Key points:

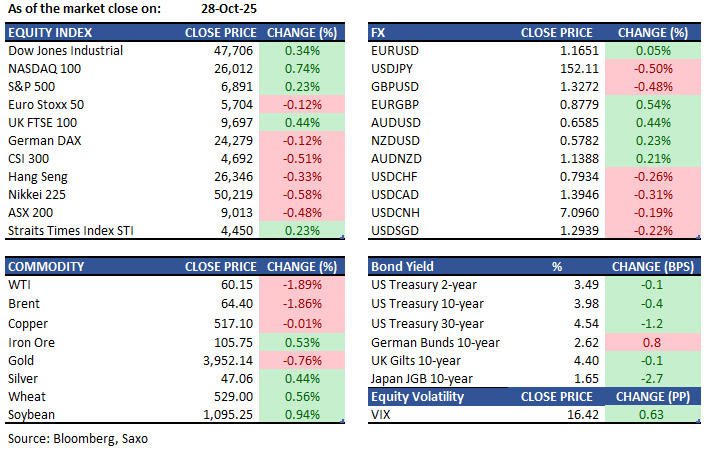

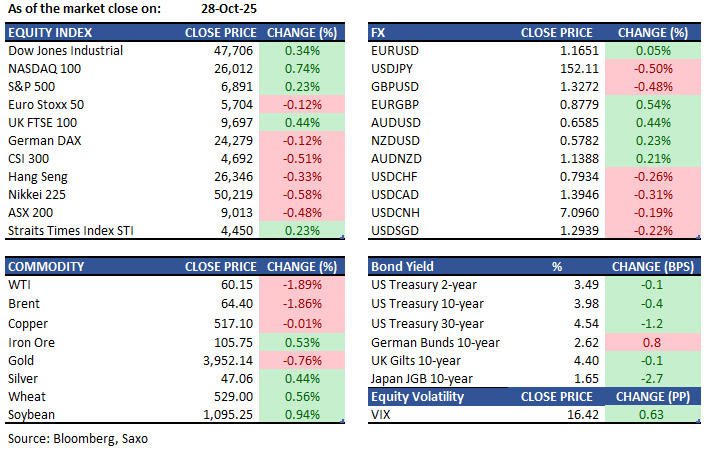

- Macro: Trump mentions considering Bessent for Fed Chair

- Equities: Nvidia gain 5% on 1B Nokia deal; Microsoft up 2.3% after 27% stake in OpenAI

- FX: JPY rebounds to 151.80; officials intervene and US-Japan security ties strengthen

- Commodities: Gold and oil fell for a third day

- Fixed income: Treasuries mixed, curve flatter; Australia 3‑year bonds fell for a sixth day

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- In October 2025, the US Fifth District's manufacturing index rose to -4, showing less pessimism. Shipments rebounded, new orders saw smaller declines, and employee numbers decreased further. Input price inflation eased, allowing companies to lower charges. Future expectations improved for shipments and new orders.

- In August 2025, the S&P Case-Shiller 20-City Index rose 1.6% year-on-year, the smallest annual increase since July 2023 and below the expected 1.9%. Home price growth continues to lag behind the 3% inflation rate, reflecting a decrease in homeowners' real wealth. New York led with a 6.1% rise, followed by Chicago and Cleveland, while Tampa saw a 3.3% decline.

- In the four weeks ending October 11, 2025, US private businesses added an average of 14,250 jobs weekly, indicating a monthly growth of about 57,000 jobs, reversing September's 32,000 job loss. ADP will start releasing weekly estimates from October 28th.

- In September 2025, Eurozone consumer inflation expectations fell to 2.7%, while three-year and five-year forecasts held at 2.5% and 2.2%, respectively. Income growth expectations were 1.1%, with economic growth at -1.2%. Unemployment held steady at 10.7%, indicating labor market stability. Home prices were expected to rise 3.5% in the next year.

- Trump mentioned considering Scott Bessent for Federal Reserve chair during a Japan visit, despite the Treasury Secretary leading the search and ruling himself out. He praised the Secretary's market-calming skills during his second term's first year.

- Trump and Xi will discuss halving 20% tariffs on Chinese goods as part of a fentanyl crackdown. The U.S. will roll back tariffs if China curbs chemical exports used to make fentanyl. The final agreement depends on their meeting and future negotiations, with expected reductions in port fees on each other's ships.

Equities:

- US - US stocks climbed Tuesday, with the S&P 500 up 0.3%, Dow gaining 180 points, and Nasdaq rising 0.8%, all hitting record highs ahead of an expected 25bp Fed cut. AI and mega-cap tech led the rally: Microsoft jumped 2.3% on a landmark OpenAI deal, while Nvidia surged 5% after a $1bn Nokia investment boosting chip demand. Strong earnings outside tech added support—UPS soared 8.1% on robust results, and UnitedHealth rose 1.6% after lifting its 2025 outlook. Amazon confirmed 14,000 job cuts but gained 1.4%. Traders eye a heavy earnings slate including Alphabet, Amazon, Apple, Meta, and Microsoft, plus Fed guidance.

- EU - European stocks eased Tuesday after hitting record highs in the prior session, as mixed earnings weighed on sentiment. The STOXX 50 slipped to 5,701 and STOXX 600 fell 0.3% to 576. Pharma led losses: Novartis plunged 4.3% on weak results, while Roche and Novo Nordisk dropped 2.5%. BNP Paribas slid 3.5% after an earnings miss. In contrast, HSBC jumped 4.4% on a stronger 2025 outlook, and Iberdrola closed higher post-results. Nokia surged 20% after Nvidia announced a $1bn equity investment, boosting optimism for networking and chip demand. Markets remain focused on trade outlook and European rate expectations.

- HK - Hang Seng fell 0.3% to 26,346 on Tuesday, snapping a three-day winning streak as U.S. futures signaled a weaker Wall Street open. Mainland stocks also retreated from decade highs ahead of October PMI data and amid doubts over U.S.-China trade easing. Consumer and tech names weighed on the index, with Zijin Mining (-4.5%), Anta Sports (-4.2%), China Hongqiao (-3.7%), and Xiaomi (-2.3%) leading losses. Sentiment was supported by PBoC Governor Pan Gongsheng’s pledge for a supportive monetary stance and Beijing’s plan to relax investor rules to attract long-term capital, emphasizing stability and diversification.

Earnings this week:

Asia: Moutai, Foxconn, China Merchants Bank, Keyence, Sinopec

Outside Asia: Microsoft, Alphabet, Meta, Caterpillar, ServiceNow

Asia: AgBank, ICBC, CCB, PetroChina, China Life Insurance

Outside Asia: Apple, Amazon, Eli Lilly, Mastercard, Shell, Gilead Sciences, S&P Global,

Asia: Tokyo Electron, Daiichi Sankyo, Hoya, Denso, Maruti Suzuki India

Outside Asia: Exxon Mobil, AbbVie, Linde, Intesa Sanpaolo, Aon

FX:

- Dollar Index fell to 98.65 on Tuesday amid US-China trade discussions, with plans to exchange tariff reductions for chemical export controls. US data showed a drop in consumer confidence and modest job growth.

- AUD rose on US-China trade optimism, driving AUDUSD gains for the fourth consecutive day, reaching 0.6590.

- JPY rebounded after Japanese officials intervened verbally and US-Japan security ties were strengthened, although Finance Minister's comments on US Treasury's BoJ rate hike remarks briefly exerted pressure. JPY strengthened to 151.80 against USD.

- GBP struggled within the G10 currencies due to fiscal concerns. An FT report indicated the OBR might reduce productivity growth forecasts, potentially impacting UK finances by GBP 20 billion. October's food inflation data fell from 4.2% to 3.7%, suggesting a more dovish BoE approach. GBPUSD currently trades around 1.3280.

Commodities:

- Oil extended a three‑day decline, with Brent below $65 and WTI near $60, as investors weighed Western sanctions on leading Russian producers and mixed US inventory estimates; President Donald Trump will press ahead with harsh new sanctions to push Vladimir Putin into talks, according to US Ambassador to NATO Matthew Whitaker.

- Gold steadied near $3,950 an ounce after a three‑day rout as risk appetite improved on hopes of a US–China breakthrough ahead of a planned Trump–Xi meeting. The Wall Street Journal said the US may roll back some tariffs if China curbs exports of fentanyl precursors, a deal that would further lift sentiment alongside a tech rally reinforcing optimism about the AI boom.

Fixed income:

- Treasuries ended narrowly mixed with a flatter curve, showing minimal reaction to record highs in US equity benchmarks, a tepid 7‑year note auction, and stronger‑than‑expected October consumer confidence. Australia’s 3‑year sovereign bonds extended losses for a sixth straight session, while Japan’s 10‑year JGB futures rose as the Bank of Japan’s two‑day meeting got under way.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.