Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Macro Strategist

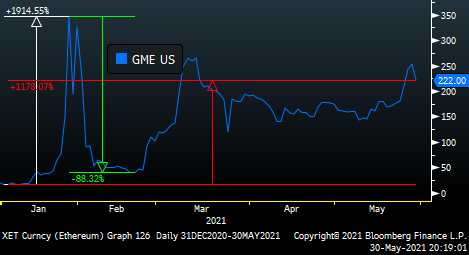

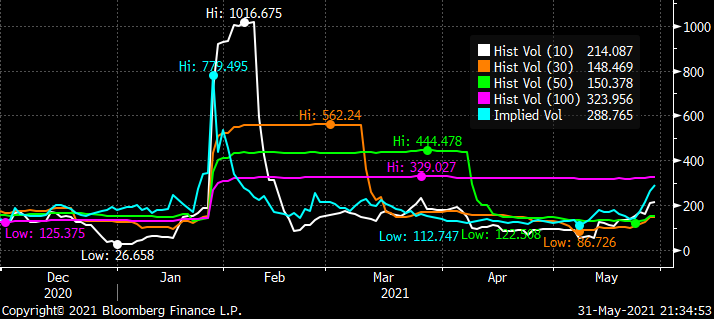

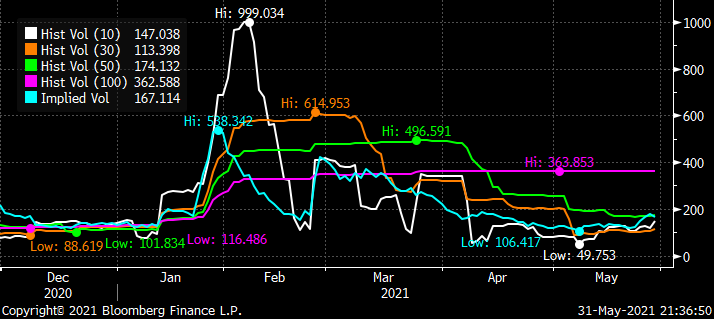

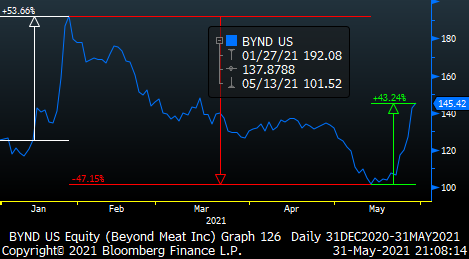

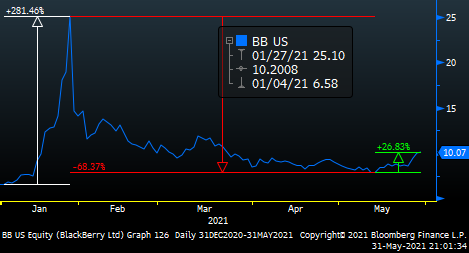

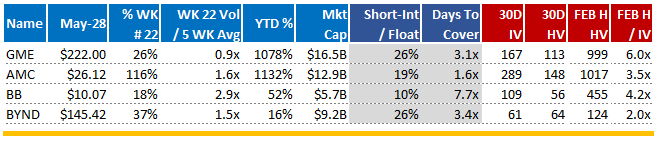

Summary: In the latest Macro Dragon Reflections think piece, KVP takes a look at the Jan-Feb short-squeeze that grew from a WSB forum on Reddit & seems to be picking up again. He delves into the concept of THE HIVE, whether BYND $145.42 or AMC $26.12 or BB $10.07 is the next GME $222.00, whilst comparing some of the recent moves we saw last wk with earlier in the year. AMC finished last wk up +112% (at one point it was up +200%)) & is now +1132% YTD. BYND clocked last wk at +37%, with GME & BB at the back with +26% & +18%.

1. BYND could potentially become a HIVE stock [what PM wants to walk into the CIO room & explain a short squeeze post what happened to Melvin], was never part of the original thesis… but cult stock like tesla or tencent was always the potential icing on the cake.

2. At $145 BYND is c. -40% from its ATH of c. $240 which it hit in the summer of 2019. Earlier this year during the WSB|RB Squeeze it got to $221 by the end of Jan, finding a 3wk run of +51% (so far we are on a 2wk run of +38% - yet worth noting growth has been killed over last few wks, so likely also a mean-reversion element on growth > value performance wise)

3. According to Bloomberg there is a 26% short interest on its float (which granted is c. 3.4x days to cover).

4. They continue to make JV & new partnerships, from Pepsi to inroads in China, etc.

5. Oatley [OTLY] another sustainable alternative play - focused on alternative dairy - recently listed & has a market cap of $14bn, is a much older company & clocked +$420m in rev in 2020 (granted +100% growth) – main point here is not substitution, but the investment theme is growing which will continue to attract a narrative & story, which leads to further capital from investors.

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP