Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Macro Strategist

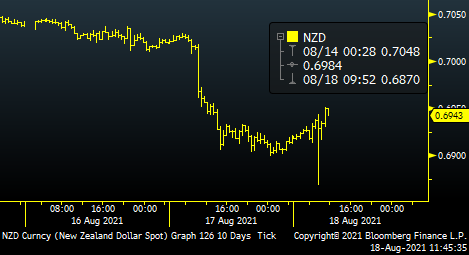

Summary: Macro Dragon checks back in on the RBNZ rate decision to leave rates unchanged at 0.25%, which is a big difference from the hikes expectations from just earlier this wk - with the key caveat being the covid-case that has taken NZ to a country wide shutdown.

-

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP