Key points:

- SGX has launched the iEdge Singapore Next 50 indices that track the next tier of large and liquid mainboard companies beyond the 30 constituents of the Straits Times Index (STI).

- The indices shine a spotlight on mid-caps and REITs, offering a different snapshot of the local market beyond banks and telcos.

- The launch comes as Singapore equities regain attention, with MAS liquidity measures, tech ambitions, and USD weakness boosting sentiment.

Why Singapore is back in focus

Singapore is emerging as a bright spot on the regional map as global investors look for stability and resilience. Several factors are working in its favour:

- Stability in a volatile world – Strong fiscal discipline, robust regulatory oversight, and political steadiness provide an anchor amid global uncertainty.

- Tech ambitions – Singapore is strengthening its role in semiconductors, data centres, and digital infrastructure, adding a growth angle to the market.

- MAS measures – Steps to deepen liquidity and broaden participation show a clear policy push to revitalise SGX.

- USD weakness – With the Fed turning dovish, the Singapore dollar is holding firm, supporting demand for local assets.

This is the context in which the iEdge Singapore Next 50 indices were launched, providing a systematic way to track mid- and large-cap names just outside the Straits Times Index (STI).

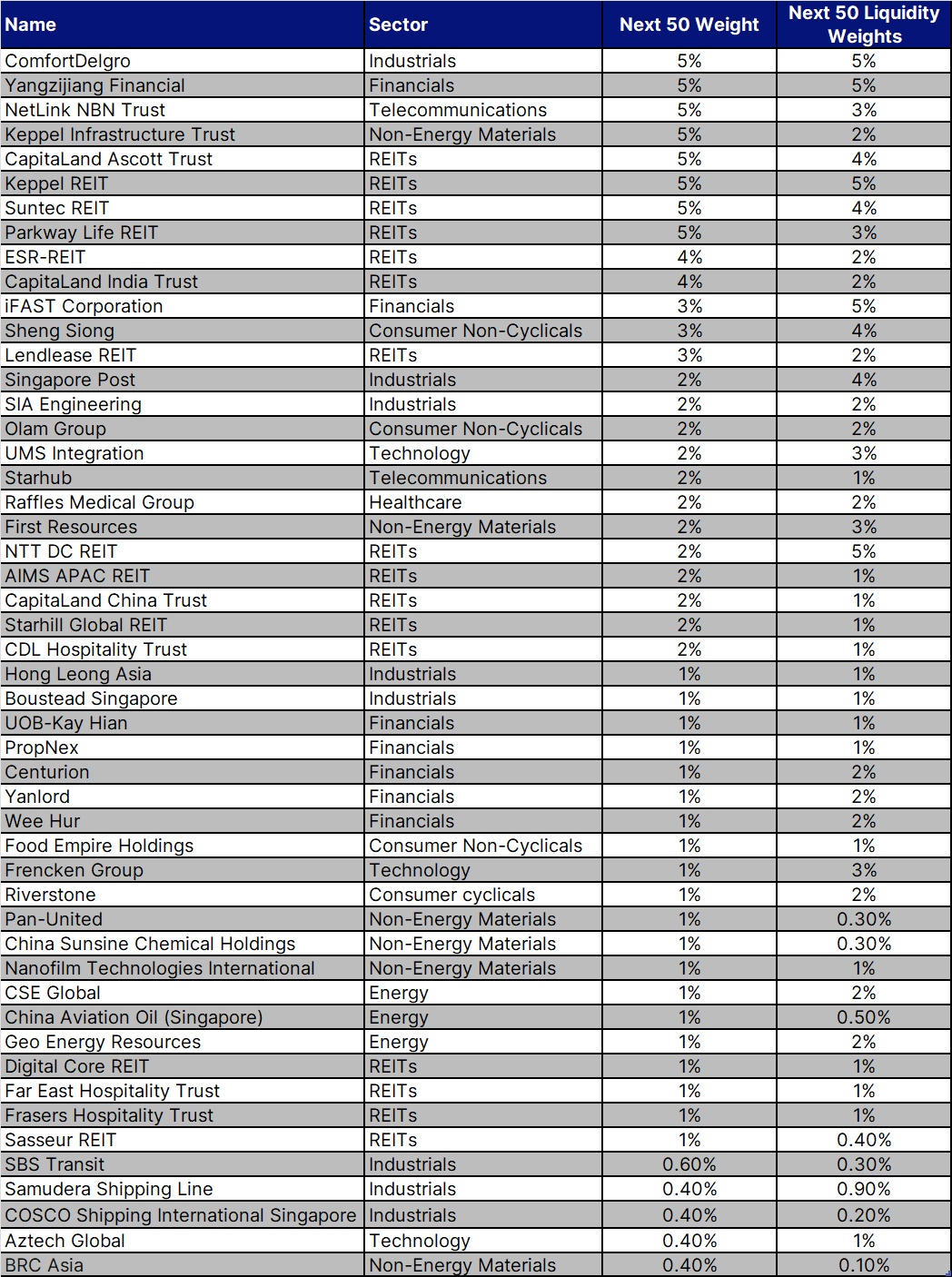

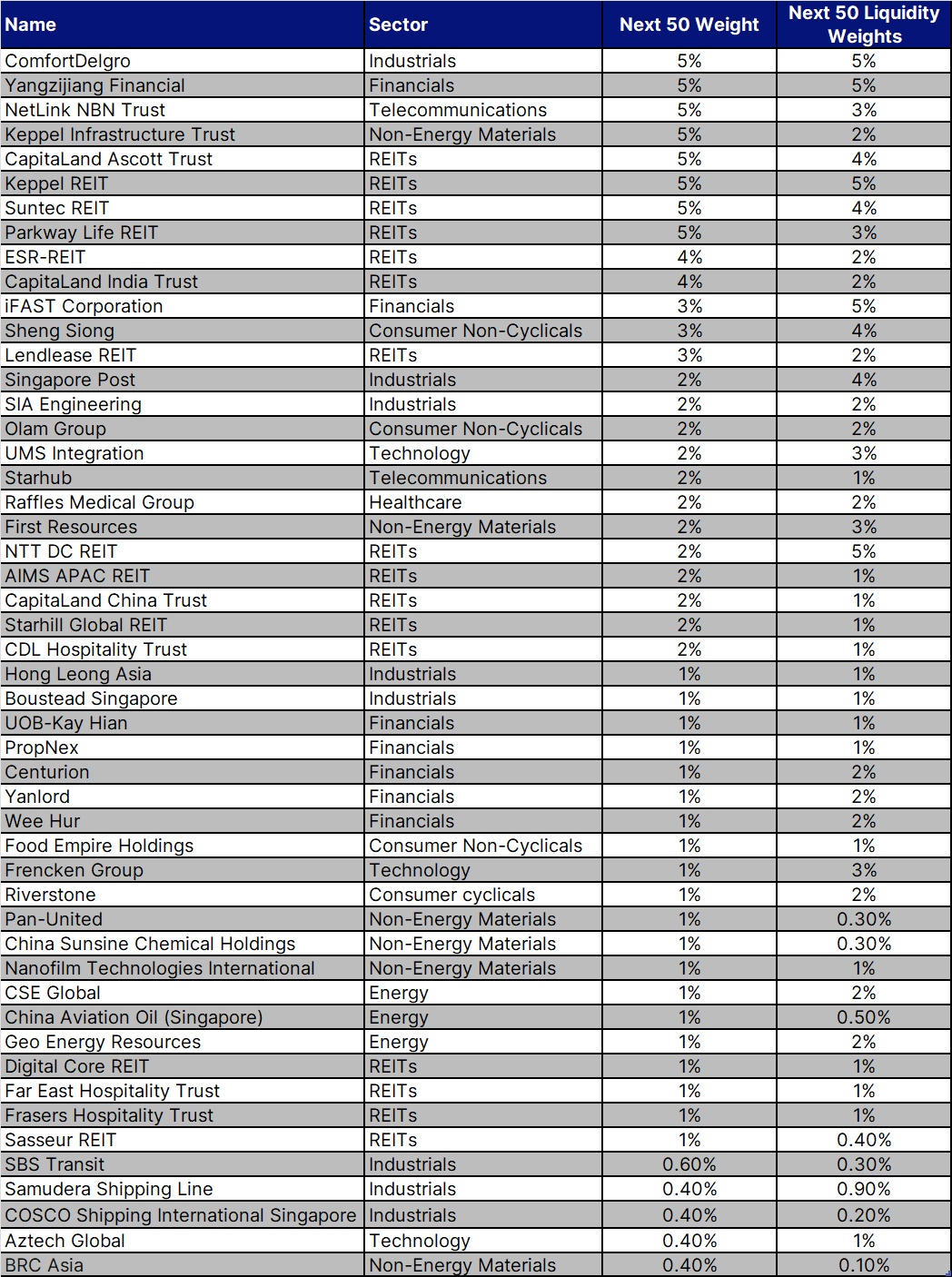

What’s in the Next 50?

- The Next 50 indices track 50 of the largest and most liquid companies listed on the SGX Mainboard outside the Straits Times Index (STI).

- There are two variants:

- Capitalisation-weighted, and

- Liquidity-weighted (to emphasize tradability)

- Key inclusion criteria include:

- Minimum market cap of SGD 100 million

- Minimum free float (≥ 15%) and trading turnover thresholds

- Cap per stock at 5% to avoid concentration

- Quarterly rebalancing takes place in March, June, September, and December.

Source: SGX

Why does it matter?

Expanding the investable universe

For too long, the spotlight has been on large-cap names in the STI. The Next 50 offers a systematic way to tap into mid-to large-cap names that may become tomorrow’s blue chips.

Greater visibility and liquidity push

The design encourages fund managers to allocate capital beyond the same dozen or two stocks, helping deepen liquidity and attention across a wider base.

The REIT tilt (and sector concentration)

Almost half of the index by weight is allocated to REITs (≈ 45%) under the cap-weighted version, and about one-third in the liquidity version. This is a double-edged feature: REITs provide steadier cash flows, especially in a benign interest rate environment, but also may introduce correlation and sector bias.

For Saxo’s Singapore REITs stocks shortlist, click here: Singapore REITs

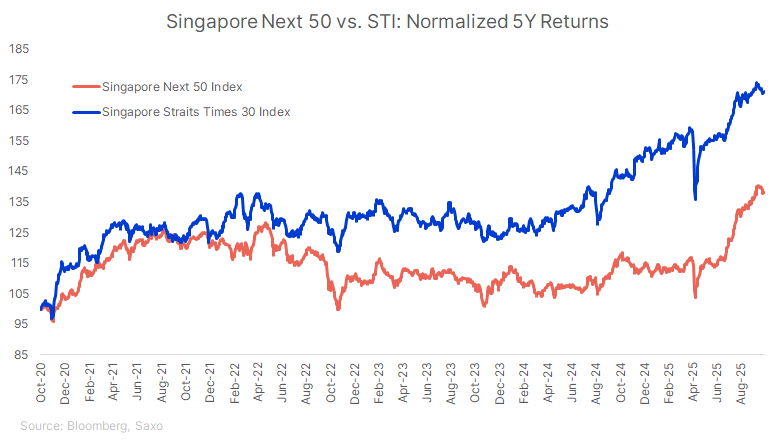

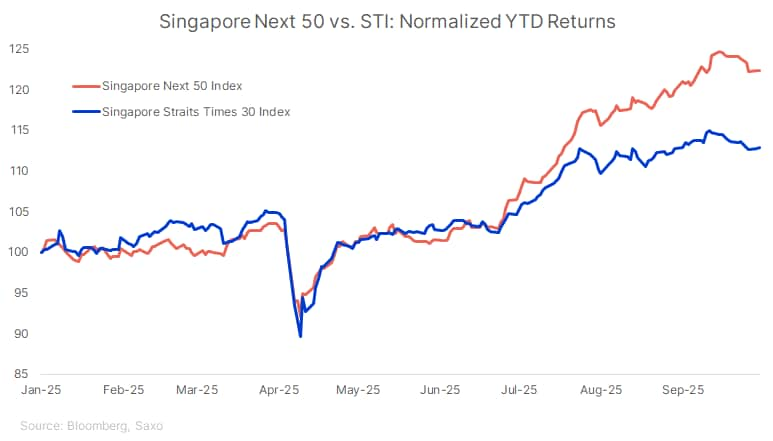

Performance snapshot

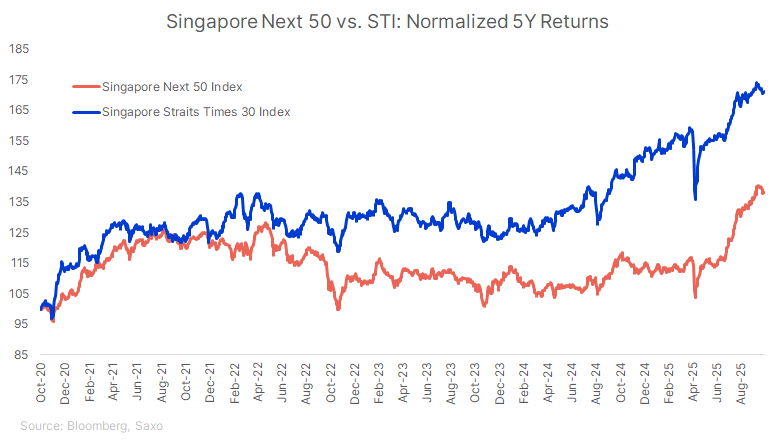

- 10-Year Annualised Return: ~5.0% (cap-weighted), ~3.1% (liquidity-weighted), vs STI’s ~8.9%.

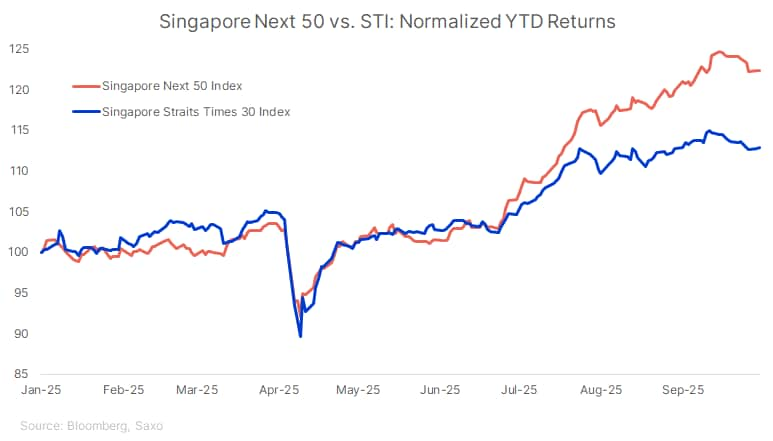

- YTD 2025: Next 50 indices +24.6% to +25.0%, outpacing STI’s +19.3%.

- Past Episodes: In certain years (e.g., 2019), the Next 50 has outperformed the STI by double digits.

Risks to keep in mind

While the indices create opportunities, they are not without caveats:

- Liquidity risk: Mid-cap stocks can be more volatile, with wider bid-ask spreads.

- Sector concentration: Heavy REIT exposure means sensitivity to funding costs and property cycles.

- Implementation hurdles: Until ETFs or funds emerge, replicating exposure requires stock-by-stock investment, adding cost and complexity.

- Global headwinds: Singapore may be stable, but is not immune to global growth risks, trade tensions, and external shocks.

Strategic takeaway

The iEdge Singapore Next 50 signals a broadening of the Singapore equity story. With performance already outpacing the STI this year and potential ETF launches on the horizon, the Next 50 could become a key barometer for Singapore’s mid-cap growth story.

It offers opportunities to look beyond the banks and telcos that dominate the STI — but risks, especially from concentration and liquidity, remain. The launch of passive products will be critical in shaping whether this index attracts wider adoption in the years ahead.