Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Global Market Quick Take: Asia – August 7, 2025

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

Equities:

Earnings this week:

FX:

Commodities:

Fixed income:

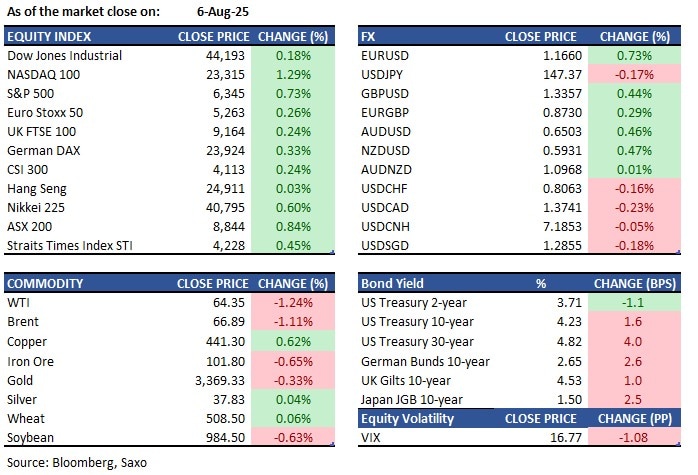

Treasuries experienced a twist steepening as the long end underperformed while the 7-year sector remained stable, impacted by a weak 10-year auction. Long-end yields were cheaper by up to 3bps, while the front end became richer by 1.5bps. This steepening widened the 2s10s and 5s30s spreads by 3bps and 4.5bps respectively. Focus is now on Thursday's $25 billion 30-year bond issue. A flash crash in Treasury futures drew attention, seemingly flow-driven with no clear catalyst. Japan's Ministry of Finance plans to sell ¥700 billion in June 2055 bonds.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance. The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.