Key points:

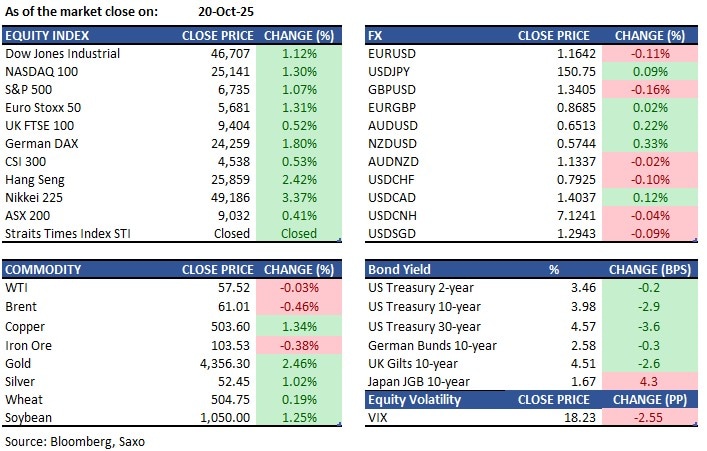

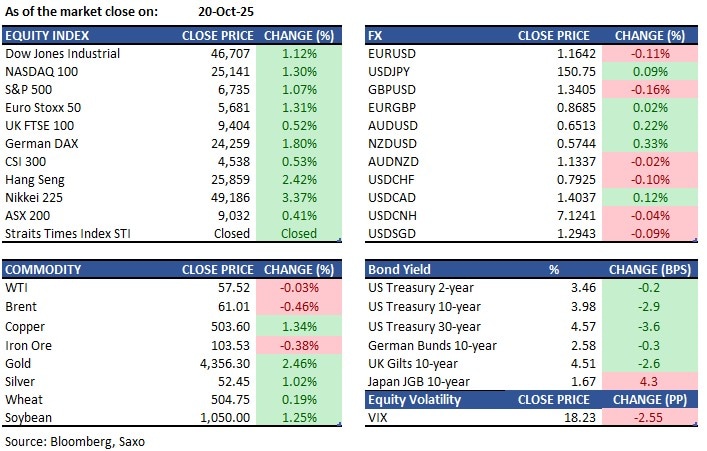

- Macro: Hassett expects shutdown to end this week else warns of stronger measures

- Equities: Apple surges 4.4% to new highs; CATL reports 41% net income growth.

- FX: USDJPY hovered near 150.60 amid trade and policy developments

- Commodities: Gold remains elevated near record level near $4,380

- Fixed income: US Treasuries rose modestly, with long-end gains flattening the curve

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- White House advisor Kevin Hassett expects the government shutdown to end this week but warned of "stronger measures" if not. The shutdown's third week sees Republicans pushing for a short-term funding bill while Democrats insist on extending ACA tax credits.

- Trump and Australian PM Albanese signed a critical minerals agreement. Trump noted no "games" with Australia, while Albanese mentioned upcoming joint projects over the next six months, including processing.

- BoJ is expected to uphold its view of moderate economic recovery and might slightly raise the FY25 growth forecast. Japan's LDP leader Takaichi and Innovation Party’s Yoshimura agreed to form a coalition government. Takaichi plans to appoint Toshimitsu Motegi as Foreign Minister and Minoru Kihara as Chief Cabinet Secretary.

Equities:

- US - U.S. stocks surged Monday on optimism over upcoming earnings and renewed bank support, while investors weighed prospects of reduced trade barriers with China. The S&P 500 and Dow each gained 1.1%, and the Nasdaq 100 rose 1.4% to a record close. Wells Fargo and Citi advanced 3.3% and 2.3%, respectively, as concerns over credit stress eased. Apple jumped 4.4% to a new high on strong iPhone 17 sales signals in the U.S. and China. Sentiment improved after President Trump hinted at trade de-escalation ahead of talks in Malaysia and exempted dozens of products from tariffs. Tesla added 1.8% before earnings.

- EU - Germany’s DAX climbed 1.8% to 24,291 on Monday, led by defense stocks amid geopolitical uncertainty. Hensoldt rose 6.9%, Rheinmetall 5.9%, and Renk 5.6% after reports that Zelensky failed to secure U.S. missile support, leaving Europe as his main option for rearmament. EU leaders will meet Thursday in Brussels to discuss using frozen Russian assets for a €140 billion Ukraine loan. A fragile Gaza ceasefire and easing U.S. banking concerns also lifted sentiment, alongside Trump’s softer tone on China ahead of trade talks in Malaysia. Tech shares advanced strongly, with Infineon up 5.1%, SAP 3.3%, and Siemens 2.2%.

- HK/CH - Hang Seng jumped 2.4% to 25,859 on Monday, rebounding from prior losses as all sectors advanced. Sentiment improved after U.S. futures rallied and President Trump signaled possible tariff cuts if China resumes U.S.-benefiting measures, including soybean purchases. Optimism was also fueled by expectations of fresh Chinese stimulus following Q3 GDP growth of 4.8%, the weakest in a year. Policymakers are meeting this week to shape the Five-Year Plan ahead of December’s key economic conferences. CATL (HKG: 3750) posted strong Q3 results, with net income rising 41.2% year-on-year to RMB 18.5 billion ($2.6 billion). Revenue grew 12.9% to RMB 104.2 billion, reflecting continued demand for the Chinese battery giant’s products.

Earnings this week:

Tuesday: Coca-Cola, GE Aerospace, Netflix, Intuitive Surgical, Texas Instruments, Capital One, RTX, 3M, General Motors, Northrop Grumman, Elevance Health, Philip Morris International, Pulte Group

Wednesday: IBM, Boston Scientific, AT&T, Tesla, Kinder Morgan, SAP, Lam Research, Thermo Fisher Scientific

Thursday: Honeywell, Dow, American Airlines, Intel, Newmont

Friday: Procter & Gamble, General Dynamics

FX:

- USD saw slight gains with limited news due to the Fed blackout and government shutdown. White House adviser Kevin Hassett predicts the shutdown may end this week. President Trump anticipates a trade deal with China but warned of tariffs by November if no deal occurs. DXY traded near 98.55.

- In G10 currencies, the AUD and NZD led gains on positive risk sentiment, while the CHF also rose. The EUR, JPY, CAD, and GBP saw minor losses, with GBPUSD trading between 1.3401 and 1.3443.

- JPY gains from positive Asia-Pacific sentiment were capped by BoJ's hawkish comments. The BoJ may revise FY25 growth forecasts at its October meeting despite tariff concerns. USDJPY traded near 150.60.

- Canadian surveys highlighted tariff-related cost and inflation concerns. The USDCAD traded near 1.4030.

Commodities:

- Oil prices were steady as investors weighed evidence of a mounting surplus ahead of US–China trade talks later this week. Brent traded below $61 a barrel after Monday’s 0.5% decline, while WTI hovered near $57. Vortexa data indicate crude on tankers at sea has climbed to a record high as producers continue adding barrels, amid slowing demand growth.

- Gold edged back toward the record set in the previous session as traders bought the dip after last week’s sharp selloff. Bullion hovered near $4,365 an ounce, having surged as much as 3.1% to a peak of $4,381.52. The move came despite easing trade tensions and prospects for a US government reopening, while technical indicators—including the relative strength index—suggest the rally that began in August may be overheating.

Fixed income:

- US Treasuries posted modest gains, flattening the curve as the long end led the move. A sharp drop in oil prices provided the initial catalyst, followed by a block buy of 10-year note futures. Australian sovereigns tracked US Treasuries higher ahead of an RBA panel appearance and the Treasurer’s interview on Bloomberg Television. Japan will sell a 10-year climate transition bond.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance. The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.