Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

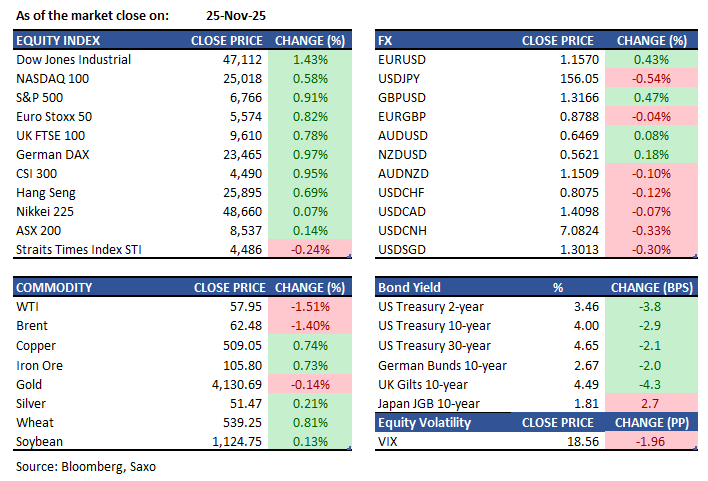

Macro:

Equities:

Earnings this week:

Li Auto, Alibaba Health Information, Envision Greenwise, Rockwool, CD Projekt, Aroundtown, Tiger Brands, Strauss Group, Deere

Bosideng International, Sime Darby, Luk Fook Holdings, Ryman Healthcare, Oberbank, Asseco Poland, Remy Cointreau, CPI Europe, Grenergy Renovables

Friday

Meituan, Chagee, China Gas, China Water Affairs, CPI Property, Dottikon ES, 4iG, Kernel Holding, ElectricaFX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance.

The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.