Key points:

- Macro: China to lift exports on rare earths

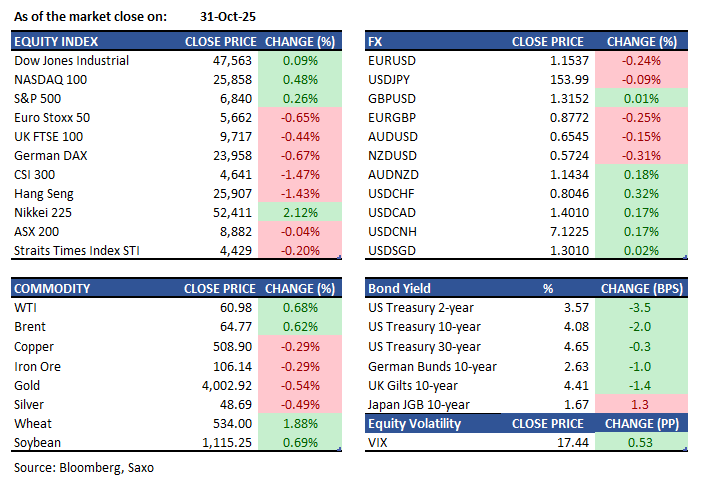

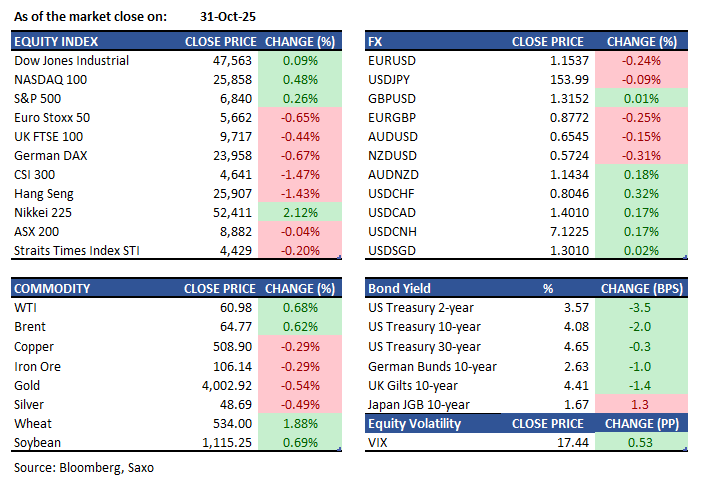

- Equities: Amazon rose 10.8% on strong cloud revenue

- FX: USD climbs for third day, DXY nearing October high at 99.845

- Commodities: Gold below $4,000/oz as China scraps VAT rebate curbing demand

- Fixed income: Treasuries mixed with yield curve steeper into month-end rebalancing

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- White House announced Saturday that China will lift export controls on rare earths and end probes into U.S. semiconductor firms under a new trade pact. China will issue general export licenses for key materials, reversing previous curbs. In exchange, the U.S. will pause certain tariffs and cancel a planned levy on Chinese goods. China will halt restrictions on rare-earth magnets, while the U.S. eases some curbs on Chinese firms. Additionally, China pledged to buy 12 million metric tons of soybeans this season and 25 million tons annually for three years. The pact aims to reduce trade tensions affecting global markets.

- Trump told Xi that chip sales are "between you and Nvidia".

- Xi Jinping announced that Shenzhen will host the APEC Economic Leaders’ Meeting in November 2026, marking China's third time as host. The 2025 APEC forum in South Korea ends today, following a temporary trade truce between Trump and Xi. At the summit, Xi stressed China's commitment to global free trade and investment appeal, countering Trump's protectionist stance.

- The Chicago Business Barometer rose to 43.8 from 40.6, exceeding expectations. While below 50 for the 23rd month, it signaled the mildest contraction in three months, driven by a rebound in new orders and improvements in output and backlogs. Employment growth hit its lowest since February.

- September 2025, Canadian GDP grew by 0.1%, indicating a similar increase in Q3 according to a flash estimate. This uptick follows a revised 0.3% contraction in August, the steepest monthly drop since December 2022, driven by Canada-U.S. trade war impacts and high BoC interest rates. Goods industries fell 0.6%, notably utilities by 2.3% and mining by 0.7%, due to lower global prices. Services dipped 0.1%, as transport and warehousing fell 1.7% and wholesale trade contracted 1.2%, despite retail trade's 0.9% gain. Year-on-year, GDP grew 0.7% in August.

- Euro area consumer inflation fell to 2.1% in October 2025, nearing the ECB's 2% target and meeting expectations. Food, alcohol, and tobacco prices rose 2.5% compared to 3.0% in September. Non-energy goods inflation dropped to 0.6%, and energy costs decreased by -1.0%. Meanwhile, services inflation increased to 3.4%, the highest since April, while core inflation, excluding energy and food, held at 2.4%.

Equities:

- US - Nasdaq Composite rose 0.7%, the S&P 500 gained 0.3%, and the Dow added 60 points. Amazon shares surged 10.8% on strong cloud revenue, boosting tech stocks. Palantir and Oracle rose on AI optimism, while Nvidia climbed. Netflix rallied 2.9% on a stock split announcement, and Tesla increased 3.1%. Chevron gained 1.9% on strong earnings, while Exxon Mobil fell 1.5% due to profit decline. Meta dropped 2.7%, and AbbVie slid 4.5% over drug pricing concerns. The Nasdaq closed October with a 4.9% gain, driven by AI deal activity. Berkshire Hathaway posted a record $381.7 billion cash reserve in Q3 and a 34% rise in operating earnings, bolstered by increased insurance underwriting profits amid reduced disaster activity.

- EU - European equities fell on the final day of October, with the STOXX 50 down 0.7% and the STOXX 600 losing 0.5%, following disappointing earnings reports. Key decliners included Linde, AXA, Saint-Gobain, and Telefonica, each reporting challenges that hit shares. In contrast, Danske Bank rose 3% on better-than-expected profits, while Anheuser-Busch and Vivendi also saw gains. Despite the day's decline, the STOXX 50 and STOXX 600 posted gains of 2.6% and 2.8% respectively for the month, as ECB policy expectations remained steady amid inflation data.

- HK - Hang Seng dropped 376 points, or 1.4%, to 25,907, its third straight session of losses amid sector-wide declines. Sentiment worsened due to China's PMI showing rapid manufacturing declines and subdued services growth. The U.S.-China trade truce and Fed Chair Powell's comments on a potential December rate cut contributed to uncertainty. Tech stocks led losses, with SMIC, Tencent, and Kuaishou retreating. The index fell nearly 1% for the week and 3.5% in October, ending a five-month winning streak.

Earnings this week:

Monday

Outside Asia: Palantir Technologies

Tuesday

Asia: Nintendo, Mitsubishi, NTT Inc

Outside Asia: Uber Technologies, Pfizer, Shopify, Super Micro Computer, Spotify, Yum! Brands, AMD

Wednesday

Asia: Hong Kong Exchange, Toyota, Itochu, Softbank, Mitsui & Co.

Outside Asia: Robinhood Markets, Qualcomm, AppLovin, DoorDash, McDonald’s, Lyft, ARM, Novo Nordisk

Thursday

Asia: Recruit, Suzuki Motor, DBS

Outside Asia: Warner Bros. Discovery, DraftKings, Block, Moderna. AirBnB

Friday

Asia: Mitsubishi Heavy Industries; OCBC; Honda; Macquarie; Fujikura

Outside Asia: Constellation Energy, KKR

FX:

- USD continued its upward trajectory for a third consecutive day on Friday, closing October with its second-strongest monthly performance of the year. DXY approached October highs at 99.845

- G10 currencies excluding JPY fell against the USD around 154.10, led by Scandies, NZD, and EUR. Despite stronger-than-expected Tokyo CPI data, JPY's gains were short-lived. Meanwhile, in Europe, sticky core inflation failed to impact EURUSD, steady around 1.1530.

Commodities:

- Oil prices rose after OPEC+ said it will pause further output increases in the first quarter, following a modest hike scheduled for December. Brent crude climbed above $65 a barrel, while WTI hovered near $61. The Organization of the Petroleum Exporting Countries and its allies said on Sunday they will raise crude production by about 137,000 barrels per day in December, matching the October and November increases, before pausing from January to March.

- Gold fell below $4,000 an ounce after China scrapped a VAT rebate for some retailers, potentially curbing demand; bullion dropped up to 0.6% to about $3,978 in early Asian trade after Beijing ended VAT offsets on gold bought from the Shanghai exchanges.

Fixed income:

- US Treasury yields climbed as traders trimmed odds of a December Fed cut after hawkish signals from Chair Powell and resilient growth. The 10-year closed near 4.09% from below 4% earlier. Late Friday, Treasuries were mixed—long-end cheaper, short-end firmer— month-end rebalancing; swap spreads widened after Dallas Fed’s Logan. Official data remain suspended amid the US government shutdown.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.