1,500,000+ clients

across 13 countries

Your asset management portfolio is highly personalised; no standard performance indicator can show you exactly how it will perform.

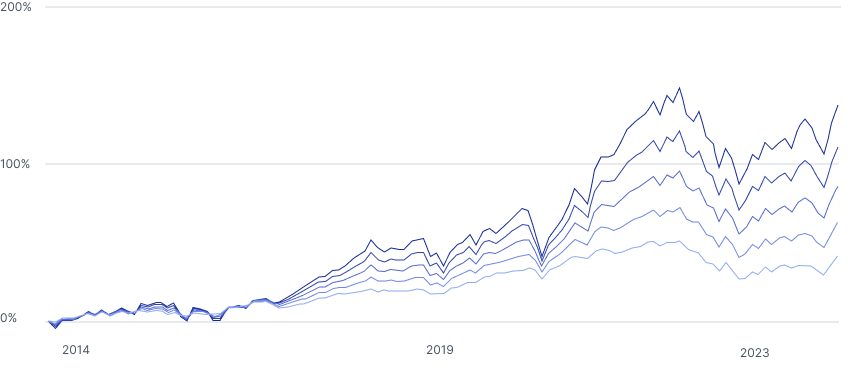

However, to give you an idea, we've mapped the 10-year returns for a simplified version of an example asset management portfolio across 5 risk profiles.

Annualised returns (10y) for different risk profiles

Very dynamic +9.00%A product fee (est. 0.05%-0.43% per year) levied by the fund managers is already included in the market price of the ETFs which make up your portfolio.

Apply and open your Saxo account in minutes.

Complete a short questionnaire to establish your goals, risk tolerance and investment timeline.

Let our SaxoWealthCare experts build and manage your personalised investment portfolio. Just check in when you want and update if needed.

SaxoWealthCare is a personalised investment portfolio that helps investors effortlessly grow their wealth and achieve their financial aspirations. The portfolios are managed by a world-class team of investment experts who are trusted by 30,000 clients worldwide and who already oversee more than EUR 1 billion in client assets.

Whether you're a seasoned investor or just starting out, SaxoWealthCare can help you simplify your long-term investment process by building, monitoring and adjusting your tailor-made portfolio.

If you have investment goals, SaxoWealthCare can help you achieve these goals more easily with the goal-based investing premium feature. Around 85% of clients who set goals in SaxoWealthCare are currently on track to meet them.

This is the plan we create based on your input about financial goals (buying a house in five years, retiring two years early etc.), how much money you want to invest, what type of 'equity style' you'd like to invest in, and how much risk you’re willing to take. We turn all these variables into a plan proposal we make for you. If you approve it, we build the corresponding investment portfolio mix and start investing your money.

The top reason to diversify your portfolio is to help spread your risk across different assets, sectors, industries or regions. Different asset classes will react differently as financial markets move up or down, so diversifying means your total investment doesn’t rely too heavily on any one thing.

For example, typically when stocks prices go up, bond prices go down. Investing in both stocks and bonds means you’ll experience lower volatility (fewer ups and downs) which is more suitable for long-term, passive investors.

Diversification is an important part of any risk management strategy that can help you protect your investments and make progress toward your goals. SaxoWealthCare offers diversified portfolios that help you achieve optimal investment returns based on your level of risk tolerance.

Saxo Capital Markets manages the portfolio allocation (the division between stocks and bonds ETFs), which is updated automatically on your behalf based on your investment preferences and market movements. The underlying ETFs that your portfolio is made up of are managed by industry leading asset managers.

Still have questions? Visit our support centre Request a call