføljen.

- Vedlikeholdsmargin: En kontinuerlig kontroll av marginen, det vil si minimumsbeløpet av kontanter eller godkjent marginsikkerhet som må opprettholdes på kontoen for å opprettholde en åpen posisjon. Vedlikeholdsmarginen brukes til å beregne marginutnyttelsen, og en tvungen avslutning vil skje så snart du ikke oppfyller kravet til vedlikeholdsmargin.

Du kan lese mer om initiell- og vedlikeholdsmargin her.

Marginkravet til valutaopsjoner beregnes per valutapar, noe som sikrer at de er innenfor rammen til konseptet med nivåbaserte marginer, som med valutaspot og forwards, og per forfallsdato. I hvert valutapar er det en øvre grense for marginkravet, som er den høyeste potensielle eksponeringen for alle valutaopsjonene samt valutaspot og forwardplasseringer multiplisert med det gjeldende spotmarginkravet. Denne beregningen tar også hensyn til potensiell binding mellom valutaopsjoner og valutaspot- og forwardplasseringer.

I strategier med begrenset risiko, f.eks. en short call spread, beregnes marginkravet for en valutaopsjonsportefølje som det maksimale fremtidige tapet.

Ved strategier med ubegrenset risiko, f.eks. naken short opsjoner, beregnes marginkravet som det nominelle beløpet multiplisert med det gjeldende spot-marginkravet.

Nivåbaserte marginsatser blir brukt til beregning av valutaopsjonsmarginer hvis kundens marginkrav er styrt av det aktuelle valutamarginkravet, og ikke det maksimale fremtidige tapet. De gjeldende valutaspotmarginnivåene er lagvis basert på nominelle beløp i USD – desto høyere det nominelle beløpet, desto høyere er den potensielle marginsatsen. Det nivåbaserte marginkravet beregnes per valutapar. Ved beregning av valutaopsjonsmarginer er det aktuelle spotmarginkravet i hvert valutapar den lagvise eller den blandede marginsatsen. Dette blir fastsatt på grunnlag av den høyeste potensielle eksponeringen for alle valutaopsjoner og valutaspot- og –forwardplasseringer.

Eksempel 1: Short Call Spread eller Begrenset Risiko strategi

Du selger en call spread på 10M USDCAD til strikes på 1,41 og 1,42.

Den gjeldende spotsatsen er 1,40.

Marginkravet blir da det maksimale fremtidige tapet på 71 429 USD (10M x (1,42 – 1,41) = 100 000 CAD/USD til 1,40).

Eksempel 2: Ubegrenset tapsrisiko

Du selger en 10M USDCAD put opsjon Du har en ubegrenset tapsrisiko. Marginkravet beregnes derfor som det nominelle beløpet multiplisert med det gjeldende spot-marginkravet.

Det gjeldende spot-marginkravet bestemmes av den høyeste potensielle eksponeringen, som er 10M USD.

Den gjeldende spotsatsen blir derfor den blandede marginsatsen på 2,2 % ((1 % x 3M USD + 2 % x 2M USD + 3 % x 5M USD) / 10M).

Marginkravet blir dermed 220 000 USD (2,2 % x 10M USD).

Initiell margin og vedlikeholdsmargin er til for å beskytte deg mot ugunstige markedsforhold, ved å skape en buffer mellom handelskapasiteten din og nivået for marginavhengig tvungen avslutning.

- Initiell margin: En handelsmarginkontroll ved ordreplassering før handelen foretas, dvs. at ved åpning av en ny posisjon må det være tilstrekkelig marginsikkerhet tilgjengelig for å oppfylle kravet til initiell margin for hele marginporteføljen.

- Vedlikeholdsmargin: En kontinuerlig kontroll av marginen, det vil si minimumsbeløpet av kontanter eller godkjent marginsikkerhet som må opprettholdes på kontoen for å opprettholde en åpen posisjon. Vedlikeholdsmarginen brukes til å beregne marginutnyttelsen, og en tvungen avslutning vil skje så snart du ikke oppfyller kravet til vedlikeholdsmargin.

Du kan lese mer om initiell- og vedlikeholdsmargin her.

Initiell margin og vedlikeholdsmargin er utformet for å beskytte deg mot ugunstige markedsforhold ved å skape en buffer mellom handelskapasiteten din og marginavslutningsnivået.

- Initiell margin: en marginkontroll før handel ved ordreinnleggelse, dvs. at det ved åpning av en ny posisjon må være tilstrekkelig marginsikkerhet tilgjengelig på konto til å oppfylle kravet til initialmargin for hele marginporteføljen.

- Vedlikeholdsmargin: en løpende marginkontroll, dvs. det minste beløpet i kontanter eller godkjent marginsikkerhet som må holdes på konto for å holde en åpen posisjon. Vedlikeholdsmarginen brukes til å beregne marginutnyttelsen, og en avslutning vil skje så snart du ikke oppfyller kravet til vedlikeholdsmargin.

Initiell- og vedlikeholdsmarginen for en CFD på en enkelt aksje er basert på aksjens rating. Saxo definerer 6 forskjellige aksjerangeringer. Denne ratingen er avledet fra markedsverdien, likviditeten og volatiliteten til det underliggende verdipapiret.

| Saxo Rating | Initiell margin | Vedlikeholdsmargin |

|---|---|---|

| 1 | 20% | 10% |

| 2 | 20% | 15% |

| 3 | 25% | 20% |

| 4 | 35% | 30% |

| 5 | 55% | 50% |

| 6 | 110% | 100% |

For å finne rating og sikkerhetsverdi kan du søke etter et spesifikt instrument i forhåndsvisningen av plattformen og åpne produktoversikten. Velg informasjonsknappen (i) øverst til høyre, og gå deretter til Instrument-fanen.

Det finnes to forskjellige marginkrav

- Initiell margin: en marginkontroll ved ordreplassering før handelen foretas

- Vedlikeholdsmargin: En kontinuerlig marginkontroll (minimum marginsikkerhet som må være på kontoen for å holde en posisjon åpen. Den brukes til å beregne marginutnyttelsen)

En indeks-CFD med en initiell margin på 5 % kan handles med en giring på 20:1.

Marginer for indeks-CFD-er (normale markedsforhold)

| Index Tracker | Initiell margin | Vedlikeholdsmargin | |

|---|---|---|---|

| US 30 Wall Street | 5 % | 2,5 % | |

| US 500 | 5 % | 2,5 % | |

| US Tech 100 NAS | 5 % | 2,5 % |

| Denmark 25 | 10 % | 5 % | |

| EU Stocks 50 | 5 % | 2.5 % | |

| France 40 | 5 % | 2.5 % | |

| Germany 40 | 5 % | 2.5 % | |

| Germany Mid-Cap 50 | 10 % | 5 % | |

| Germany Tech 30 | 10 % | 5 % | |

| Netherlands 25 | 10 % | 5 % | |

| Norway 25 | 10 % | 5 % | |

| Spain 35 | 10 % | 5 % | |

| Sweden 30 | 10 % | 5 % | |

| Switzerland 20 | 10 % | 5 % |

| Australia 200 | 5 % | 2,5 % | |

| Hong Kong | 10 % | 5 % |

Kontraktdetaljer for indeks-CFD-er (forfall)

| Index Tracker | Initiell margin | Vedlikeholdsmargin | |

|---|---|---|---|

| China 50 | 10 % | 5 % | |

| UK 100 | 5 % | 2,5 % | |

| UK Mid 250 | 10 % | 5 % | |

| Singapore | 10 % | 5 % | |

| Taiwan | 10 % | 5 % | |

| US2000 | 10 % | 5 % | |

| Japan 225 | 5 % | 4,5 % | |

Det finnes to forskjellige marginkrav

- Initiell margin: en marginkontroll ved ordreplassering før handelen foretas

- Vedlikeholdsmargin: En kontinuerlig marginkontroll (minimum marginsikkerhet som må være på kontoen for å beholde en åpen posisjon. Den brukes til å beregne marginutnyttelsen)

En CFD på valuta med en initiell margin på 3,33 % kan handles med en giring på 30:1.

| Instrumentnavn | Symbol | Initiell margin | Vedlikeholdsmargin |

|---|---|---|---|

| VALUTAER | |||

| Euro / Amerikanske Dollar | EURUSDEC | 3,33 % | 1,66 % |

| Euro / Japanske Yen | EURJPYRY | 3,33 % | 1,66 % |

| Euro / Sveitsiske Franc | EURCHFRF | 3,33 % | 1,66 % |

| Euro / Britiske Pund | EURGBPRP | 3,33 % | 1,66 % |

| Britiske Pund / Amerikanske Dollar | GBPUSDBP | 3,33 % | 1,66 % |

| Australske Dollar / Amerikanske Dollar | AUDUSDAD | 3,33 % | 1,66 % |

| USD-indeks | USDINDEX | 20 % | 10 % |

Det finnes to forskjellige marginkrav

- Initiell margin: en marginkontroll ved ordreplassering før handelen foretas

- Vedlikeholdsmargin: En kontinuerlig marginkontroll (minimum marginsikkerhet som må være på kontoen for å beholde en åpen posisjon. Den brukes til å beregne marginutnyttelsen)

En CFD på råvarer med en initiell margin på 10 % kan handles med en giring på 10:1.

| Instrumentnavn | Symbol | Initiell margin | Vedlikeholdsmargin |

|---|---|---|---|

METALLER | |||

| Gull | GOLD | 5 % | 2,5 % |

| Sølv | SILVER | 10 % | 5 % |

| Platinum | PLATINUM | 10 % | 5 % |

| Palladium | PALLADIUM | 10 % | 5 % |

| US Kobber | COPPERUS | 10 % | 5 % |

ENERGI | |||

| US Råolje | OILUS | 10 % | 5 % |

| UK Råolje | OILUK | 10 % | 5 % |

| Fyringsolje | HEATINGOIL | 10 % | 5 % |

| Bensin (USA) | GASOLINEUS | 10 % | 5 % |

| Gassolje | GASOILUK | 10 % | 5 % |

| Naturgass (USA) | NATGAS | 10 % | 5 % |

| CO2-utslipp | EMISSIONS | 10 % | 5 % |

JORDBRUK | |||

| Mais | CORN | 10 % | 5 % |

| Hvete | WHEAT | 10 % | 5 % |

| Soyabønner | SOYBEANS | 10 % | 5 % |

MYKE RÅVARER | |||

| Sugar No. 11 (New York) | SUGARNY | 10 % | 5 % |

| Kaffe (New York) | COFFEE | 10 % | 5 % |

| Kakao (New York) | COCOA | 10 % | 5 % |

KJØTT | |||

| Levende storfe | LIVECATTLE | 10 % | 5 % |

Det finnes to forskjellige marginkrav

- Initiell margin: en marginkontroll ved ordreplassering før handelen foretas

- Vedlikeholdsmargin: En kontinuerlig marginkontroll (minimum marginsikkerhet som må være på kontoen for å holde en posisjon åpen. Den brukes til å beregne marginutnyttelsen)

En obligasjons-CFD med en initiell margin på 10 % kan handles med en giring på 10:1.

| Initiell margin | Vedlikeholdsmargin | Produkt/Instrument |

|---|---|---|

| 20 % | 10 % | German Government 5 year Bobl German Government 2 year Schatz |

| 20 % | 10 % | German Government 10 year Bund |

| 20 % | 10 % | French Government 10 year OAT |

| 20 % | 10 % | Italian Government 10 year BTP |

Marginsatser for ikke-profesjonelle vil som standard gjelde. Du kan velge å endre kategori til kvalifisert profesjonell for å dra nytte av lavere marginkrav*. Hvis du vil lese mer om fordelene med profesjonelle kontoer og hvordan du kvalifiserer deg, kan du klikke her.

Hvis du ønsker en oversikt over margininformasjon for kvalifiserte profesjonelle, kan du klikke her.

Initiell margin og vedlikeholdsmargin er til for å beskytte deg mot ugunstige markedsforhold, ved å skape en buffer mellom handelskapasiteten din og nivået for marginavhengig tvungen avslutning.

- Initiell margin: En handelsmarginkontroll ved ordreplassering før handelen foretas, dvs. at ved åpning av en ny posisjon må det være tilstrekkelig marginsikkerhet tilgjengelig for å oppfylle kravet til initiell margin for hele marginporteføljen.

- Vedlikeholdsmargin: En kontinuerlig kontroll av marginen, det vil si minimumsbeløpet av kontanter eller godkjent marginsikkerhet som må opprettholdes på kontoen for å opprettholde en åpen posisjon. Vedlikeholdsmarginen brukes til å beregne marginutnyttelsen, og en tvungen avslutning vil skje så snart du ikke oppfyller kravet til vedlikeholdsmargin.

Du kan lese mer om initiell- og vedlikeholdsmargin her.

For å finne rating og sikkerhetsverdi, søk etter et spesifikt instrument i vår forhåndsvisningen av plattformen og åpne produktoversikten. Velg informasjonsknappen (i) øverst til høyre, og gå deretter til Instrument-fanen.

Saxo Bank opererer med to marginprofiler:

- En grunnleggende profil som i utgangspunktet bare kan brukes til å kjøpe opsjoner – puts og/eller calls.

- En avansert profil for individuelt vurderte kunder som gir samme muligheter som den grunnleggende profilen, pluss muligheten til å utstede (selge/shorte) opsjoner samt motta marginfordeler på opsjonsstrategier (kombinasjoner av opsjoner og/eller underliggende posisjoner).

Du finner mer informasjon om marginkrav og marginreduksjon i de respektive delene nedenfor. Hvis det inntreffer et marginbrudd hvor en tvangslukking utløses, stenges alle opsjonsposisjonene. Nedenfor finner du informasjon om marginkrav og tillatte grenser for den avanserte profilen:

| Strategi | Initiell- og vedlikeholdsmargin |

|---|---|

Long straddle | Ingen |

| OTM Naked call | AksjeopsjonerPris for call + Maksimum ((X%* underliggende pris) – out-of-the-money-beløp), (Y% * underliggende pris)) Out-of-the-money-beløpet for en call tilsvarer: Maks (0, strike – underliggende pris) Eksempel: shorte 1 DTE jan14 12,50 call til 0,08 Underliggende pris på 12.30

|

| Utstedelse av put uten dekning | AksjeopsjonerPris for put + Maksimum ((X%* underliggende pris) - out-of-the-money-beløp), (Y% * strike)) Eksempel: shorte 1 DTE jan14 12 put til 0,06 Underliggende pris på 12.30

|

| Bull Call Spread | Maksimum ((Strikepris long call – Strikepris short call), 0) Eksempel: Long DTE Jan14 12,5 kjøpsopsjon til 0,10 og short DTE Jan14 13,5 call opsjon til 0,02

|

Bull Put Spread | (Strike Short Put – Strike Long Put) – (Short Put-pris – Long Put-pris) Eksempel: Short DTE Jan14 salgsopsjon 12 salgsopsjon til 0,08 og long DTE Jan14 11 salgsopsjon til 0,02

|

Short Straddle | Hvis Initial Margin Short Put > Initial Short Call, så |

Short-posisjoner i American Style opsjoner kan kombineres med long-posisjoner eller eierskap i underliggende for å utligne den høye risikoeksponeringen. Marginkravet kan derfor reduseres eller frafalles. Vi reduserer marginer for følgende kombinasjoner:

- Covered Call

- Call/put-spread

- Short Straddle

Covered Call

En short-posisjon i en call kan utlignes med en long-posisjon i den underliggende aksjen.

Call/put-spread

Med en spread-posisjon kan en long-posisjon gi dekning for en short-posisjon i en opsjon av samme type, med samme underliggende. Når long-posisjonen er dypere in-the-money enn short-posisjonen (debit-spread), brukes verdien av long-posisjonen til å kompensere for verdien til short-posisjonen for dekning, uten ekstra marginkrav.

Når short-posisjonen er dypere in-the-money enn long-posisjonen (kreditt-spread), brukes hele verdien av long-posisjonen til å kompensere pluss en ekstra margin tilsvarende forskjellen i innløsningspris.

Merk: For å lukke en spread-posisjon anbefales det å først selge short-posisjonen og deretter long-posisjonen, for å unngå et høyt marginkrav for en short-posisjon uten dekning. Siden spread-marginen kanskje ikke er tilstrekkelig til å dekke kontantbeløpet som kreves for å kjøpe tilbake short-posisjonen, låses kunden kanskje fast i en posisjon der han ikke kan løse seg ut uten ytterligere midler.

Short straddle/strangle

En short straddle/strangle er annerledes enn en posisjon med dekning eller en spread, da beina til en short straddle ikke gir dekning for hverandre. En short straddle/strangle kombinerer en short call med en short put. Siden eksponeringen til en short call og en short put er motsatt med tanke på markedsretning, kreves det bare ekstra margin for det beinet som er mest out-of-the-money.

Når den underliggende kursen er i beinet til kjøpsopsjonen i strangle-posisjonen, må kunden levere den underliggende aksjen. I motsatt tilfelle, når den underliggende kursen er i beinet til salgsopsjonen i strangle-posisjonen, må kunden ta levering for den underliggende aksjen. Long-posisjonen i aksjen kan kombineres med det andre call-beinet i den opprinnelige strangle-posisjonen, hvilket gir en Covered call.

For visse instrumenter, inkludert aksjeopsjoner, stiller vi krav til margin for å kunne imøtekomme eventuelle tap som kan oppstå ved at man har en posisjon i instrumentet. Aksjeopsjoner blir behandlet som «full premium style»-opsjoner.

Eksempel med full premie:

Ved kjøp av en full premie-opsjon trekkes premien fra kundens kontantbeholdning. Verdien fra en åpen long-posisjon i en opsjon vil ikke være tilgjengelig for marginhandel, med mindre marginkravet er redusert ved bruk av en marginreduksjonsstrategi.

I det følgende eksempel kjøper en kunde en Apple Inc. DEC 2013 530 Call @ $25 (Apple-aksjen omsettes for $529,85. En opsjon omfatter 100 aksjer, kurtasjen er $6,00 per lot og børsavgiften er $0,30. Med en kontantbeholdning på $10 000 vil kundens kontooversikt se ut som følger:

Kontant- og posisjonssammendrag | ||

|---|---|---|

Verdi av posisjon | 1 * 25 * 100 aksjer = | $2500,00 |

Urealisert gevinst/tap | -- | |

Kostnader for å lukke | – 1* ($6 + $0,30) = | – $6,30 |

Urealisert verdi av posisjoner | $2493,70 | |

Kontantbeholdning | $10 000,00 | |

Transaksjoner ikke bokført | – ($2500 + $6,30) = | – $2506,30 |

Kontoverdi | $9987,40 | |

Ikke tilgjengelig som marginsikkerhet | – 1 * 25 * 100 aksjer = | – $2500,00 |

Brukt til marginkrav | -- | |

Tilgjengelig for marginhandel | $7487,40 | |

Ved fullpremieopsjoner legges de ikke-bokførte transaksjonene til i kundens kontantbeholdning fra dag til dag. Neste dag når opsjonsmarkedet har beveget seg til USD 41 (spot på 556,50), viser kontooversikten følgende:

Kontant- og posisjonssammendrag | ||

|---|---|---|

Verdi av posisjon | 1 * 41 * 100 aksjer = | $4100,00 |

Urealisert gevinst/tap | -- | |

Kostnader for å lukke | – 1*($6+$0,30) = | –$6,30 |

Urealisert verdi av posisjoner | $4093,70 | |

Kontantbeholdning | $7493,70 | |

Transaksjoner ikke bokført | -- | |

Kontoverdi | $11 587,40 | |

Ikke tilgjengelig som marginsikkerhet | – 1 * 41 * 100 aksjer = | –$ 4100,00 |

Brukt til marginkrav | -- | |

Tilgjengelig for marginhandel | $7487,40 | |

Verdi av posisjon: Høyere på grunn av høyere opsjonspris.

Urealisert verdi av posisjoner: Høyere på grunn av høyere opsjonspris.

Kontantbeholdning: Redusert av opsjonsprisen. «Transaksjoner ikke bokført» er nå null.

Kontoverdi: Høyere på grunn av høyere opsjonspris.

Ikke tilgjengelig som marginsikkerhet: Økt på grunn av posisjonens nye verdi.

Margin for short-opsjon

En short-posisjon i opsjonen eksponerer innehaveren av den posisjonen for risikoen for å måtte levere underliggende når motparten velger å innløse opsjonen sin for levering. Tap på short-posisjoner i opsjoner kan være betydelige når markedet går mot posisjonen. Vi belaster derfor en marginpremium for å sikre at det er tilstrekkelig verdi på kontoen til å lukke short-posisjonen, og ekstra margin for å dekke endringer i underliggendes verdi fra dag til dag. Marginbeløpene overvåkes i sanntid for endringer i markedsverdier, og posisjonen kan tvangslukkes hvis det samlede marginkravet for alle marginposisjoner overskrider kundens marginprofil.

Den generelle marginformelen for en short-posisjon i en opsjon er:

- Margin for short-opsjon = marginpremium + tilleggsmargin

Marginpremium sikrer at short-posisjonen kan lukkes til gjeldende markedspris, og tilsvarer gjeldende salgspris for opsjonen i løpet av handelsdagen. Tilleggsmarginen skal dekke prisendringer for underliggende fra dag til dag når opsjonen ikke kan lukkes, på grunn av begrensede handelstider.

Aksjeopsjoner

For aksjeopsjoner tilsvarer tilleggsmarginen en prosent av underliggende referanseverdi minus en rabatt for beløpet som opsjonen er out-of-the-money med.

- Ekstra marginkrav for en call= Maks (X% * underliggende spot) - out-of-the-money-beløp, Y% * underliggende spot)

- Ekstra marginkrav for en put = Maks (X% * underliggende spot) - out-of-the-money-beløp, Y% * innløsningspris)

Marginprosentene bestemmes og kan endres av Saxo Bank. De faktiske verdiene kan variere avhengig av opsjonskontrakten, og kan konfigureres i marginprofilene. Kundene kan se de gjeldende verdiene i kontraktens handelsvilkår.

Out-of-the-money-beløpet for en call tilsvarer:

- Maks (0, innløsningspris - underliggende spot)

Out-of-the-money-beløpet for en put tilsvarer:

- Maks (0, underliggende spotpris - innløsningspris)

For å komme frem til valutabeløpet som er involvert må du gange anskaffelsesverdiene med handelsenheten (100 aksjer).

Eksempel:

La oss ta utgangspunkt i at FORM har X-margin på 15 % og en Y-margin på 10 % for Apple-aksjer.

En kunde shorter en Apple DEC 2013 535 Call til $ 1,90 (Apple-aksje $ 523,74). Én opsjon tilsvarer 100 aksjer. OTM-beløpet er 11,26 aksjepunkter (535 - 523,74), hvilket gir en tilleggsmargin på 67,30 aksjepunkter ($ 6730). I kontosammendraget beregnes marginpremium ut fra posisjonsverdien:

| Kontant- og posisjonssammendrag | ||

|---|---|---|

Verdi av posisjon | – 1 * $1,90 * 100 aksjer = | – $190,00 |

Urealisert gevinst/tap | -- | |

Kostnader for å lukke | – (6 + $0,30) = | – $6,30 |

Urealisert verdi av posisjoner | – $196,30 | |

Kontantbeholdning | $10 000,00 | |

Transaksjoner ikke bokført | $190 – ($6 + $0,30) = | $183,70 |

Kontoverdi | $9987,40 | |

Ikke tilgjengelig som marginsikkerhet | -- | |

Brukt til marginkrav | – 100 aksjer *( (0,15 * 523,74) – 11,26) | – $6730,00 |

Tilgjengelig for marginhandel | $3257,40 | |

Selgeren av opsjonen (utsteder) er pliktet til å selge (i tilfellet med kjøpsopsjon) eller kjøpe (i tilfellet med salgsopsjon) det underliggende instrumentet til eller fra kjøperen av opsjonen (innehaver) til en spesifisert pris på kjøperes forespørsel.

En short-posisjon i opsjoner kan føre til betydelige tap hvis markedet går mot posisjonen. Saxo krever en premie for å sikre at kundekontoen har tilstrekkelige midler tilgjengelig for å lukke short-posisjonen i opsjoner, og en tilleggsmargin for å dekke eventuelle kursendringer over natten for verdien til det underliggende instrumentet.

Den generelle marginformelen for en short-posisjon i en opsjon er: Margin for short-opsjon = marginpremium + tilleggsmargin.

Marginkravet overvåkes i sanntid. Hvis kundens tap overskrider marginutnyttelsen, kan det føre til automatisk marginavhengig tvungen avslutning, hvilket betyr at Saxo vil umiddelbart si opp, avbryte og lukke hele eller deler av eventuelle åpne posisjoner.

Marginhandel har et høyt risikonivå som kan føre til omfattende tap som overskrider kontantbeløpet og/eller godkjent sikkerhet på kundekontoen.

Marginhandel passer ikke for alle. Sørg for at du forstår risikofaktorene og ber om råd fra en uavhengig part hvis nødvendig.

Sikkerhetssatser for marginhandel

(Kun for profesjonelle kunder)

Saxo Bank tillater at en prosentandel av investeringen i visse aksjer og ETF-er brukes som sikkerhet for marginhandel. Sikkerhetsverdien til en aksje- eller ETF-posisjon avhenger av den enkelte aksjen eller ETF-ens rating – se tabellen nedenfor for mer informasjon

| Rating | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Posisjonens sikkerhetsverdi | 75% | 50% | 50% | 25% | 0% | 0% |

Eksempel: 75 % av verdien til en aksje- eller ETF-posisjon med rating 1 kan brukes som sikkerhet (i stedet for kontanter) til å handle marginprodukter som valuta, CFD-er, futures og opsjoner. Vær oppmerksom på at Firmanavn forbeholder seg retten til å redusere eller fjerne bruken av aksje- eller ETF-investeringer som sikkerhet for store posisjonsstørrelser, eller aksjeporteføljer som anses å ha svært høy risiko.

For å finne rating og sikkerhetsverdi kan du søke etter et spesifikt instrument i forhåndsvisningen av plattformen og åpne produktoversikten. Velg informasjonsknappen (i) øverst til høyre, og gå deretter til Instrument-fanen.

Saxo Bank tillater at en prosentandel av investeringen i visse obligasjoner kan brukes som sikkerhet for marginhandel.

Sikkerhetsverdien av en obligasjonsposisjon avhenger av ratingen til den aktuelle obligasjonen, som beskrevet nedenfor:

| Ratingdefinisjon* | Sikkerhetsprosent |

|---|---|

| Høyeste rating (AAA) | 95 % |

| Meget høy kvalitet (AA) | 90 % |

| Høy kvalitet (A) | 80 % |

Eksempel: 80 % av markedsverdien til en obligasjonsposisjon med A-rating kan brukes som sikkerhet (i stedet for kontanter) til å handle marginprodukter som valuta, CFD-er eller futures og opsjoner.

Vær oppmerksom på at Saxo Bank forbeholder seg retten til å redusere eller eliminere bruken av obligasjonsposisjoner som sikkerhet.

For ytterligere veiledning eller for å be om rating og sikkerhetsbehandling av en spesifikk eller potensiell obligasjonsposisjon, send en e-post til fixedincome@saxobank.com eller kontakt kundebehandleren din.

Sikkerhetsrentene varierer fra instrument til instrument og avhenger av markedsverdien på de aktuelle instrumentene. Sikkerhetsnivåer kan være underlagt myndighetspålagte maksimumsgrenser og kan endres i henhold til instrumentets underliggende likviditet og volatilitet. Derfor gir de mest likvide instrumentene i de fleste tilfeller høyere pantesikkerhet.

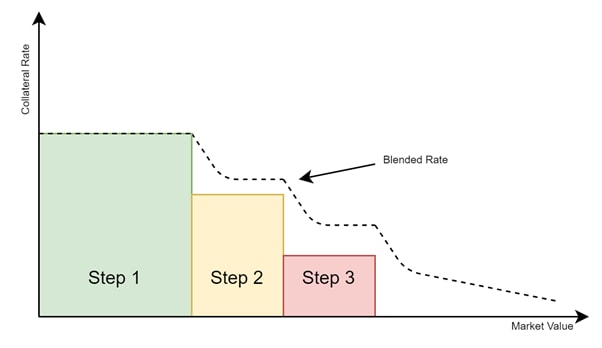

Saxo tilbyr metoden for trinnvis sikkerhetsstillelse som en mekanisme for å håndtere gap- og likviditet-risiko. Med trinnvis sikkerhet reduseres den gjennomsnittlige sikkerhetsrenten ("Blended collateral rate") med instrumentets markedsverdi. Det motsatte er også tilfelle; når markedsverdien på instrumentet synker, øker den gjennomsnittlige sikkerhetsrenten. Dette konseptet er illustrert nedenfor:

De ulike markedsverdiene (eller nivåene) er definert som et absolutt antall amerikanske dollar. (USD) på tvers av alle instrumenter. Hvert instrument har en spesifikk sikkerhetsrente i hvert nivå.

Vær oppmerksom på at sikkerhetsstillelsen kan bli endret uten forvarsel.

Saxo forbeholder seg retten til å redusere sikkerhetsstillelsen for store posisjoner, inkludert kundeporteføljer som anses å ha høy risiko.

Dette er basert på sikkerhetskravene (collateral rates), hvor alle eiendeler tildeles både et marginkrav (for CFD-er og opsjoner) og en verdi som sikkerhetsstillelse.

Hvis den eiendelen som brukes som sikkerhet, er den samme som det underliggende for den gearede posisjonen, vil det bli trukket et ekstra "haircut". Det ekstra "haircut" vil tilsvare marginkravet for den gearede posisjonen.

Verdien av sikkerheten for den underliggende eiendelen vil være lik sikkerhetsverdien av eiendelen minus marginkravet for den gearede posisjonen.

Dette vil gjøre marginutnyttelsen mer følsom for kursbevegelser i den underliggende eiendelen. "Haircutet" innføres for å ta hensyn til den iboende høyere risikoen ved å ha en eksponering som er konsentrert rundt én underliggende eiendel og ikke er diversifisert.

Eksempel

En kunde med faste marginsatser ønsker å kjøpe 25.000 USD i CFD-er i et selskap og eier allerede aksjer i samme selskap for 10.000 USD. Siden det underliggende for CFD-posisjonen er det samme som aksjene, vil det bli trukket et "haircut". Hvis selskapets aksje vurderes til 1, vil beregningen for marginutnyttelsen være:

| Portefølje, CFD-er og aksjer med samme underliggende | Verdi (USD) |

|---|---|

| CFD-er | 25.000 |

| Aksjer | 10.000 |

| Marginkrav 10% | 2.500 |

| Haircut for sikkerhetsstillelse, 25% av aksjer i selskapet | 2.500 |

| Haircut = marginkrav for CFD-er | 2.500 |

| Sikkerhetsverdi av aksjer etter haircut | 5.000 |

| Marginutnyttelse = Marginkrav/sikkerhetsverdi av aksjer | 50% |

Hvis den underliggende eiendelen for CFD-posisjonen hadde vært forskjellig fra kundens aksje, ville marginutnyttelsen ha vært 33%.