Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Saxo Group

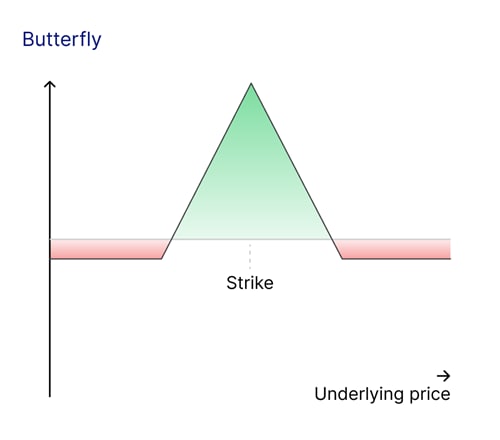

A butterfly spread is an advanced options strategy designed to profit when the underlying asset’s price remains stable. The strategy uses three sets of options to create a defined-risk, targeted-profit position:

The result resembles a butterfly’s shape, with the middle options forming the body and the two purchased options representing the wings.

The butterfly spread’s payoff profile peaks when the underlying asset’s price is exactly at the middle strike price at expiration. Losses are limited at the wings, making this a low-risk, low-reward strategy often used in low-volatility environments.

The butterfly spread is attractive to traders for several reasons:

This strategy is particularly useful for traders expecting low volatility but wanting to avoid the unlimited risk associated with selling a straddle or strangle outright.

To better understand how a butterfly spread works, let’s consider a practical example using Crude Oil futures.

Suppose crude oil is currently trading at USD 80.00 per barrel, and you expect prices to stay around this level in the short term. You decide to implement a butterfly spread:

USD 1.00 + USD 1.20 = USD 2.20.

USD 2.50 × 2 = USD 5.00.

USD 5.00 - USD 2.20 = USD 2.80.

This setup demonstrates how a butterfly spread can generate income while keeping risk under control.

One key advantage of the butterfly spread is that it provides the benefits of selling a straddle without the associated unlimited risk.

A straddle involves selling both a call and a put at the same strike price, betting on minimal price movement. However, a straddle exposes you to unlimited losses if the underlying asset’s price moves significantly in either direction.

By adding wings to the position, as in a butterfly spread, you cap the potential losses. This makes it a safer alternative, especially for retail traders.

Suppose corn futures are trading at USD 6.00 per bushel, and you are confident prices will remain stable near this level. To use a butterfly spread:

Net credit: The premiums received from selling the straddle exceed the cost of the wings.

Risk management: The wings limit your maximum loss to the difference between adjacent strike prices.

Profit potential: Highest if corn remains at USD 6.00.

For retail traders, this structure is particularly appealing because brokers often prohibit unlimited-risk strategies like naked straddles. The butterfly spread not only caps losses but also meets margin requirements, making it more accessible.

A major motivation for employing butterfly spreads is to profit from low implied volatility.

In options trading, vega measures sensitivity to changes in implied volatility. By selling the middle options, a butterfly spread takes a short vega position, benefiting if volatility decreases or stays stable.

Options traders also analyse skew (the relative pricing of options at different strike prices) and kurtosis (the likelihood of extreme price moves) when constructing butterfly spreads:

Butterfly spreads can also take advantage of pricing discrepancies. For example, if middle-strike options are overpriced relative to the wings, the strategy becomes more cost-effective. This requires careful analysis of option pricing and market conditions.

Butterfly spreads are most effective when traders expect the underlying asset’s price to remain within a narrow range. This expectation might stem from factors such as seasonal trends, anticipated periods of market calm, or technical price resistance and support levels.

Additionally, butterfly spreads work particularly well in situations where implied volatility is elevated but expected to decline. High implied volatility makes option premiums more expensive, allowing traders to collect a larger credit when selling the middle options. As volatility decreases, the value of these sold options erodes faster, boosting the strategy’s profitability.

For retail traders, butterfly spreads offer a way to sell options without requiring significant collateral. Unlike naked options, which carry unlimited risk and require large amounts of margin, butterfly spreads define the maximum loss upfront. This ensures that margin requirements remain manageable while still allowing traders to profit from stable market conditions.

The butterfly spread strategy comes with several benefits, particularly for traders looking to profit from stable prices with minimal risk:

Despite its advantages, the butterfly spread isn’t without drawbacks. Here are some limitations to keep in mind:

To make the most of the butterfly spread strategy, consider the following tips:

The butterfly spread is a highly versatile options strategy that offers a balance between defined risk and targeted profit potential. Whether you’re trading crude oil, corn, or other assets, this strategy allows you to capitalise on price stability while keeping your downside firmly under control.

Its clear risk-reward profile, cost efficiency, and margin advantages make it an attractive choice for both professional and retail traders. By understanding the factors that influence butterfly spreads—such as skew, kurtosis, and volatility—traders can optimise their positions and enhance profitability.

Ultimately, the butterfly spread exemplifies precision risk management in options trading, allowing traders to navigate uncertain markets with a clear plan. For those expecting stability in price movements, this strategy is an excellent tool to generate income while keeping risks clearly defined.