Equities - How do investors choose shares?

Level: Beginner / Length: 13 minutes

In this module we’ll explore the reasons why investors choose to buy or sell shares. In particular we’ll focus on the differences between fundamental and technical analysis and factors that may impact a decision for both.

The fundamental analyst searches for under-valuation, over-valuation and fair valuation by comparing market cap to book value.

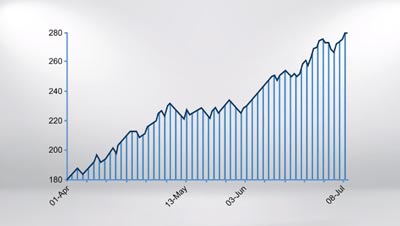

The technical analyst will look for trends. A trend indicates the possible direction of a share price. They study historical charts to predict where a share is heading.

In this module we’ll take a look at:

- The two main approaches used by professional traders

- An overview of how fundamental analysis and technical analysis differ

- And, we’ll look at a few examples of both