Key points:

- Investors aren’t exiting AI, they’re balancing it: Investors worried about over-exposure to the AI theme are rotating into sectors with steadier earnings (healthcare, materials, financials, energy) and adding old-economy exposures as stabilisers.

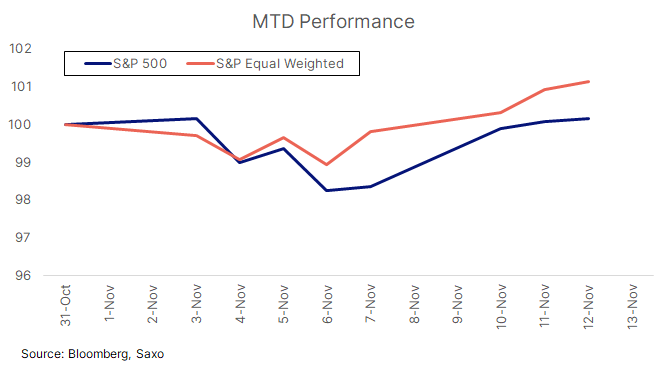

- Portfolio construction is doing more work: Equal-weight indices, quality tilts, low-volatility factors, and simple options are helping reduce dependence on mega-cap AI leaders.

- Investors are blending equity rotation with alternative hedges: While equity tilts help reduce concentration risk, many are also adding precious metals and miners to create a broader cushion against market volatility.

AI has been the defining market theme of the past two years — but even powerful trends can experience fatigue.

With the AI-heavy tech sector slipping this month, while healthcare, materials, financials and energy lead the S&P 500, many investors are asking a simple question:

“How do I stay invested in the long-term AI story without being too exposed to short-term swings?”

Below is a clear explainer of what investors are doing today, why these approaches are gaining traction, and the risks to keep in mind.

1. Rotating into stability and “old economy” leaders

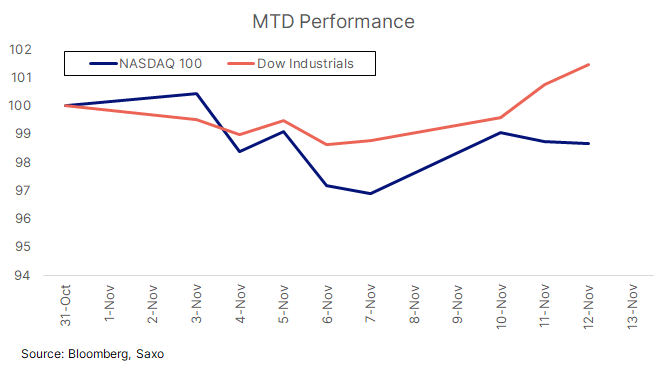

With the Nasdaq 100 down 1.3% MTD and the Dow up around 2%, investors are increasingly rotating into parts of the market with more earnings stability and less sensitivity to AI-driven sentiment.

Where flows are going

This month’s strongest performers include:- Healthcare (+5.9%)

- Materials (+3.3%)

- Financials (+2.5%)

- Energy (+2.3%)

- Consumer Staples & Real Estate (both positive)

- Utilities (slightly positive)

Source: Bloomberg

Why these sectors attract flows

These areas tend to offer:

- Steady earnings and defensive cash flows

- Lower valuations compared with AI-heavy tech

- Better earnings visibility

- Less dependence on market sentiment

- Lower volatility, making them useful stabilisers when AI leaders swing sharply

The idea behind the rotation

Instead of exiting tech, investors are balancing AI-heavy portfolios with sectors that have clearer demand drivers, more predictable fundamentals, and valuations that are not stretched.

Risks to consider

- Defensive and old-economy sectors may lag sharply if tech rebounds

- Global growth slowdowns can hurt industrials, materials and banks

- Energy and materials face commodity price-cycle volatility

- Over-rotation reduces exposure to long-term AI-led structural growth

2. Portfolio-level adjustments to reduce concentration risk

Some investors are hedging AI exposure via how the portfolio is built, not what it holds:

- Equal-weight indices: reduces mega-cap concentration

- Quality tilt: favours firms with stable earnings and strong balance sheets

- Low-vol tilt: smooths the ride in volatile markets

Risks

- May lag in strong upward tech-led markets.

- Factor tilts can become crowded.

3. Rotating into tech with more earnings support

Not all tech is experiencing the same valuation pressure. Investors are selectively rotating within tech rather than abandoning it.

Investors are rotating into areas with clearer earnings and less AI hype, such as:

- Infrastructure & industrial suppliers powering the data-centre buildout

- Energy and utilities benefiting from rising power demand

- Asian tech and semiconductors with more reasonable valuations

- Japanese automation and robotics, supported by capex and reshoring trends

These segments offer a way to stay connected to structural trends — digitalisation, capex cycles, healthcare innovation, and power demand — without the valuation risk sitting in a few AI megacaps.

Risks

- Sector rotation can lag in a tech-led rally

- Growth-sensitive sectors may weaken if US macro slows

- China and Asia tech faces regulatory and sentiment risks, and can be more sensitive to export cycles.

- Currency swings may affect returns for global investors.

- Rotating within tech still leaves exposure to the broader tech cycle.

4. Adding gold, silver and miners as defensive hedges

Gold and silver remain popular hedges when high-valuation sectors see turbulence.

Why they’re used

- Often act as diversifiers during equity pullbacks

- Miners can offer leveraged exposure to rising metal prices

- Silver may benefit from industrial and solar demand alongside its defensive role

Risks

- Metals are sensitive to currency moves and rate expectations

- Miners carry operational and cost risks

- The hedge isn’t always correlated over short periods

5. Simple options approaches for stability

- Protective puts: Basic insurance against large market drops.

- Covered calls: Generate extra income on existing holdings to cushion mild pullbacks.

- Put spreads: More cost-effective protection by combining two puts.

These strategies help manage volatility while staying invested in long-term themes.

Risks

- Puts cost money and can reduce returns.

- Covered calls cap upside.

- Options protection weakens if volatility drops.