Quarterly Outlook

Q1 Outlook for Traders: Five Big Questions and Three Grey Swans.

John J. Hardy

Global Head of Macro Strategy

Chief Investment Strategist

Markets don’t reward the same exposures every quarter. Multi-asset investing is less about chasing returns and more about building a portfolio that can behave through different regimes, especially when drawdowns test decision-making.

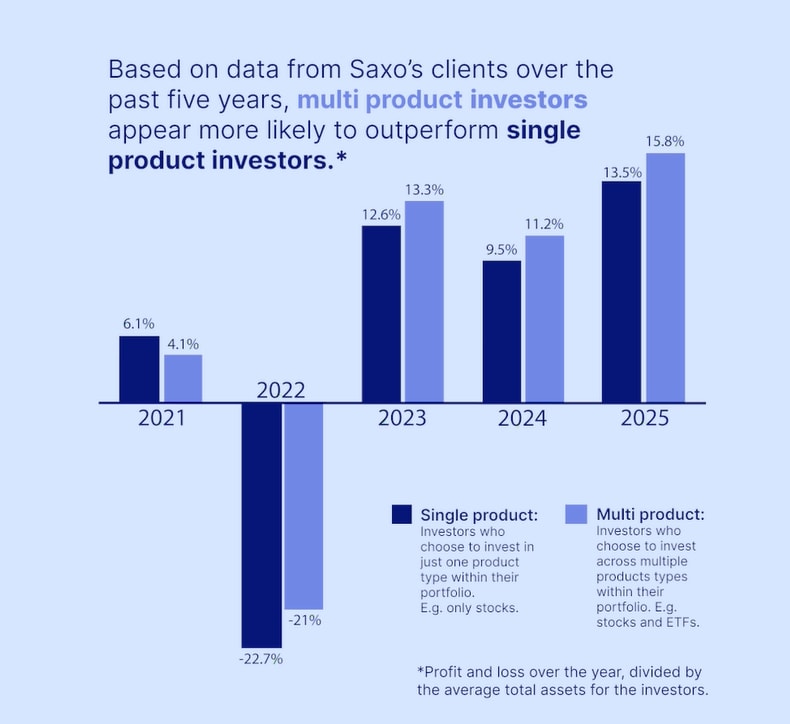

Looking at aggregated Saxo client activity over the past five years, clients who used more than one product type were more likely to have higher profitability outcomes than clients who only used one (for example, stocks only).

Note: Past performance is not indicative of future results.

Source: Saxo client data

This is an association, not proof that using multiple products causes better results. Clients who use more instruments may differ in experience, risk management, time horizon, trading frequency, and costs—each of which can influence outcomes.

The practical takeaway is simpler: having more than one tool can give investors more ways to respond to changing market regimes—and may reduce the odds that one “single story” dominates results.

1) A smoother ride can improve behaviour

When outcomes are less dominated by one market move, investors are often less likely to panic-sell, overreact, or abandon a plan after a drawdown.

2) Different environments reward different exposures

Stocks don’t lead every quarter. Adding other building blocks (like bonds or commodities) can help when leadership rotates.

3) Less hidden concentration

“Stocks-only” portfolios often drift into concentrated bets (a few mega-caps, one sector, one region). Adding another product type can reduce single-story risk.

4) More consistent habits

ETFs and recurring contributions can encourage steadier investing behaviour. These are often more important than perfect timing.

Myth 1: “Diversification means lower returns.”

Diversification can reduce extremes, both on the highs and lows. For many investors, the bigger benefit is avoiding deep drawdowns and the bad timing decisions they often trigger.

Myth 2: “ETFs are just beginner products.”

ETFs are simply a wrapper. They can express broad markets, quality, dividends, sectors, regions, or themes – all without relying on single-stock outcomes.

Myth 3: “Bonds don’t matter anymore.”

Bonds are less about excitement and more about ballast. They may help cushion equity volatility and provide liquidity when markets are stressed.

Myth 4: “Commodities are only for traders.”

Commodities can be volatile, but they can also diversify portfolios in certain regimes (inflation surprises, supply shocks) when stocks and bonds become correlated.

Myth 5: “Options are leverage.”

Some options strategies are highly leveraged. But collateralised strategies like covered calls and cash-secured puts are often used by long-term investors as portfolio tools (still risky, but not the same as naked options).

A broader toolkit doesn’t have to mean a full rebuild. The examples below are educational illustrations of how investors sometimes introduce a second return driver or a shock absorber. They’re not investment advice and may not be suitable for everyone.

What it does: ETFs can reduce reliance on a handful of stocks by spreading exposure across more companies, sectors, or regions—while still keeping equity exposure.

Simple ways to start (illustrative):

Reality check: ETFs still carry market risk and can fall materially in a broad selloff.

2) Bonds (potential shock absorber / liquidity sleeve)

What it does: Bonds are often used as ballast and liquidity—particularly when equity volatility rises.

Simple ways to start (illustrative):

Reality check: Bonds can lose money (especially longer duration) and may not hedge equities in every regime.

What it does: Commodities can diversify portfolios in certain macro environments, such as inflation surprises or supply shocks.

Simple ways to start (illustrative):

Reality check: Commodities can be highly volatile and may not provide protection when you most want it.

Some investors use collateralised option structures to introduce rules—often around income discipline or entry discipline. These strategies still carry meaningful risk and are not suitable for all investors.

Two examples (for information only):

A) Covered call (income-focused)

B) Cash-secured put (entry-focused)

Reality check: Options involve risk and are not suitable for all investors. Covered calls and cash-secured puts can still result in losses, missed upside, early assignment, and outcomes comparable to holding (or being obligated to buy) the underlying shares.

The big takeaway from Saxo’s own client data is simple: portfolios with more than one way to work may be more resilient, and resilience often supports better outcomes.

If you’re stocks-only, you don’t need a complicated overhaul. Common examples investors sometimes explore include: start with an ETF, consider bonds, include a small real-asset diversifier, or use ETO in a simple collateralised way to add structure.