Key points:

- Germany is gaining strategic relevance as investors seek diversification away from U.S. policy and fiscal risks—helped by pro-growth reforms and industrial strength.

- The DAX remains attractively valued relative to the S&P 500, despite its outperformance, and offers exposure to global megatrends through high-quality European names.

- Mid-cap German equities (MDAX) could present the next opportunity, with domestic reform momentum and innovation-led names poised for a potential catch-up rally.

Note: This content is marketing material.

Investors have long treated the U.S. as the anchor of global equity portfolios—but 2025 is putting that conviction to the test.

- Policy uncertainty is rising, with erratic tariff moves undermining U.S. credibility and complicating long-term corporate planning.

- Fiscal risks are mounting, as ballooning deficits and political dysfunction force investors to demand higher yields—not out of optimism, but caution.

- The U.S. dollar is weakening, adding another layer of volatility to global portfolios heavily tilted toward the U.S.

Against this backdrop, investors are starting to question their U.S. equity bias. In contrast, Europe—and Germany in particular—offers a compelling diversification story, grounded in industrial strength, global export exposure, and greater policy stability.

This shift in sentiment is already showing up in the numbers, as evident in the chart below. The DAX has outperformed the S&P 500 year-to-date, highlighting growing investor appetite for diversified, industrial-heavy exposure outside the U.S.

Despite its YTD outperformance, the DAX remains meaningfully cheaper than the S&P 500 on a forward P/E basis.

- DAX 1-year forward P/E: ~14-16x

- S&P 500 1-year forward P/E: ~20–22x

That gap gives Germany headroom to re-rate—especially as macro risks in the U.S. rise and European earnings begin to surprise on the upside.

Tactical rotation or structural re-rating?

Germany isn’t just riding a market wave—it’s stepping into a potential policy renaissance. Recent local elections have opened the door to more business-friendly macro policies, including:

- Debt brake reform, allowing more public investment in growth.

- Corporate tax cuts aimed at boosting competitiveness.

- Deregulation initiatives to accelerate green and digital transitions.

These changes could reshape investor confidence in Germany’s economic trajectory and give the DAX a structural boost beyond short-term rotation flows.

What is the DAX index?

The DAX 40 is Germany’s benchmark stock index, representing 40 of the country’s largest and most liquid companies listed on the Frankfurt Stock Exchange. But this isn’t just about Germany—the DAX is home to global leaders in:

- Industrial automation (Siemens)

- Clean energy (E.ON, Siemens Energy)

- Mobility (Volkswagen, BMW, Mercedes-Benz)

- Pharmaceuticals (Bayer, Merck)

- Insurance (Allianz, Munich Re)

- Consumer goods (Adidas, Henkel)

These companies generate a significant share of their revenue outside Germany, offering international diversification through deeply rooted, export-driven business models.

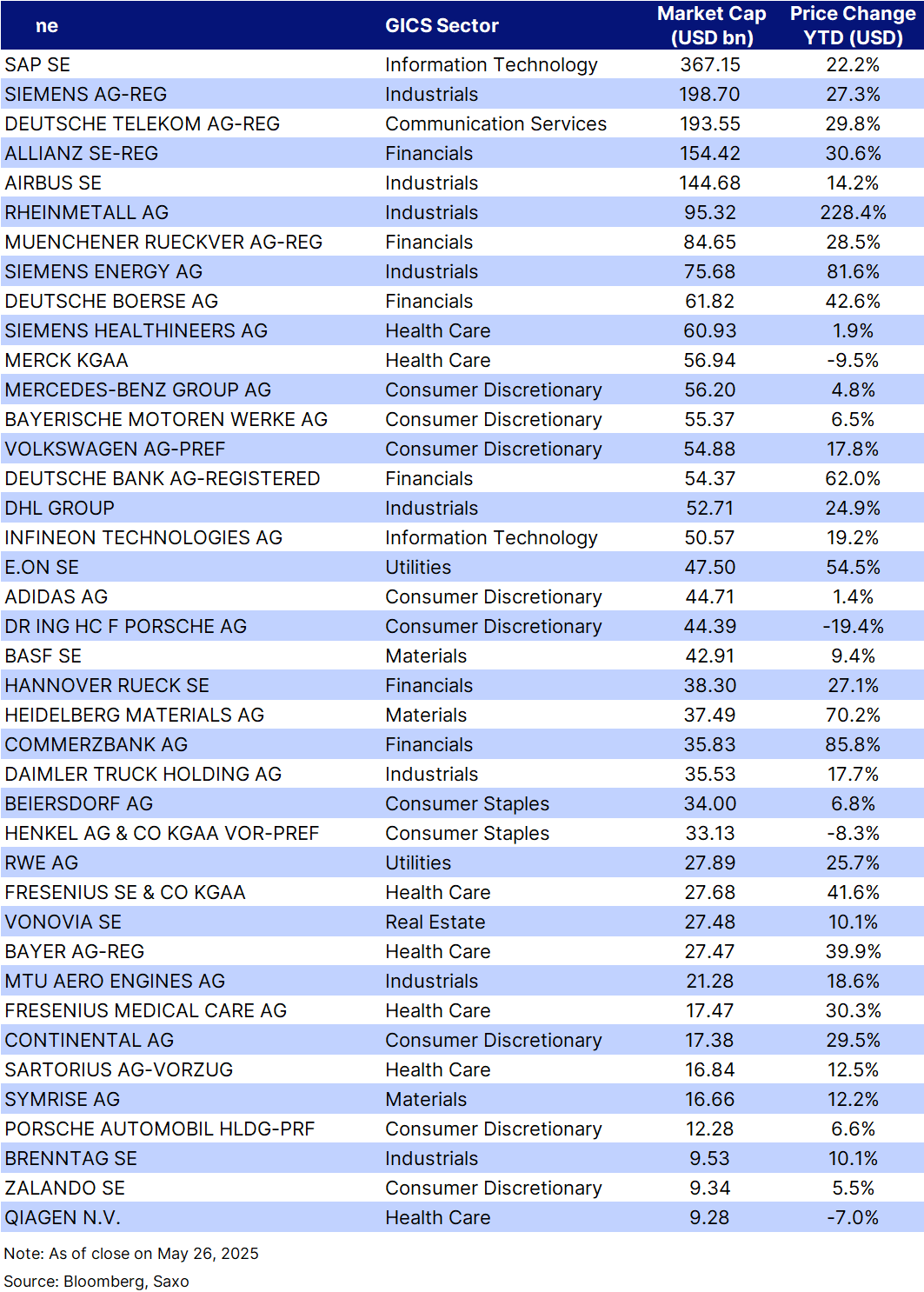

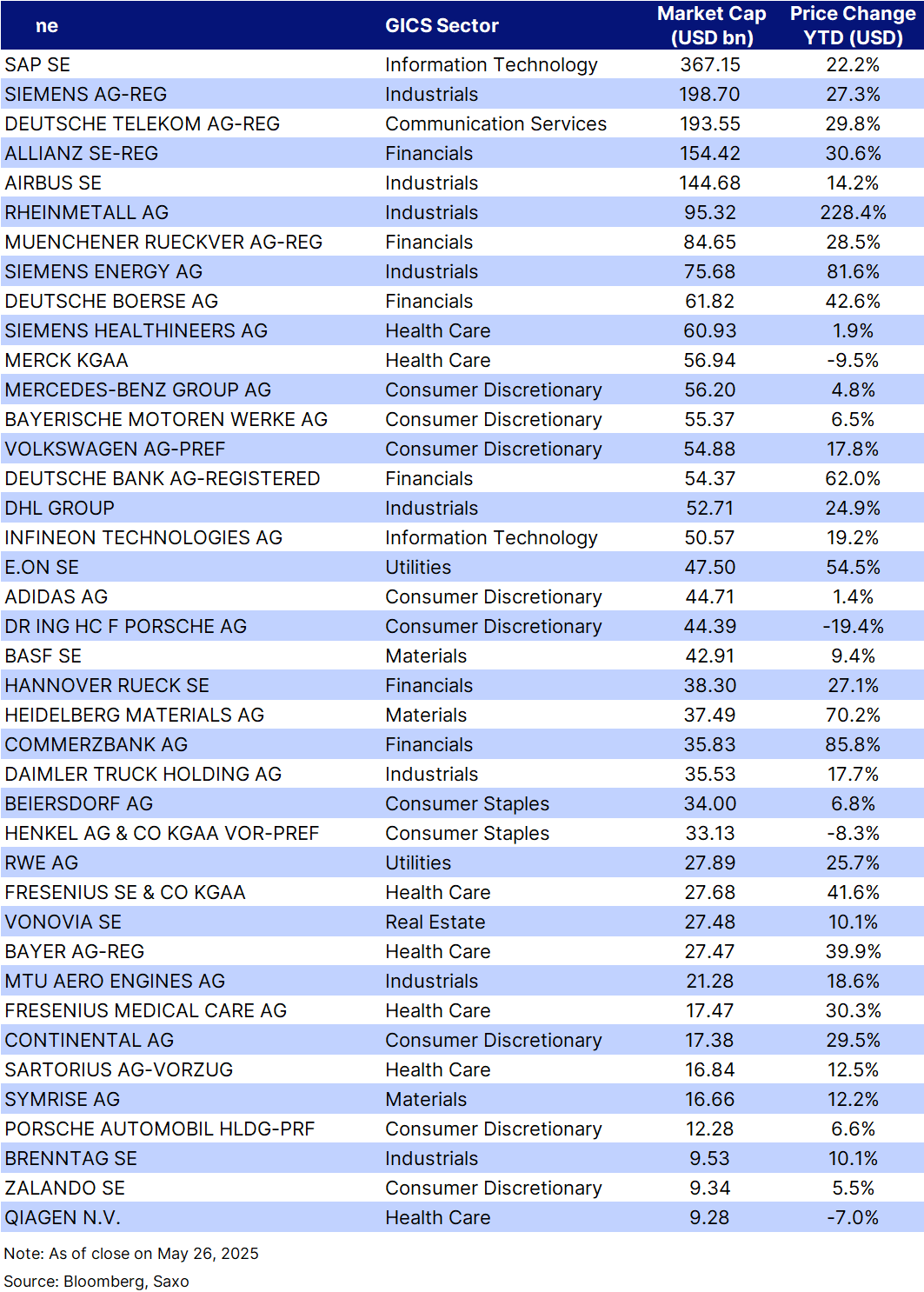

Here are the DAX constituents by market cap:

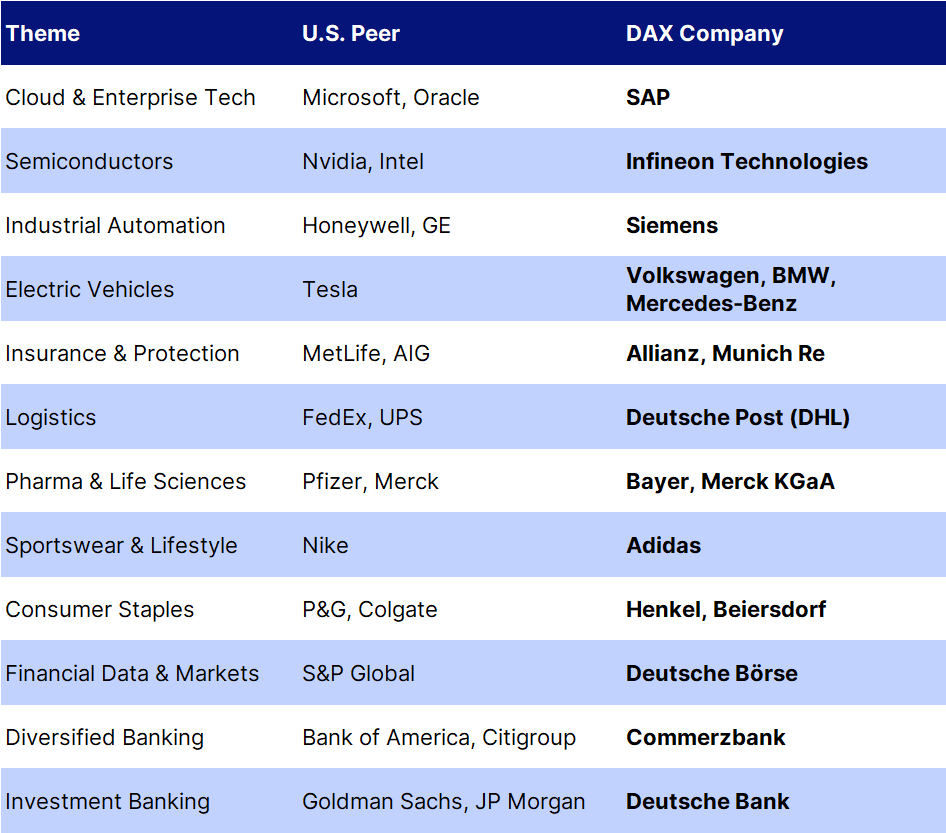

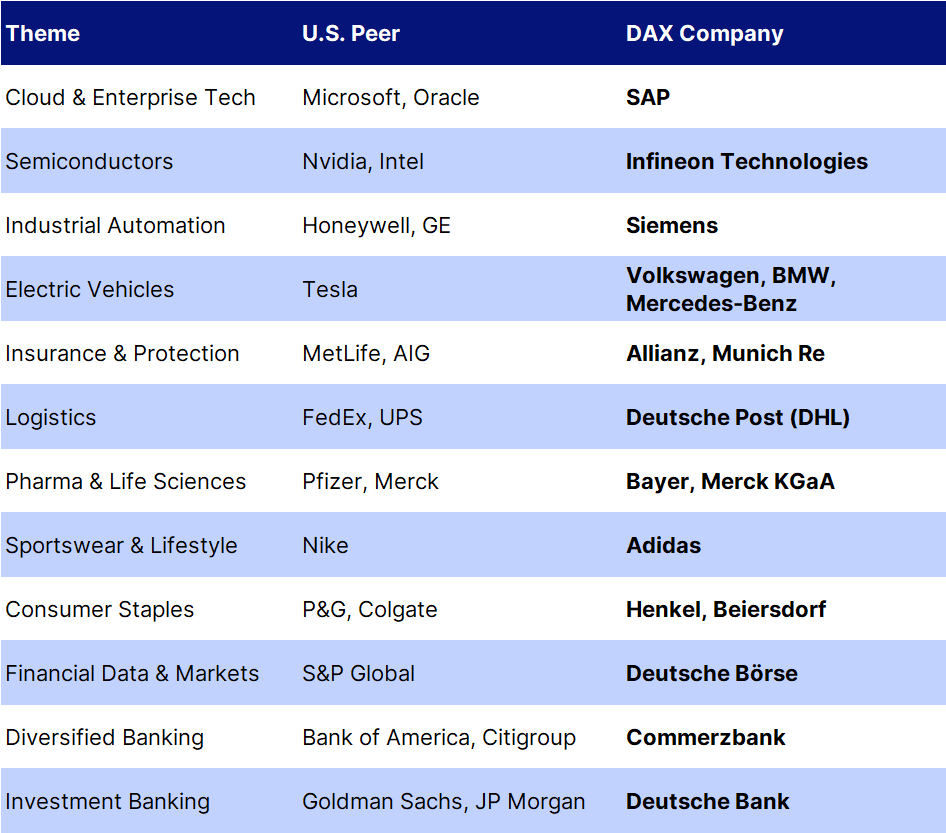

DAX vs. Wall Street: Familiar themes, different names

For investors accustomed to the S&P 500, the DAX offers exposure to many of the same global megatrends—just through European lenses.

Don’t overlook the MDAX

As capital flows broaden, mid-cap German equities are getting harder to ignore. The MDAX, Germany’s mid-cap index comprising 50 companies with a stronger domestic focus, offers exposure to Germany's innovation engine across biotech, automation, defense, and consumer sectors.

Some notable names include:

- Delivery Hero – Online food delivery platform with global footprint

- Renk – Defense and mobility systems manufacturer

- Thyssenkrupp – Engineering conglomerate and green steel play

- Hensoldt – Defense tech firm specializing in radar and sensor systems

- Evotec – Biotech company enabling drug discovery

- Hugo Boss – Leading fashion brand

- Kion Group – Warehouse automation and logistics systems

With the MDAX still underperforming the DAX YTD, there’s room for a catch-up rally as confidence improves in Germany’s domestic outlook.

What could fuel the next leg higher?

Several macro tailwinds could add fuel to the German equity story:

- Ceasefire or peace deal in Ukraine, which could ease energy prices and geopolitical risk premiums.

- Revisions to EU emissions rules, which could delay cost pressures on autos and industrials.

- Tariff relief from the U.S., especially if election outcomes in 2025 favor trade normalization.

- Stronger euro helping anchor inflation and support real incomes in the Eurozone.

These developments would provide support to margins, confidence, and capital spending—key ingredients for sustained earnings growth.

What are the risks?

Germany’s equity story isn’t without hurdles. Key risks to monitor include:

- Structural energy costs: Even with easing tensions, Germany’s post-nuclear energy strategy leaves it exposed to higher input costs.

- China exposure: Many DAX firms have significant reliance on Chinese demand—any slowdown or trade frictions could weigh on earnings.

- Cyclical vulnerability: As an export-heavy economy, Germany remains sensitive to global growth shocks and supply chain dislocations.

- Execution risk on reforms: Political gridlock or failure to implement promised business-friendly measures could undercut the current momentum.