Key points:

- Asia is AI’s backbone: Roughly 70% of global chipmaking, 90% of AI memory, and almost all advanced packaging capacity sit in Taiwan, Korea, and Japan — making the region indispensable to the AI ecosystem.

- Value play, not decoupling: In our view, Asia’s enablers offer cheaper, more earnings-linked exposure to the AI build-out, though they remain part of the same global tech cycle.

- When hype cools, fundamentals count: In our view, Asia sits on the capex inflow, not the outflow. Its factories continue running regardless of which U.S. platform wins the software race.

The big picture

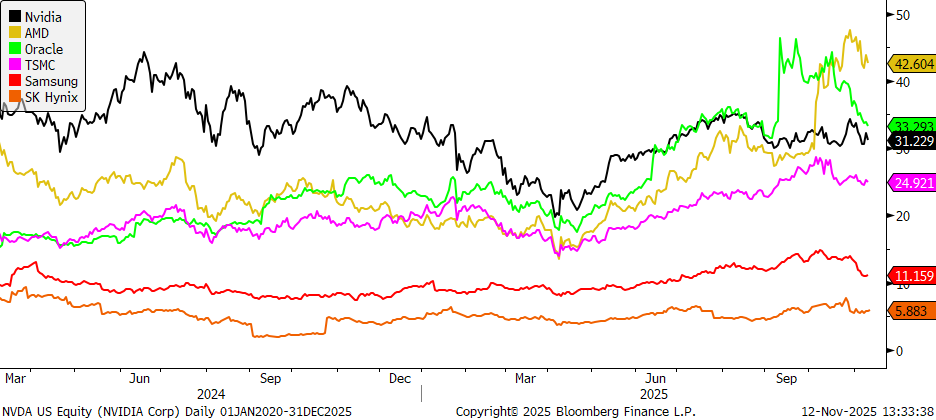

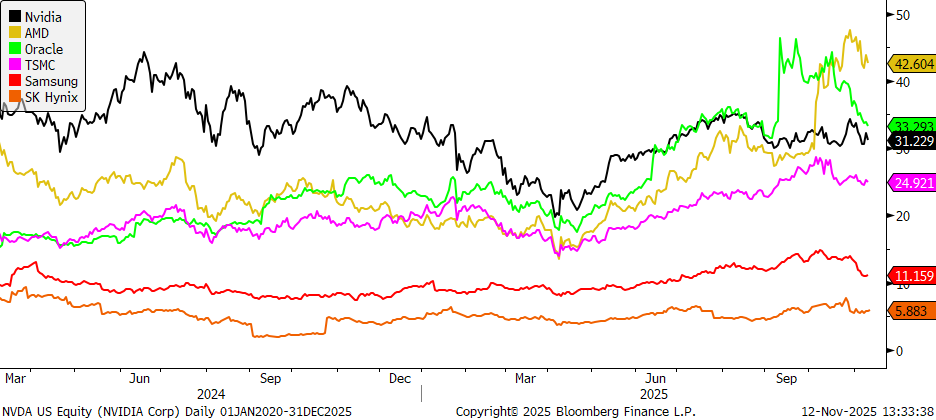

AI enthusiasm remains high, but bubble concerns are growing. U.S. tech valuations are elevated, with the S&P 500 Info Tech sector trading near 30× forward P/E (Bloomberg data, Nov 2025). The rally has narrowed, driven by a handful of mega-cap stocks.

Meanwhile, the physical build-out of AI infrastructure — chips, servers, data centres — continues at full speed, and much of that is happening in Asia.

If the U.S. is selling the AI dream, Asia is building the machinery.

According to company filings, Asia accounts for around 70% of leading-edge chipmaking capacity (TSMC ~71 %), 90% of high-bandwidth memory (SK Hynix + Samsung), and nearly all advanced packaging.

As investors shift focus from “who builds the smartest AI” to “who supplies the tools,” Asia’s enablers may represent the value side of the AI trade.

The U.S. AI story: strengths and fragilities

While U.S. firms remain the innovation leaders, several risks are emerging:

- Concentration risk: A handful of stocks — Nvidia, Microsoft, Alphabet — dominate the AI market.

- Capex strain vs. ROI: In our view, the current AI boom has triggered the largest corporate investment cycle in history. Morgan Stanley projects that global hyperscalers will spend around USD 700 billion on capital expenditure in 2027, driven by the race to expand AI-ready data-centre capacity. This surge in infrastructure spending marks a scale unprecedented even by dot-com or mobile-era standards, and the magnitude makes the ROI questionable.

- Power constraints: Global data-centre electricity demand is forecast to nearly double to ~950 TWh by 2030 (IEA 2024).

- Circularity: Many large tech firms are both customers and suppliers in AI, creating earnings loops dependent on sentiment. It works while spending is booming — but if budgets tighten next year, those stocks could wobble.

- Valuation fatigue: High multiples mean small disappointments can trigger sharp moves. If fiscal risks in the U.S. come back into focus and bond yields rise, long-duration assets such as growth and AI-linked stocks could face renewed valuation pressure as discount rates reprice.

Why Asia matters more than ever

a) The manufacturing backbone

- TSMC (~71 % foundry share) produces the advanced wafers powering leading AI chips.

- SK Hynix and Samsung together hold over 90% of global HBM market share.

- Japan’s Lasertec, Advantest, and Ibiden remain essential for inspection, testing, and substrates.

Together, they form the “throughput stack” that converts AI investment into computing capacity. In our view, Asia sits on the capex inflow, not the outflow. Its factories continue running regardless of which U.S. platform wins the software race.

b) Infrastructure advantage

Asia’s semiconductor clusters already have the power, land, and skilled labour to scale. Recent projects, such as TSMC’s new fab in Kumamoto, Korea’s Yongin semiconductor cluster, and the planned doubling of CoWoS packaging capacity, show how investment and policy are working together to accelerate scaling. Unlike the U.S., where data-centre growth faces grid bottlenecks, Asia’s expansion, despite its own challenges, remains more capital-efficient and faster to execute.

c) Valuation cushion

As per Bloomberg data, forward multiples for Asia’s technology markets are:

- Korea: ~10–12× forward P/E

- Japan: High-teens P/E with double-digit EPS growth

- Taiwan: Mid-teens multiples despite record bookings

This provides an earnings anchor and relative value buffer, though not immunity.

Signs of the shift

- Nvidia’s Jensen Huang emphasized reliance on TSMC recently, and asked TSMC for more chip supplies to meet AI demand.

- SK Hynix expects 30%+ annual HBM growth through 2026.

- Samsung is validating HBM4 for 2026 production.

- SoftBank recently sold a USD 5.8 bn Nvidia stake to refocus on Japan’s AI ecosystem.

These developments suggest that Asia’s players are evolving from suppliers to strategic control points in the global AI value chain.

Why Asia may represent the “AI value play”

- Lower valuations: Hardware exposure still trade at discounts to U.S. AI peers (see image below).

- Earnings visibility: Multi-quarter order books provide steadier forecasts.

- Capex leverage: Much of the global AI infrastructure capex flows into Asian supply chains.

- Policy support: Japan’s governance reforms and Korea’s Value-Up drive are improving shareholder returns.

In our view, Asia’s enablers offer cheaper, more earnings-linked exposure to the AI build-out, despite still sharing global cycle risk.

Chart 1: 12-month forward P/E multiples

Source: Bloomberg

The risks

- Concentration: Key capacity sits with a handful of players (TSMC, SK Hynix, Samsung, Lasertec).

- Geopolitics: Export-rule shifts or cross-strait tensions could disrupt supply.

- Cycle risk: If AI capex slows, margins may normalise quickly.

- Crowding: Large-cap Asia AI names are widely held.

Scenario snapshot

- If U.S. AI rallies on guidance: Asia is likely to participate with leaders (TSMC, SK Hynix, Samsung) typically moving in tandem, while second-line suppliers catch up later.

- If U.S. AI de-froths but capex holds steady: Asia may hold up better on a relative basis, supported by ongoing supply chain and infrastructure orders.

- If U.S. AI cuts capex: Asia likely underperforms near term given operating leverage; watch order-book breadth before re-risking.

The bottom line

As U.S. tech faces higher costs and stretched valuations, we believe Asia offers a cheaper, more earnings-anchored route into the same megatrend.

Note: The author holds no positions in the securities mentioned.