Key points:

- Macro: US CPI rises 2.7% as expected, up 2.4% from May

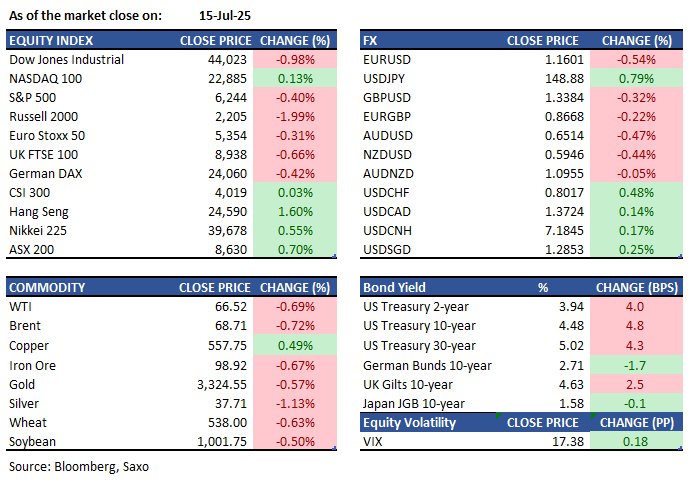

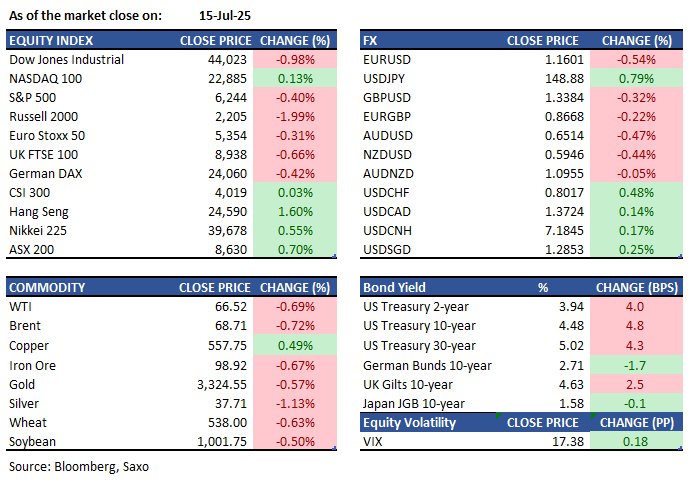

- Equities:S&P 500 fell 0.4% but Nasdaq 100 outperformed on Nvidia & AMD.

- FX: USD strengthens post-CPI; GBP below 1.34, USDJPY near 149

- Commodities: Iron ore fell as China's crude steel production sharply decreased

- Fixed income: The 30-year yield surpassed 5% for the first time since early June

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US annual CPI rose to 2.7% in June 2025, up from 2.4% in May. Core CPI rose 2.9%, in line with estimates. Food, transportation services, and used car prices increased, while energy costs fell less. Gasoline and fuel oil prices continued to decrease, and inflation for shelter and new vehicles slightly declined.

- Trump announced a deal with Indonesia, which will pay a 19% tariff, while the US pays nothing. Indonesia committed to buying $15 billion in US energy, $4.5 billion in agricultural products, and 50 Boeing jets, including many 777s.

- Canada's annual CPI increased to 1.9% in June 2025 from 1.7%, matching expectations but still below the 2% target for the third consecutive month, amidst tariffs and supply disruptions.

- In July 2025, the New York Empire State Manufacturing Index rose to 5.5, the first positive figure since February, up from -16.0 in June, exceeding the expected -9.0. This rebound indicates expanding business activity, with new orders at 2.0 and shipments at 11.5.

- The Reuters Tankan index for Japanese manufacturers rose to +7 in July 2025 from +6 in June, driven by a semiconductor rebound. Manufacturers expect sentiment to improve to +8 by October. Electronics machinery rose to -4 from -16, and chemicals increased to +18 from +12, due to recovering chip demand

Equities:

- US - On Tuesday, stocks closed mixed as investors reacted to June's inflation increase, bank earnings reports, and news that Nvidia might resume chip sales to China. The S&P 500 dropped 0.4%, the Dow fell 436 points due to financial stock declines, while the Nasdaq 100 rose by 0.1% with Nvidia gaining 4%. Concerns over Trump's proposed EU and Mexico tariffs boosting inflation grew after the Consumer Price Index increased monthly and yearly. Wells Fargo slid 5.5% and JPMorgan declined by 0.9% on mixed earnings; Citigroup gained nearly 3.8% amid uncertainties over trade policies and inflation affecting future Federal Reserve actions during an uncertain earnings season.

- EU - European stocks initially gained before closing mostly lower on Tuesday, as concerns grew over potential US tariffs impacting European businesses. The STOXX 50 fell 0.3% to 5,358 points and the STOXX 600 dropped 0.4% to finish at 545 points. President Trump has announced a forthcoming 30% tariff on EU imports starting August 1st, pushing for negotiations but leaving the EU readying a €72 billion retaliation package against US goods if needed. Financial stocks like Allianz, BBVA, and UniCredit led declines between 2-1%, and Ericsson dipped over 4% despite strong earnings due to worries about tariffs. In contrast, ASML rose by 2.7%, thanks in part to relaxed US export restrictions on Nvidia chips.

- HK - Hong Kong equities dropped 0.2% to 24,244 by midday Tuesday, ending a three-day winning streak. The market responded to China's Q2 GDP growth of 5.2% year-on-year, its slowest in three quarters but slightly better than the forecast of 5.1%. China’s statistics agency highlighted ongoing external uncertainties and weak domestic demand. Limiting further losses were stronger-than-expected new yuan loans in June due to seasonal surges and strong bond sales. Property stocks mainly fell, led by Longfor Group (-3.6%), China Resources Land (-2.9%), and China Overseas Land (-1.9%).

Earnings this week:

- Wednesday: ASML Holding (ASML), Bank of America (BAC), Goldman Sachs (GS), United Airlines (UAL), Johnson & Johnson (JNJ), Morgan Stanley (MS).

- Thursday: Netflix (NFLX), TSMC (TSM), PepsiCo (PEP), Abbott Laboratories (ABT), Interactive Brokers (IBKR).

- Friday: 3M (MMM), American Express (AXP), Charles Schwab (SCHW).

FX:

- USD strengthened after the latest US CPI report showed mixed results, with a hawkish market reaction despite softer-than-expected core readings. Dollar index rose above 98.60.

- EUR fell, testing below 1.1600, amid dollar strength and political challenges in France. GBP declined below 1.3400, with little impact from Mansion House texts, as focus shifts to upcoming UK CPI data.

- JPY weakened further, with USDJPY reaching 149 due to the dollar on inflation data.

- Economic calendar – UK Inflation Rate, EU Balance of Trade, US PPI, US Industrial Production

Commodities:

- Oil rose as President Trump announced trade progress. WTI neared $67 after a nearly 3% drop earlier in the week, and Brent settled just below $69. Trump secured a deal with Indonesia and plans more before August 1.

- Iron ore prices fell as China's crude steel production dropped sharply due to property sector challenges. Futures slid 1.6% amid mixed economic data showing weak demand. June steel output fell 9.2% year-on-year to 83.2 million tons.

- Spot gold rose 0.2% to $3,331.47. Silver gained after retreating from a 14-year high last week. Palladium and platinum stayed steady.

Fixed income:

- Treasuries fell, pushing yields to a month's high as investors assessed June CPI data ahead of the PPI release. Yields increased 4bp-7bp, led by intermediate sectors, with the 30-year yield topping 5% for the first time since early June. Japanese government bonds were under pressure over concerns the ruling coalition might not secure a majority in Sunday's election.

For a global look at markets – go to Inspiration.