Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Strategist

A visible rotation: Healthcare outperforms while tech pauses

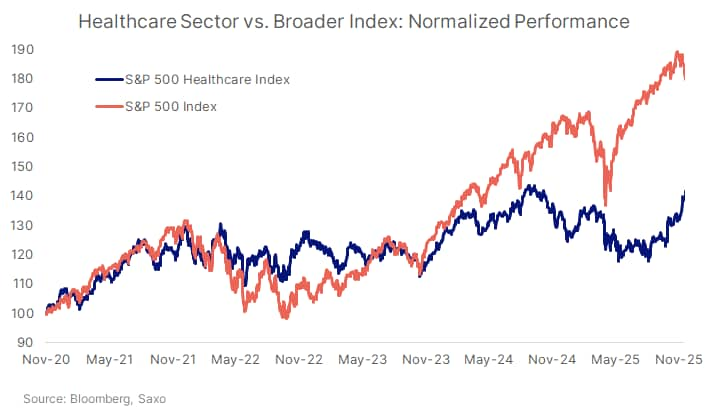

Over the past month, the S&P 500 Healthcare Index gained roughly 8+%, outperforming every major sector, while the S&P 500 Information Technology Index fell by approximately 3-4%. Eli Lilly, Cardinal Health, Regeneron, Biogen, and Merck were among the strongest contributors, with several delivering 20–30% monthly gains.

In our opinion, markets have been dominated by AI-driven leadership for much of the past two years, but the recent combination of AI-bubble concerns and rising macro uncertainty—including signs of softer US economic data—is encouraging investors to take a more defensive stance. At the same time, the healthcare sector’s outperformance should be viewed with caution: healthcare faces its own set of risks, including reimbursement pressure, regulatory scrutiny, and trial-driven volatility.

This shift does not signal the end of the AI theme. Rather, it highlights a more discerning market environment that demands clearer monetisation pathways and manageable balance-sheet commitments before rewarding AI-linked businesses with further gains.

Earnings resilience is attracting flows

Consensus expects S&P 500 healthcare sector earnings to grow 12-15% in 2025, versus 10-12% for the broader S&P 500, according to Bloomberg estimates. Meanwhile, large-cap pharma names such as Eli Lilly and Novo Nordisk have delivered double-digit revenue growth driven by GLP-1 obesity and diabetes treatments.

However, this resilience coexists with risks: drug-pricing debates are intensifying ahead of the US election cycle, and several large pharma names face patent expiries in the coming years. In our view, the sector’s relative stability is attractive — but not immune to headline-driven volatility.

These developments point to durable innovation cycles. Still, drug development remains inherently risky: trial failures can erase years of investment, regulatory approval timelines can shift, and safety concerns can materially affect valuations.

Energy and Information Technology have returned ~170% over the past five years, far outpacing healthcare’s ~60% performance. In our opinion, part of the recent strength reflects mean reversion from years of lagging returns.

Yet relative undervaluation is uneven. Some biotech and medtech names still trade at elevated multiples despite earnings uncertainty, while pharma appears more reasonably valued but faces patent-cliff risks.

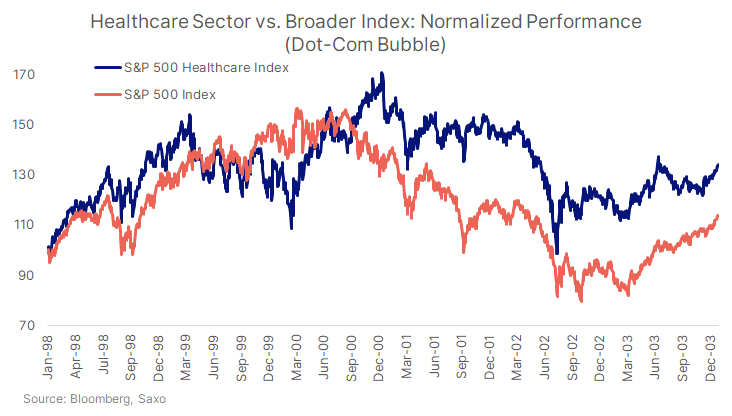

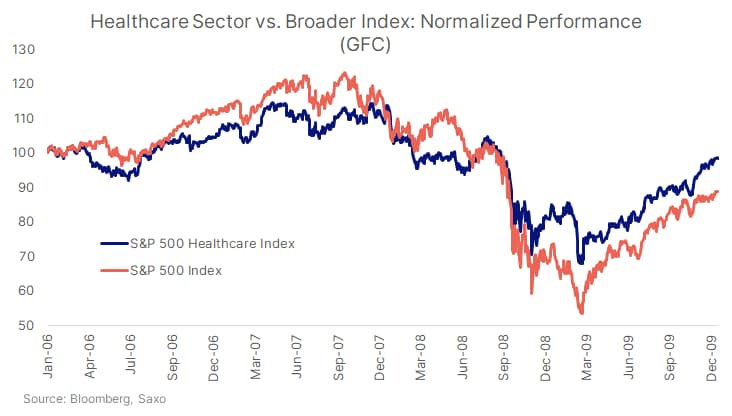

Historically, healthcare has tended to fall less and recover faster during major drawdowns, as shown during the dot-com unwind (2000–2002) and the Global Financial Crisis (2008–09). This behaviour often becomes valuable when growth slows.

But defensiveness is not uniform. Managed-care stocks can be sensitive to policy shifts; medtech can be exposed to declines in elective procedures; and biotech is particularly vulnerable to funding cycles.

With US macro data showing early signs of softening and volatility rising around AI valuations and rate expectations, healthcare’s relative stability may appeal to investors — though policy and regulatory uncertainties remain key watchpoints.

Healthcare is not a monolith. It consists of several distinct industries with different risk and return characteristics.

Investor takeaway: Healthcare is diversified internally, offering growth (biotech), stability (pharma), cyclicality (devices), or cash flow (managed care). But each subsector carries distinct risks alongside its potential benefits.

Healthcare sits in a rare sweet spot:

To maintain a balanced view:

Healthcare is therefore not a “low-risk” alternative but a differently structured risk.

The goal is also not to replace AI exposure or step away from structural digital themes.

Instead, the focus is on diversifying growth sources and broaden the drivers of risk and return within a portfolio.

For investors who have benefited from the AI-led rally, introducing healthcare exposure can help reduce concentration risk while maintaining exposure to long-term innovation — provided investors remain aware of subsector-specific risks.