Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Saxo Group

If you think the term "iron condor" sounds more like a mythical creature than an investment strategy, you’re not alone. However, while it may seem exotic, this strategy is surprisingly straightforward once broken down. Let’s explore how this strategy works, why traders use it, and how it could fit into your futures trading toolkit.

An iron condor is a neutral options strategy that involves four options contracts:

These options are based on the same underlying asset, such as Crude Oil futures, and share the same expiration date.

Together, they form two spreads:

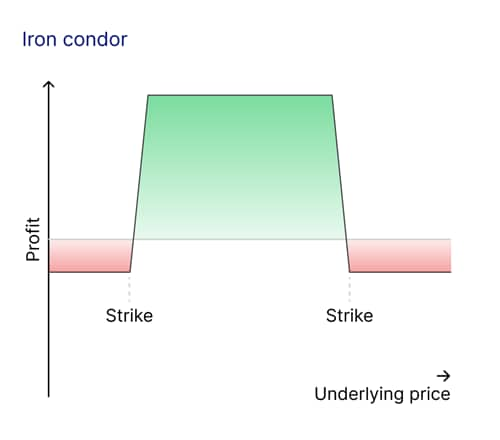

The strategy is called iron condor because the profit and loss chart looks like a bird with wings.

Imagine Crude oil futures are trading at USD 75 per barrel, and you expect the price to remain between USD 70 and USD 80 over the next month. Here’s how you might set up an iron condor:

Let’s assume each option covers 1,000 barrels of oil (the standard size for a crude oil futures contract).

Premiums collected:

(1.50 + 1.50) × 1,000 = USD 3,000

Premiums paid:

(0.50 + 0.50) × 1,000 = USD 1,000

Net premium (maximum profit):

3,000 - 1,000 = USD 2,000

In this setup, your goal is for Crude Oil prices to stay between USD 73 and USD 77 until the options expire.

Iron condors are appealing for several reasons:

Let’s revisit the Crude oil example to examine potential outcomes:

If Crude oil prices remain within this range until expiration, both the put and call spreads expire worthless.

Outcome: You keep the entire USD 2,000 premium as profit.

If Crude oil falls to USD 72, the USD 73 put option you sold is in the money, and the buyer exercises it. However, the USD 70 put option you bought limits your loss:

Now imagine Crude oil rises to USD 78. The USD 77 call you sold is in the money, but the USD 80 call you bought limits your loss:

If Crude oil rises to USD 85 or drops to USD 65, your losses are capped at the width of the spreads (in this case, USD 3 per barrel):

Iron condors are one of many options strategies, each suited to specific market conditions. Let’s explore how iron condors compare to other popular strategies.

While iron condors can be an effective tool for range-bound markets, it’s essential to understand their potential rewards and risks before diving in.

Iron condors are best suited for traders who:

This strategy may not be ideal for highly volatile markets or traders who lack experience with options. However, if you’re confident in your ability to predict market ranges and are comfortable with steady, incremental returns, iron condors can be a valuable addition to your trading toolkit.

Trading doesn’t always have to feel like a roller coaster. Sometimes, the best opportunities arise from quiet, predictable markets. The iron condor strategy allows you to profit from stability, providing a steady income stream whilst keeping risks manageable.

Whether you’re a seasoned professional or just exploring the world of options, the iron condor offers a practical way to navigate calm markets. It may not carry the mystique of its name, but it can certainly provide a consistent and reliable approach to trading.