Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

The backdrop: A laggard finally waking up

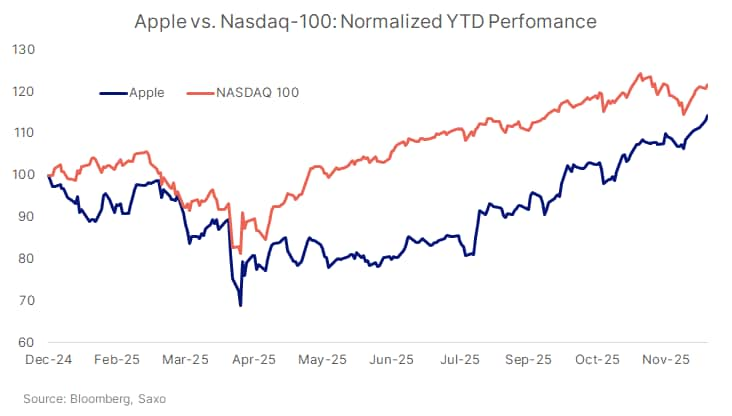

For most of 2025, Apple was the outlier among mega-cap tech. It underperformed the Nasdaq as investors rotated aggressively into AI infrastructure and semiconductor names. Concerns about a muted iPhone upgrade cycle, soft China demand, and a slower on-device AI roadmap kept sentiment cautious.

More recently, Apple’s resurgence toward record highs has been one of the more notable shifts in global equity leadership. The company’s market capitalisation has climbed to around USD 4.2 trillion, placing it within reach of overtaking Nvidia as the world’s most valuable publicly listed business. In our view, the combination of improving fundamentals and earlier underweight positioning has created fertile ground for a catch-up move.

The most important change has been evidence of a stronger-than-expected iPhone 17 cycle:

Given that the iPhone remains the core gateway into Apple’s services and software stack, a healthier upgrade trajectory supports the narrative that Apple is regaining product-cycle momentum. In our opinion, this is particularly important at a time when most consumers are expected to engage with AI primarily through their smartphones rather than dedicated devices.

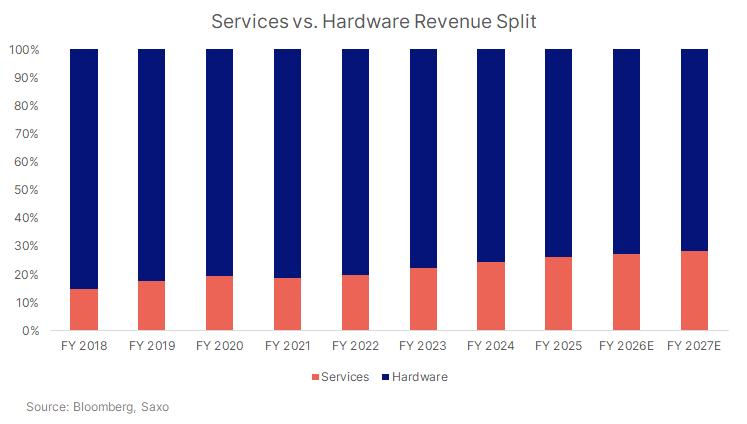

Apple’s services business — App Store, iCloud, Apple Music, TV+, payments — continues to expand at a high-margin clip. It crossed USD 100bn in annual revenue, with strong subscription momentum across regions.

In our view, this has several implications:

Bloomberg consensus forecasts indicate EPS growth of roughly 10% in FY2026 and again in FY2027, alongside gradual margin improvement, reflecting the rising services contribution. These projections are based on Bloomberg analyst estimates, and are subject to change and carry no guarantees. However, the mix shift toward recurring revenue is an important support for valuation at a time when many investors are paying up for more predictable cash flows.

Being “late” to the AI race has, in our opinion, turned into an unexpected advantage for Apple. Apple sidestepped the extreme GPU-driven capex cycle that is now weighing on parts of the market, while still positioning itself to benefit from mass-market AI adoption.

Recent developments that have boosted confidence include:

Compared to the tens of billions in incremental capex needed for AI data centres elsewhere, Apple’s approach is generally seen as more capital-efficient, leaning on its own silicon and on-device inference rather than chasing hyperscale GPU build-outs.

In short, many investors now see Apple as a way to participate in AI themes with less direct exposure to AI capex cycles — although this perception could change if the competitive landscape evolves.

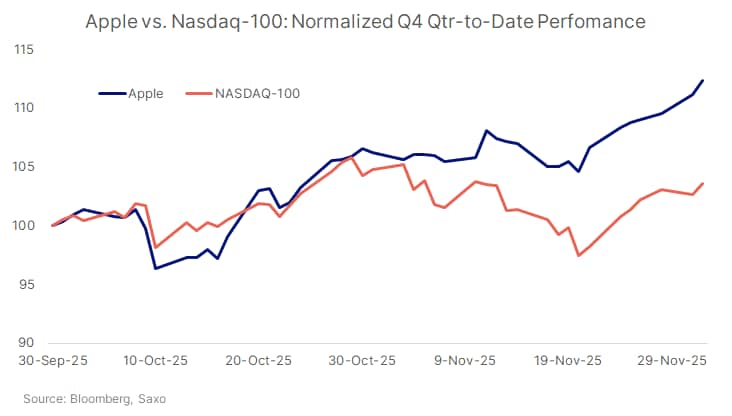

As fundamentals turned, flows amplified the price action.

With broader equity volatility rising and questions emerging over the sustainability of AI-infrastructure spending, some market participants appear to view Apple as a relative safe haven within mega-cap tech — though this is a perception, not a guarantee, and does not eliminate the risk of drawdowns.

From here, the positive scenario for the stock in our view rests on several conditions being met:

In our opinion, if Apple were to sustain >20% services growth and low-single-digit hardware growth, earnings visibility would remain relatively strong even if macro volatility rises. However, none of these outcomes are assured and they depend on both execution and the broader economic environment.

To balance the picture, we highlight several key risks:

Overall, we see Apple’s move to record highs as the product of stronger iPhone data, record services revenue, a more credible and capital-efficient AI strategy, and powerful passive flows, set against a backdrop of meaningful valuation and execution risks. How the balance between these forces evolves will determine whether the current re-rating proves durable.