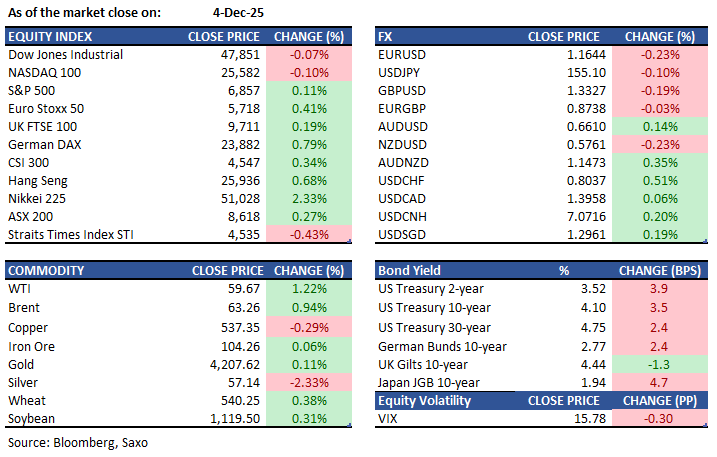

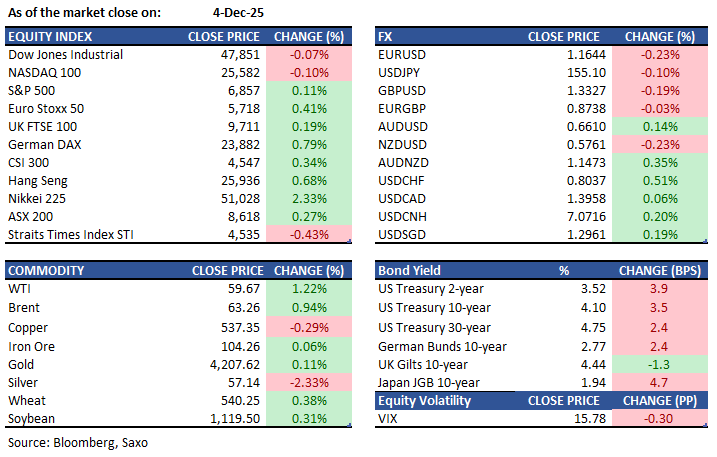

Key points:

- Macro: U.S. jobless claims fell by 27,000 to three-year low

- Equities: Meta jumped 3.4% after cutting metaverse spending by 30%

- FX: CNH faced pressure as China intervened to curb Yuan appreciation

- Commodities: Oil up despite Saudi cuts; silver dips after profit-taking post-surge

- Fixed income: US Treasuries fell post-jobless data; UK Gilts up on supply changes

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US unemployment benefit applications fell to the lowest in more than three years, with initial claims down 27,000 to 191,000 in the week ended 29 Nov, below all estimates in a Bloomberg survey, as a low‑hire, low‑fire labour market keeps claims subdued but limits job‑finding for the unemployed.

- Japan's October 2025 household spending fell 2.9% YoY, missing expectations and marking its first decline since April amid persistent cost pressures. Monthly spending dropped 3.5%, against forecasts for a 0.7% increase.

Equities:

- US - US stocks closed mostly flat Thursday as investors awaited next week’s Fed decision and weighed mixed labor data, keeping markets heavily pricing a 25bp cut. ADP reported a 32,000 drop in private payrolls and Challenger announced 71,321 layoffs, reinforcing easing expectations despite initial claims falling to 191,000. Treasury yields rose, with the 10-year near 4.10%, pressuring tech while boosting small caps. Intel sank 7.5%, Amazon fell 1.4%, Apple 1.2%, and Alphabet 0.7%, while Meta jumped 3.4% on spending-cut reports. Salesforce gained 3.7% and Dollar General surged 14%, offering pockets of strength ahead of Friday’s PCE and next week’s FOMC.

- EU - European stocks closed higher on Thursday, boosted by gains in banking and automotive sectors. The STOXX 50 and STOXX 600 indices rose 0.5%. Inditex advanced 2.6%, while Stellantis surged 3.6% after an upgrade from UBS. Automakers Mercedes Benz, BMW, and Volkswagen saw gains of over 3%, following favorable ratings from Bank of America. Banks like Santander, BNP Paribas, and BBVA climbed about 2%. However, Sanofi and Bayer declined by 1.3% and 2.6%, respectively. Anticipation of a rate cut by the Federal Reserve next week aided European equities, even amid strong U.S. jobless claims data.

- HK - Hang Seng Index rose 0.7%, or 175 points, to 25,936 on Thursday, recovering from a steep fall the day before. Gains were driven by stronger U.S. futures ahead of Friday's PCE index and an expected 25 basis point rate cut by the Federal Reserve. Country Garden secured approval for $13 billion in convertible bonds amid its restructuring. CMOC Hong Kong added 1.6% on news of its FTSE China A50 Index inclusion, while Innoscience jumped 4.4% following a deal with On Semiconductor. Xiaomi, SMIC, and Meituan also advanced.

Earnings this week:

- Friday: Victoria's Secret, MoneyHero

FX:

- Dollar Index gained slightly on Thursday, fueled by EUR and CHF selling over JPY strength. Weekly jobless claims dropped more than expected, supporting the Fed's labor mandate but attributed by some to Thanksgiving seasonal adjustments. Despite higher U.S. yields, the DXY remained around 99.00.

- JPY held gains after a Bloomberg report that Prime Minister Sanae Takaichi’s government wouldn’t block a BoJ rate hike, with USDJPY touching 154.51—the strongest since 17 Nov—before paring, while OIS lifted December hike odds to about 90% from 56% a week ago.

- EURUSD slipped 0.2% to 1.1653 as two‑week volatility jumped 38bps to 6.32%

- AUDUSD rose 0.4% to 0.6624 near a two‑month high on RBA‑hike speculation and 3‑year yields above 4% for the first time since January, USDCAD was little changed at 1.3950, and Washington opened a three‑day USMCA hearing.

- CHF and Scandinavian currencies suffered as the weakest performers among G10 currencies, following softer-than-expected inflation data. Sweden's CPI Flash for November came in at 2.3% versus the anticipated 2.5%, exerting pressure on the SEK, with EURSEK rising to approximately 10.97. USDCHF climbed from a low of 0.7995 to around 0.8035.

- CNH faced headwinds after the PBoC set a softer reference rate. In response to the Yuan's 14-month high, Reuters noted that Chinese state-owned banks bought USD in the onshore market, while Bloomberg cited China signaling its strongest effort since 2022 to curb Yuan appreciation.

Commodities:

- Oil rose in volatile trade as geopolitics offset Saudi Arabia’s price cut to Asia, with WTI up 1.2% to settle just below $60 as Ukraine talks move to Florida and Putin rejects parts of a US‑backed peace plan, keeping sanctions relief on Russian oil elusive and underpinning prices.

- Silver retreated from a record as traders took profits after an eight‑day surge seen as too fast, too far, falling as much as 3.4% after US jobless claims hit a three‑year low without shifting rate‑cut bets for next week, with spot silver down 2.7% at $56.95, gold little changed at $4,208.53 an ounce, and platinum and palladium also lower.

Fixed income:

- US Treasuries drifted lower after stronger‑than‑expected jobless claims, ending near session lows with yields near the highs as the curve bear‑flattened, while SOFR options saw continued demand for upside protection into FOMC meetings in H1 next year; Gilts outperformed as UK yields fell 1–4bp in a bull flattening on a favourable supply outlook after the DMO said it will exclude long‑maturity bonds from next quarter’s conventional issuance.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.