Tangible assets are winning

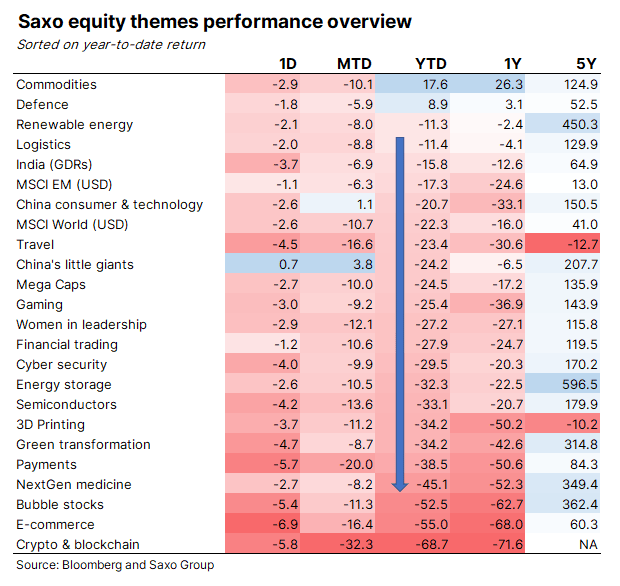

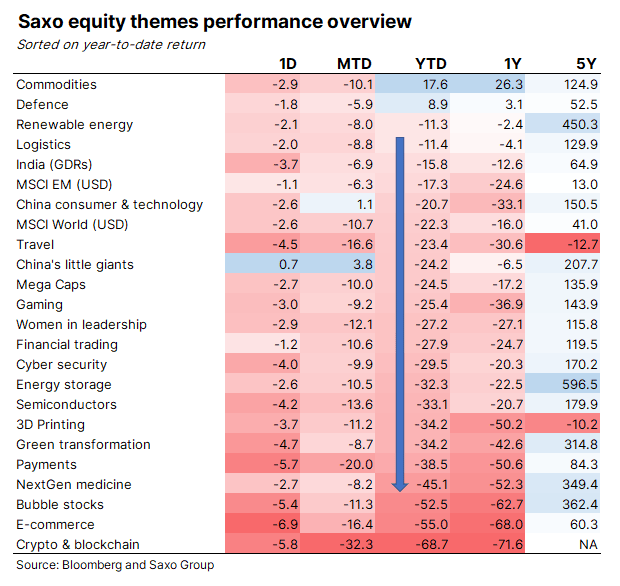

Looking at the year-to-date performance as of 16 June 2022 across our theme baskets, it is clear what stands out. Commodities, the principal driver of the current supply side inflation, and defence stocks, being at the receiving end of Europe’s increase in military spending due to the war in Ukraine, are the only theme baskets that are up. The two best theme baskets among all the losing baskets are logistics and renewable energy. We expect these themes to continue doing well until equities hit bottom in the current drawdown. The worst-performing themes this year are crypto and blockchain, e-commerce, bubble stocks, nextgen medicine and payments. The red thread is that tangible assets are generally outperforming intangible assets as a function of the higher cost of capital-compressing equity valuations of intangibles from insanely high levels, as supply constraints in the physical world push up the prices of physical capital goods and components.

The only exception to tangible assets winning is real estate. This is the part of the physical world that was sucked into the there-is-no-alternative (TINA) trade. This led to excessive valuation levels on residential homes and capitalization rates (across all segments) as low as 5.4 percent in the US in the second half of 2021, according to CBRE, down from 6.4 percent just before the pandemic. Low interest rates combined with tight supply in many urban areas in the US and Europe have pushed real estate into a position where it is quite vulnerable to rising interest rates in the short term.

If we look at the 1970s home prices in the US, tracked inflation translated into real rate returns of zero—preserving purchasing power—which was a much better performance than equities that failed to keep up with inflation during that period. In a normal inflation cycle, we would be positive on real estate for preserving purchasing power. However, when you start from very low interest rates and historically high real estate valuations, and couple those with a significant change in interest rates, it becomes difficult to be positive on real estate, despite it being a tangible asset.

Explore equities at Saxo

Explore equities at Saxo