Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

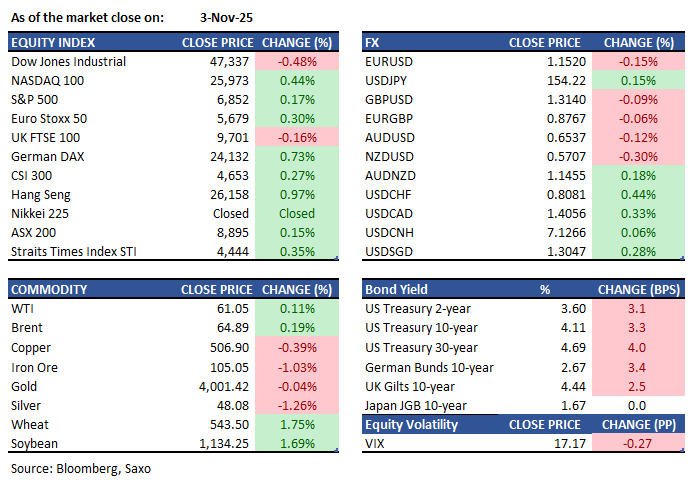

Macro:

Equities:

Earnings this week:

Tuesday

Asia: Nintendo, Mitsubishi, NTT Inc

Outside Asia: Uber Technologies, Pfizer, Shopify, Super Micro Computer, Spotify, Yum! Brands, AMD

Wednesday

Asia: Hong Kong Exchange, Toyota, Itochu, Softbank, Mitsui & Co.

Outside Asia: Robinhood Markets, Qualcomm, AppLovin, DoorDash, McDonald’s, Lyft, ARM, Novo Nordisk

Thursday

Asia: Recruit, Suzuki Motor, DBS

Outside Asia: Warner Bros. Discovery, DraftKings, Block, Moderna. AirBnB

Friday

Asia: Mitsubishi Heavy Industries; OCBC; Honda; Macquarie; Fujikura

Outside Asia: Constellation Energy, KKR

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.