Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

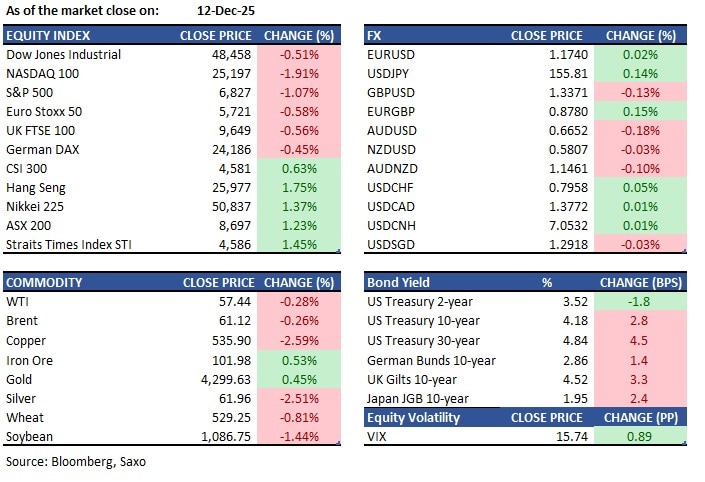

Asia Market Quick Take – December 15, 2025

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

Equities:

Earnings this week:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance. The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.