Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Strategist

It finally happened. After weeks of relentless red screens and investor nerves stretched thin, Wall Street got a major jolt of relief—and it was a big one. The Nasdaq surged 12% in a single day. The S&P 500 rallied nearly 10%. Even the battered Dow saw a 7.9% comeback.

Tech was the undisputed leader, with Nvidia up 19%, Tesla popping 23%, and Apple adding 15% in a flash. The rally followed a surprise policy move by President Trump, who announced a 90-day pause on the harshest new tariffs—for countries that hadn’t retaliated against the U.S. Investors had been bracing for a deeper economic hit from escalating trade tensions, so the temporary truce sparked a massive wave of buying.

But beyond the headlines, yesterday’s rally sent a powerful message: this is why staying invested matters.

Market timing sounds good in theory. In reality? It’s incredibly hard to do. Selling during downturns can protect capital in the moment, but it risks missing the exact days that drive long-term returns.

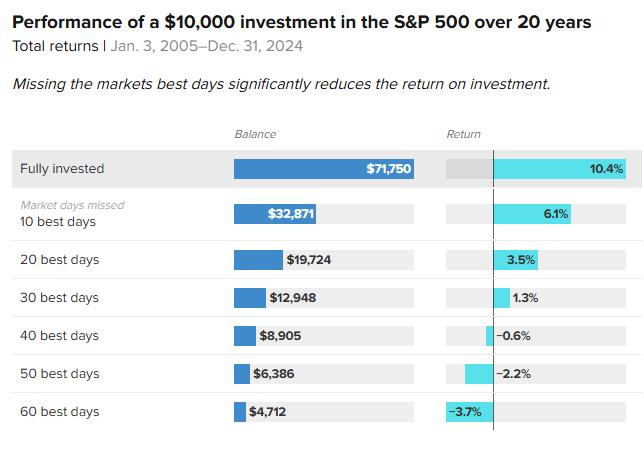

Historically, just a handful of the market’s best days each year account for the lion’s share of long-term returns. Miss them, and you could drastically undercut your portfolio’s performance.

Let’s say you sold earlier this week to “wait out the volatility.” It’s totally understandable—but it would’ve meant sitting out one of the strongest one-day rallies in history.

Yes, the news was significant. But the bigger story is what this kind of day tells us about investing: you need to be in the market to benefit from days like this.

The JP Morgan chart below shows the steep cost of missing just a few key days—even over a 20-year horizon.

Source: JP Morgan Asset Management

Many of those "best days" come right after the worst. Just like Wednesday.

The market has been under pressure for weeks as tariffs between the U.S. and China escalated. Tech, in particular, took it on the chin. But Wednesday’s surge showed just how quickly sentiment can shift. Investors didn’t need all the uncertainty to go away—they just needed a little less bad news.

And here’s the kicker: Trump also announced a steep 125% tariff on China the same day. So yes, risks remain, and this rally may prove short-lived.

But markets looked past the negatives and seized on any hint of progress. That’s how bottoms often form: quietly, amid a fog of bad news, and when few expect it.

Trade tensions are still high, inflation risks remain, and the Fed isn’t in a rush to cut rates.

But if you’re investing with a multi-year lens, this week was your reminder: staying calm, consistent, and committed matters more than ever. You don’t need to time the bottom—you just need to be there when it happens.

Consider these strategies: