Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

AI is not being abandoned by markets. It is being priced more carefully.

Over the past few weeks, the underperformance of software and SaaS stocks has sparked a familiar question: is the AI trade breaking down? The answer is no. What we are seeing instead is a shift from broad AI enthusiasm to a more selective, more demanding phase of the story — one that is forcing investors to distinguish between hype and defensible value.

This is not about giving up on technology or artificial intelligence. It is about identifying where the real bottlenecks, moats, and profit pools are likely to sit as AI moves from promise to practice.

Recent AI product announcements have sharpened this debate, because they made the pace of disruption feel more immediate — and more practical.

Put together, these moves pushed the conversation from “AI helps” to “AI replaces or automates,” and that is what changed the tone.

When AI starts to replicate tasks traditionally performed by professionals — drafting, analysing, coding, reviewing — it naturally raises questions about the long-term pricing power of certain software products. Investors are no longer impressed simply by the presence of AI features.

This is why the pressure has shown up most clearly in SaaS: it’s where the market is first forced to debate what AI will replace, who retains pricing power, and who absorbs the costs of adoption.

SaaS sits closest to the point where AI can change behaviour quickly. Many SaaS models are built around per-seat pricing, recurring subscriptions, and workflow dependency. AI challenges each of these assumptions.

If AI can automate parts of a workflow, customers may need fewer seats. If AI becomes embedded at the platform or operating-system level, the standalone value of individual SaaS tools can be questioned. And if AI raises computing and development costs before it raises revenue, margins come under scrutiny.

This does not mean SaaS is broken. It means SaaS is being stress-tested.

Markets are asking simple, practical questions:

These questions are harder to answer for SaaS than for other parts of the tech stack.

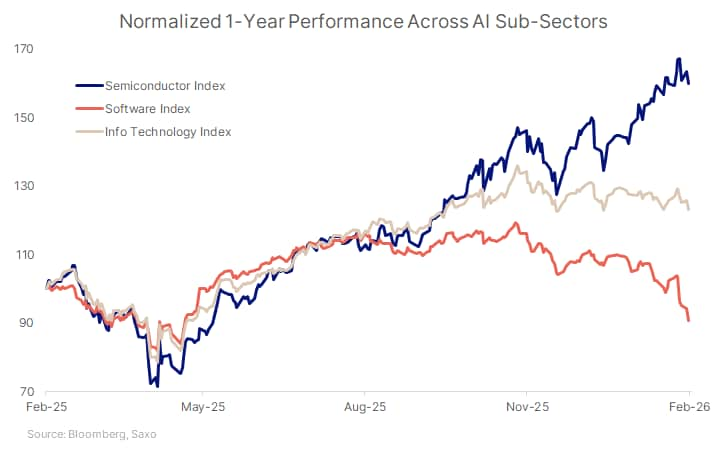

The clearest signal of this shift is the growing divergence between software stocks and semiconductors.

Chipmakers and infrastructure providers sit at the heart of AI spending. They benefit when models get larger, workloads grow heavier, and demand for computing power rises. Their revenues are tied to volume and usage, not to how end-users price productivity.

SaaS companies, by contrast, sit at the edge where AI changes user behaviour first. That makes their earnings more sensitive to disruption risk, pricing debates, and execution.

This divergence is not a vote against AI. It is a signal that investors are differentiating between who enables AI and who may be disrupted by it.

When technology evolves quickly, value often accrues first to the bottlenecks — the parts of the system that everyone needs and cannot easily bypass.

In AI, those bottlenecks include:

These areas benefit regardless of which application wins. They are the “picks and shovels” of the AI build-out.

SaaS, meanwhile, sits further downstream where success depends on execution: defending workflows, proving return on investment, and integrating AI in a way that customers are willing to pay for.

This does not make SaaS unattractive. It makes it selective.

What markets are experiencing now is rotation, not abandonment — and that rotation reflects a maturing AI narrative.

In the early phase of any major technology shift, markets tend to reward broad exposure. The story matters more than the numbers. As adoption deepens, that balance flips. Monetisation starts to matter more than demonstrations. Cash flow matters more than optionality. Moats matter more than speed.

This is why capital is rotating:

At this stage, it is genuinely difficult to know which application-layer and SaaS players will ultimately emerge as winners or losers. Questions around what AI will replace, who retains pricing power, and who absorbs the costs of adoption are still being worked through.

That uncertainty explains why investors are gravitating toward bottlenecks and infrastructure first — areas that benefit regardless of which applications win — while becoming more selective within SaaS.

This pattern is familiar from previous technology cycles. Early leaders are often infrastructure and enablers. Application-layer winners tend to emerge later, once business models stabilise and value capture becomes clearer.

For investors, this phase is uncomfortable but healthy. It reduces excess, forces discipline, and creates differentiation.

The key takeaway is not to exit technology or AI, but to rethink how exposure is built.

A few practical lenses help:

Investors should expect:

In practice, that can mean keeping a core anchored in bottlenecks or enablers such as semis, networking, and infrastructure, and then adding a sleeve of software/adopters, but with a higher bar on moats and treat as higher disruption risk the tools where AI can commoditise the “first draft” output and put pressure on seat-based pricing.

The risk to this view is clear. If SaaS companies demonstrate faster-than-expected monetisation and durable pricing power from AI, sentiment can turn quickly.Explore our AI value-chain shortlist to see how different parts of the AI ecosystem are being expressed across infrastructure, enablers, and software.

AI is not losing relevance. It is gaining accountability.

The current underperformance of SaaS reflects a more nuanced market that is asking harder questions about moats, margins, and monetisation. This is how long-term winners are ultimately identified.

The AI era is moving from excitement to execution. For investors, the challenge — and the opportunity — lies in separating those who control the bottlenecks from those still proving their place in the value chain.