Key points:

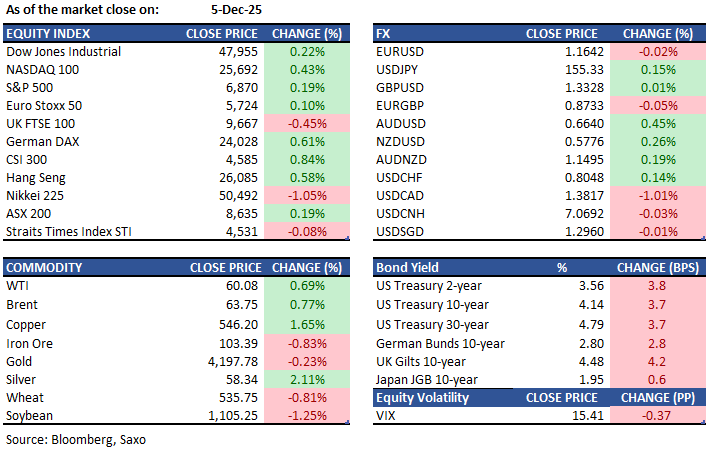

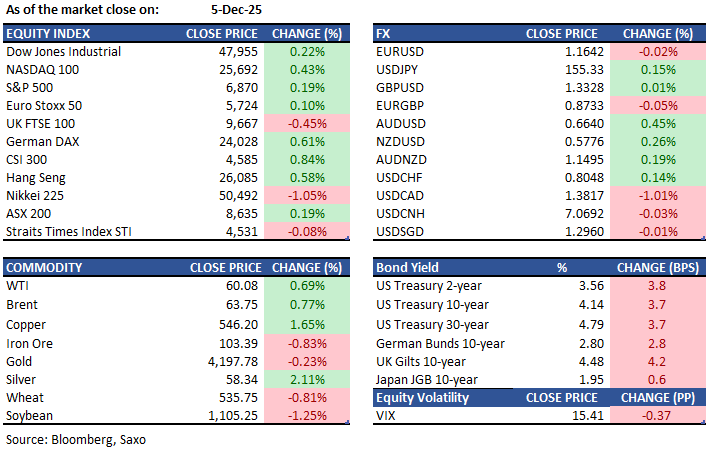

- Macro: US PCE index rose 0.3%; Michigan Sentiment Index improved to 53.3 in December

- Equities: Netflix fell 2.9% on regulatory worries after Warner Bros deal

- FX: CAD rose on strong jobs report; USDCAD fell to 1.3820

- Commodities: Oil rises after U.S.-Russia talks; Russian exports set to surge

- Fixed income: T-notes drop; yields rise amid data, Canadian bonds decline

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US. PCE price index rose 0.3% in September 2025, matching August and in line with expectations. Goods prices increased by 0.5%, while services slowed to 0.2%. Core PCE, excluding food and energy, rose 0.2%, consistent with forecasts. Annually, headline PCE inflation climbed to 2.8%, its highest since April 2024, while core PCE inflation decreased to 2.8%. September's report was delayed due to a government shutdown.

- University of Michigan Consumer Sentiment Index rose to 53.3 in December 2025 from 51 in November, beating expectations of 52 and marking the first rise in five months. Improved personal finance expectations, notably among younger consumers, drove the increase. Year-ahead inflation expectations dropped to 4.1%, the lowest since January, and five-year expectations fell to 3.2%.

- U.S. personal spending rose 0.3% in September 2025, increasing by $65.1 billion, meeting expectations after a revised 0.5% gain in August. A $63 billion jump in services led the growth, notably in housing, healthcare, and food services. Goods spending increased slightly by $2.1 billion, driven by a $17.2 billion surge in energy goods, which offset declines in vehicles, recreational goods, and apparel.

- China's foreign exchange reserves increased by $3 billion to $3.346 trillion in November 2025, the highest since 2015, amid a weaker US dollar. The yuan fell 0.65% against the dollar, while analysts expected reserves of $3.36 trillion. The People's Bank of China also boosted its gold holdings for the thirteenth month, with reserves rising to 74.12 million fine troy ounces, increasing gold's value to $310.65 billion.

- Canada's unemployment rate fell to a 16-month low of 6.5% in November 2025, down from 6.9% and beating expectations of a rise to 7%. The unemployed population decreased by 80,000 to 1.5 million, while the labor force shrank by 26,000, lowering participation to 65.1%. Employment rose by 53,600 to 21.14 million, driven by a 63,000 increase in part-time jobs, with 18% working part-time involuntarily.

Equities:

- US - US stocks closed higher Friday, buoyed by expectations of a 25-basis-point Fed rate cut next week as traders see an 87% chance of a move. The S&P 500 gained 0.2%, the Nasdaq advanced 0.4%, and the Dow rose 0.2%, influenced by a light PCE report and stronger Michigan sentiment. Core PCE rose 0.2% in September, reducing the annual rate to 2.8%. Mega-cap stocks spearheaded gains with Alphabet up 1.2%, Meta climbing 1.8%, and Broadcom increasing 2.4%. Microsoft added 0.5%, while Tesla edged up 0.1%, Apple fell 0.7%, and Nvidia slipped 0.5%. Netflix dropped 2.9% amid regulatory concerns following its Warner Bros Discovery deal. The tech sector showed strength, with XLK marking its tenth consecutive gain and Salesforce surging 5.3% on robust results. For the week, the S&P rose 0.4%, the Nasdaq increased 0.9%, and the Dow improved 0.5%.

- EU - European stocks rose for the second straight week amid considerations of next year's rate outlook and Russia-Ukraine ceasefire possibilities. The STOXX 50 climbed 0.1% to 5,726, up 1% for the week, while the STOXX 600 remained flat but gained 0.4% weekly. U.S. data reinforced Fed rate cut expectations, while Eurozone labor market revisions supported ECB's unchanged stance. Auto manufacturers like Mercedes and BMW gained 2-4%, while AI infrastructure stocks had mixed results. Rheinmetall and Leonardo ended higher on Ukraine peace hopes.

- HK - Hang Seng gained 0.6%, closing at 26,085 and reversing morning losses for its second consecutive session of gains. Investor sentiment improved as markets anticipated fresh stimulus from Beijing to help a slowing economy, despite lingering concerns over China's shadow banking. Gains were driven by tech, financial, and consumer stocks. Hong Kong markets recorded a second consecutive weekly increase of 0.8%, lifted by optimism around AI developments with Moore Threads Technology Co., dubbed “China’s Nvidia,” surging roughly fivefold in its Shanghai debut, contrasting weaker debuts from Guangzhou Xiao Noodles and Guangdong Tianyu Semiconductor. Among top performers were Xiaomi Corp. (2.5%), Zijin Gold International (1.7%), and Meituan (1.2%).

Earnings this week:

- Monday: Compass Minerals, Mama's Creations, Toll Brothers

- Tuesday: AutoZone, Campbell's, GameStop, Cracker Barrel

- Wednesday: Oracle, Adobe, Chewy, Synopsys, Nordson

- Thursday: Costco, Broadcom, RH (Restoration Hardware), Lululemon

- Friday: Quanex Building Products, Johnson Outdoors

FX:

- Dollar Index stayed flat Friday as the September PCE report, aligned with expectations, is unlikely to affect the Fed's December plans. The University of Michigan Sentiment Index rose for the first time in five months, buoyed by improvements in expected personal finances, especially among younger consumers. DXY recovered to near 99 from lows amid rising U.S. yields.

- CAD surged following a strong November jobs report, with unexpected job growth of 53.6k and a drop in unemployment to 6.5%, shifting BoC policy expectations towards a rate hike by end-2026. USDCAD fell to 1.3820.

- AUD hit a two-month high at $0.661, driven by strong domestic demand and prospects of an RBA rate hike. October's household spending surged 1.3%, boosting expectations for a rate increase, with a 50% chance by May.

- JPY weakened against the dollar as U.S. yields rose and BoJ hawkish signals persisted, with Bloomberg suggesting possible December hikes. Intervention comments shifted USDJPY from a low of 154.35 to above 155.20 in later trading.

Commodities:

- WTI rose $0.41 to settle at $60.08/bbl; Brent gained $0.49, closing at $63.75/bbl, as crude extended recent gains following a lackluster U.S.-Russia meeting. Russian ESPO crude discounts to China widened amid lower demand, and Russia plans to boost December oil exports by 27% month-over-month. Meanwhile, the G7 and EU consider banning Russian access to maritime services to disrupt exports. WTI and Brent reached higher intraday levels before paring gains. Baker Hughes reported an increase in oil rigs, adding six for a total of 413.

- Silver climbed above $58, approaching record highs, after data reaffirmed expectations of a Fed rate cut. The September PCE and Michigan survey maintained cut prospects and eased inflation forecasts, enhancing silver's appeal. Slow hiring trends bolstered policy easing chances, aiding bullion. Recovery was underpinned by low inventories, fresh ETF demand, and a projected 2025 supply deficit. Robust demand from solar and green tech supports medium-term price strength.

- US natural gas futures exceeded $5/MMBtu, driven by strong export demand and Europe's move to phase out Russian LNG by 2027. U.S. LNG exports climbed 40% year-on-year in November. A cold front increased demand, particularly in the Northeast and Great Lakes. EIA reported a 12 bcf withdrawal, marking a seasonal drop but above the expected 18 bcf.

Fixed income:

- T-notes fell Friday with yields up 3-4bps amid US data meeting expectations and sentiment improving. Large trades drove selling, while Canadian bonds dropped on BoC rate hike expectations. NEC Director Hassett advocated cautious Fed rate cuts, differing from Trump and raising Fed independence concerns due to hawkish regional presidents.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.