Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Macro Strategist

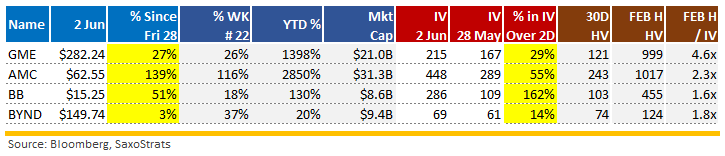

Summary: In the latest Macro Dragon Reflections think piece, KVP checks back in on the Monday dive into the MEME, WSB, Reddit Army stocks. We now have AMC taking the GME throne with BB looking interesting, GME still in the running & BYND showing no signs of elevated volatility in its options. Still two days to go before the wk is out & already this wk AMC $62.55 is +139%, BB $15.25 +51%, GME $282.24 +27% & BYND $149.74 +3%.

Yellow highlighted columns capture price & implied volatility increases so far this wk from Fri 28 May Close

A few takeaways (So far at least)

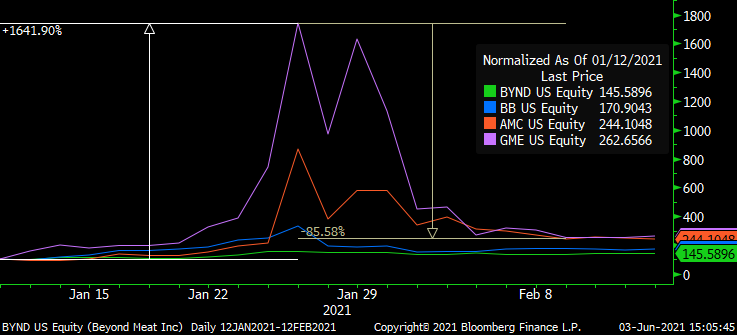

For the Jan / Feb squeeze (Based from 12 Jan ) GME was firmly in the driver’s seat….

For the current squeeze (Based from May 10) AMC has overtaken & no one else is even close…

...making one wonder who is the contender going to be, GME again or BB, BYND or brand new name?

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP