Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Head of Fixed Income Strategy

Bond volatility is about to become the norm. Last week we thought that US treasuries had stabilised, but already on Monday, we saw that this is not the case. Treasuries are sliding quite fast and are dragging other government bonds down with them and the yield on 5-year bunds are trading above zero for the first time since November 2015. This is just the beginning.

Although the level at which global government bonds are trading at the moment is becoming increasingly interesting, we are still far away from the levels seen before the financial crisis. This implies that there is plenty of room for a more significant revaluation.

Although USD investment grade and high yield bonds are still well bid, it's clear that it is just a matter of time before investors will realise there is not any more room for further tightening, thereby triggering a selloff of riskier assets.

On the other hand, for euro-denominated instruments, the party doesn’t seem to be over yet. The European Central Bank is looking to reduce stimulus at the end of this year, however, an interest rate hike seems to be far away and unlikely to happen before the second quarter of 2019. Given that ECB chief Draghi’s mandate will finish in October next year, we can assume that he will be as prudent as he’s always been and will opt for a gradual disinvestment of the balance sheet.

At the same time, in case things are not going as expected, we can expect Draghi to pull the brake and wait. Therefore, EUR-denominated bonds’ prices should continue to be supported for at least one more year and should not fall as much as dollar-denominated bonds. Although this seems to be reasonable, there are two factors that can cause an immediate spike in volatility: the Italian elections and the sustainability of the European Union itself.

The political situation at the moment

Italians are scheduled to vote for a new government on March 4 and ahead of polling day, the situation is muddled and the outcome is very uncertain.

Since prime minister Matteo Renzi resigned in December 2016 after his proposal to reform the Italian senate was not approved in a referendum, Paolo Gentiloni has stepped in as caretaker premier. Since then, the populist movement of the party M5S (Five Star Movement) has been growing and giving alarming signals of a more nationalistic and anti-European Union approach to politics that may further hurt the economic unit. M5S is currently running at 28% in the opinion polls (up 3% since the last election). However, a recent electoral reform that favours coalitions means its influence will likely be much reduced.

In order not to leave things to chance, the centre-right party of Forza Italia has pulled its ace card: the 82-year-old former prime minister Silvio Berlusconi. Despite his age, Berlusconi looks on top of his game.

And this is how things are getting interesting: M5S is in the lead in the polls, followed by the centre-left coalition led by Matteo Renzi (23%) and the centre-right coalition led by Berlusconi (17%). Although Berlusconi cannot become prime minister (because of a tax conviction), he’s still quite influential among the Italian electorate and a victory of his centre-right coalition is quite possible.

If that proves to be the case, the technicalities of the Italian electoral system mean that the centre-right coalition will be elected while the M5S party will still get the majority of the votes. The result? A hung parliament.

Italian government bond yields to go above 4% once the ECB buying programme ends

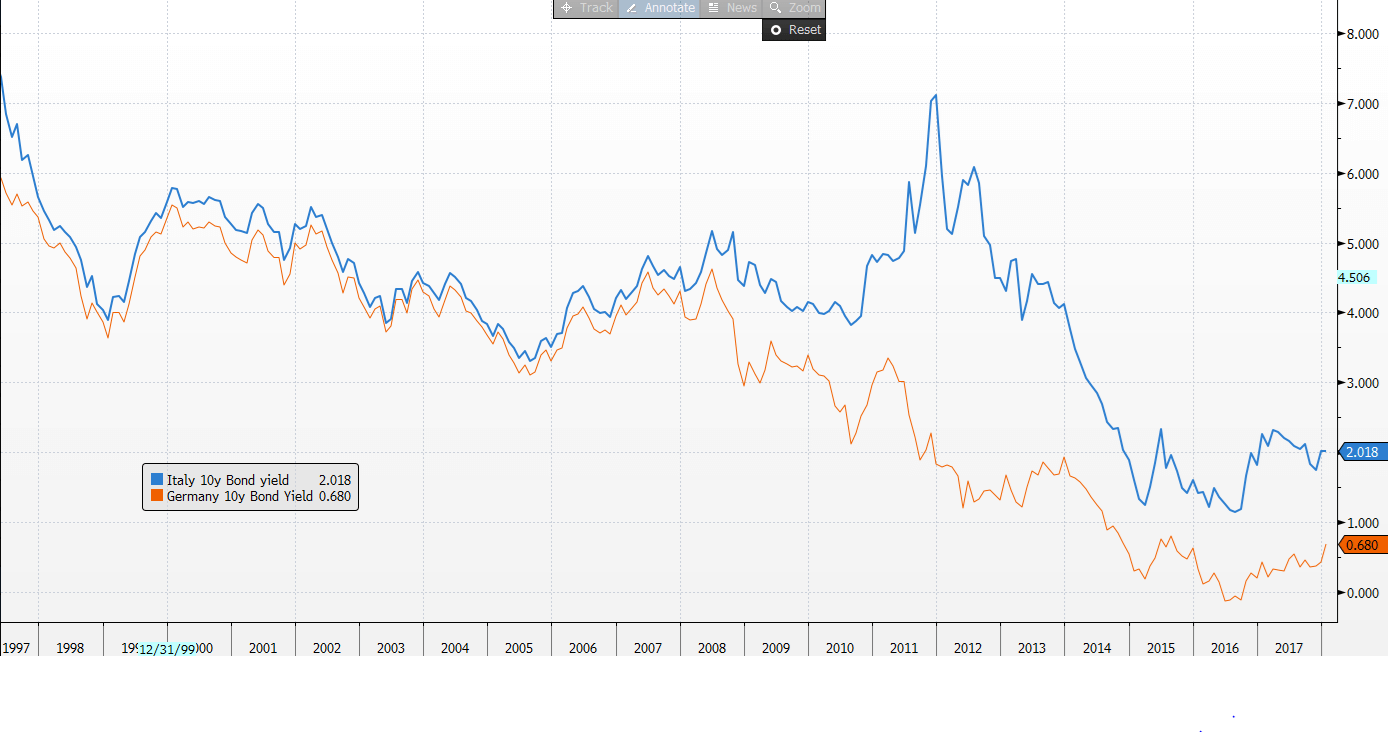

Since the European debt crisis in 2012 when Draghi said that the central bank was willing to do 'whatever it takes' to save the euro, Italian multi-year treasury bonds (Buoni Poliennali del Tesor) rallied massively. In 2011 the 10-year BTP yield reached 7%. It currently trades around 2%. If we look back in time we can see that BTPs actually never traded at such low levels historically, suggesting that the ECB’s quantitative easing is the reason why Italian government yields are trading at an historic low. This implies that as soon as the ECB starts to taper, Italian government bonds should go back to their historic average yield levels. For 10-year BTPs this is around 4%.

Another thing worth considering is the spread between Italian BTPs and bunds. As you can see, since 2008 the spread has increasingly become wider, while pre-2008 the spread between the two was significantly narrower. This may mean two things: either the ECB has been buying higher volumes of German bunds, or investors perceive more risk in Italian government bonds. I personally believe that is a mixture of both and given the political situation Italy is facing right now, I believe that the spread between the two will grow even wider in the medium-term as once the ECB begins to taper, the rate at which BTPs slide will be faster than bunds. Furthermore, the fall of bund yields will be limited by investors seeking safety in German debt.

The uncertainty around US politics increases the volatility of the treasuries making bunds a more desirable safe haven. This means that in the medium-term it is quite unlikely that bunds will trade at the same level as pre-crises, making the spread between BTPs and bunds even wider.

Another factor impossible to ignore is that Italy is one of the most indebted countries in the world with a total debt-to-GDP ratio of 131% third only to Japan (223%) and Greece (180%).

It doesn’t seem that the parties participating in the elections are worried about these data as their economic programmes seem very costly. Berlusconi promises a flat tax for individuals of 23% while the M5S is promising to raise the minimum income for the poorest households – a measure that would definitely deepen Italy's deficit. The good news is that if the elections results in a hung parliament, any of these costly ideas will be delayed until parties agree with each other. Regardless of the country's high level of indebtedness and the volatile political environment, it is likely that the 10-year yield will push above the 4% threshold once the ECB’s buying programme has completely ended.

Market should expect volatility in sovereigns first and as BTPS fall in the financials

Market participants seem that are not taking seriously just how close the Italian elections are and just how confused the political situation is.The Italian treasury has recently sold EU750m of notes maturing in 2067. The average yield was 3.44% and the bid to cover was 1.85 signaling that investors are still hungry of assets and hungry of yields.

The Italian elections this year come at an unfortunate time. All eyes are on the election results especially because in order to guarantee a strong united European Union we will need a strong pro-European government. A hung parliament will imply that the EU is weak and episodes such as Brexit are still highly possible. The first countries to be affected from this result will be the periphery, however, volatility may spill to various sectors. The Italian financial industry is the one most likely to suffer the most, especially regional banks that have high exposure to BTPs in their balance sheet and were not able to diversify in the last few year, while more international banks will be less affected.

The Italian story just adds to the tension that we are already witnessing in the markets. What is certain is that history teaches us that when the market drops, the two instruments that are the most stable are gold and bonds. Within bonds, it is important to select those names with optimal duration and the lowest risk.