Margin information

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: the amount of margin required to open a new position.

- Maintenance margin: the amount of margin required to maintain an open position.

Read more about Initial and Maintenance margin here.

To find FX margin information, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Margin requirements differ by currency pair and depend on the exposure in the currency pair. Margin requirements may be subject to regulatory mandated minimums and may be subject to change according to the underlying liquidity and volatility of the currency pair. For this reason, the most liquid currency pairs (the majors) in most cases require a lower margin requirement.

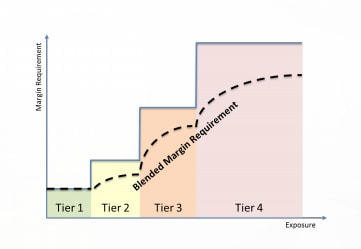

Saxo offers tiered margin methodology as a mechanism to manage political and economic events that may lead to the market becoming volatile and changing rapidly. With tiered margin, the average margin requirement (‘Blended Margin Requirement’) increases with the level of exposure. The opposite is also true; as the level of exposure decreases the margin requirement also decreases. This concept is illustrated below:

The different levels of exposure (or tiers) are defined as an absolute number of U.S. Dollars (USD) across all currency pairs. Each currency pair has a specific margin requirement in each tier.

Please note that margin requirements may be changed without prior notice. Saxo reserves the right to increase margin requirements for large position sizes, including client portfolios considered to be of high risk.

By default retail margins will apply. Retail clients can apply to opt-up to Eligible Professional Client status. Margin rates for elective professional clients differ from retail clients. You can find more information about margin rates and eligibility criteria here.

To get an overview of the margin information for elective professionals please click here.

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

Read more about Initial and Maintenance margin here.

The margin requirement on FX options is calculated per currency pair, (ensuring alignment with the concept of tiered margins as per FX spot and forwards) and per maturity date. In each currency pair, there is an upper limitation to the margin requirement that is the highest potential exposure across the FX options and FX spot and forward positions, multiplied by the prevailing spot margin requirement. This calculation also takes into account potential netting between FX options and FX spot and forward positions.

On limited risk strategies, e.g. a short call spread, the margin requirement on an FX options portfolio is calculated as the maximum future loss.

On unlimited risk strategies, e.g. naked short options, the margin requirement is calculated as the notional amount multiplied by the prevailing spot margin requirement.

Tiered margin rates are applicable to the FX options margin calculation when a client's margin requirement is driven by the prevailing FX spot margin requirement, and not the maximum future loss. The prevailing FX spot margin levels are tiered based on USD notional amounts; the higher the notional amount potentially the higher the margin rate. The tiered margin requirement is calculated per currency pair. In the FX options margin calculation, the prevailing spot margin requirement in each currency pair is the tiered, or blended, margin rate determined on the basis of the highest potential exposure across the FX options and FX spot and forward positions.

Example 1: Short Call Spread or Limited Risk strategy

You sell a call spread on 10M USDCAD at strikes 1.41 and 1.42.

The current spot rate is 1.40.

The margin requirement will be the maximum future loss of 71,429 USD (10M x (1.42 – 1.41) = 100,000 CAD / USD @ 1.40).

Example 2: Unlimited Downside Risk

You sell a 10M USDCAD put option. You have an unlimited downside risk. The margin requirement is therefore calculated as the notional amount multiplied by the prevailing spot margin requirement.

The prevailing spot margin rate is determined by the highest potential exposure, which is 10M USD.

Thus, the prevailing spot rate is the blended margin rate of 2.2% ((1% x 3M USD + 2% x 2M USD + 3% x 5M USD) / 10M).

The margin requirement is therefore 220,000 USD (2.2% x 10M USD).

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

Read more about Initial and Maintenance margin here.

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

The initial and maintenance margin of a single stock CFD is based on the stock rating. Saxo defines 6 different stock ratings. This rating is derived from the market capitalization, liquidity and volatility of the underlying asset.

| Saxo Rating | Initial Margin | Maintenance Margin |

|---|---|---|

| 1 | 20% | 10% |

| 2 | 20% | 15% |

| 3 | 25% | 20% |

| 4 | 35% | 30% |

| 5 | 55% | 50% |

| 6 | 110% | 100% |

To find the rating and collateral value, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

An Index CFD with an initial margin of 5% can be traded at 20:1 leverage.

Index CFDs margins (normal market conditions)

| Index Tracker | Initial Margin | Maintenance Margin | |

|---|---|---|---|

| US 30 Wall Street | 5% | 2.5% | |

| US 500 | 5% | 2.5% | |

| US Tech 100 NAS | 5% | 2.5% |

| Denmark 25 | 10% | 5% | |

| EU Stocks 50 | 5% | 2.5% | |

| France 40 | 5% | 2.5% | |

| Germany 40 | 5% | 2.5% | |

| Germany Mid-Cap 50 | 10% | 5% | |

| Germany Tech 30 | 10% | 5% | |

| Netherlands 25 | 10% | 5% | |

| Norway 25 | 10% | 5% | |

| Spain 35 | 10% | 5% | |

| Sweden 30 | 10% | 5% | |

| Switzerland 20 | 10% | 5% |

| Australia 200 | 5% | 2.5% | |

| Hong Kong | 10% | 5% |

Index CFDs contract details (expiring)

| Index Tracker | Initial Margin | Maintenance Margin | |

|---|---|---|---|

| China 50 | 10% | 5% | |

| UK 100 | 5% | 2.5% | |

| UK Mid 250 | 10% | 5% | |

| Singapore | 10% | 5% | |

| Taiwan | 10% | 5% | |

| US2000 | 10% | 5% | |

| Japan 225 | 5% | 4.5% | |

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

A Forex CFD with an initial margin of 3.33% can be traded at 30:1 leverage.

| Instrument Name | Symbol | Initial Margin | Maintenance Margin |

|---|---|---|---|

| CURRENCIES | |||

| Euro / US Dollar | EURUSDEC | 3.33% | 1.66% |

| Euro / Japanese Yen | EURJPYRY | 3.33% | 1.66% |

| Euro / Swiss Franc | EURCHFRF | 3.33% | 1.66% |

| Euro / British Pound | EURGBPRP | 3.33% | 1.66% |

| British Pound / US Dollar | GBPUSDBP | 3.33% | 1.66% |

| Australian Dollar / US Dollar | AUDUSDAD | 3.33% | 1.66% |

| USD Index | USDINDEX | 20% | 10% |

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

A Commodity CFD with an initial margin of 10% can be traded at 10:1 leverage.

| Instrument Name | Symbol | Initial Margin | Maintenance Margin |

|---|---|---|---|

METALS | |||

| Gold | GOLD | 5% | 2.5% |

| Silver | SILVER | 10% | 5% |

| Platinum | PLATINUM | 10% | 5% |

| Palladium | PALLADIUM | 10% | 5% |

| US Copper | COPPERUS | 10% | 5% |

ENERGY | |||

| US Crude | OILUS | 10% | 5% |

| UK Crude | OILUK | 10% | 5% |

| Heating Oil | HEATINGOIL | 10% | 5% |

| Gasoline US | GASOLINEUS | 10% | 5% |

| Gas Oil | GASOILUK | 10% | 5% |

| US Natural Gas | NATGAS | 10% | 5% |

| CO2 Emissions | EMISSIONS | 10% | 5% |

AGRICULTURE | |||

| Corn | CORN | 10% | 5% |

| Wheat | WHEAT | 10% | 5% |

| Soybeans | SOYBEANS | 10% | 5% |

SOFTS | |||

| NY Sugar No. 11 | SUGARNY | 10% | 5% |

| NY Coffee | COFFEE | 10% | 5% |

| NY Cocoa | COCOA | 10% | 5% |

MEATS | |||

| Live Cattle | LIVECATTLE | 10% | 5% |

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

A Bond CFD with an initial margin of 10% can be traded at 10:1 leverage.

| Initial Margin | Maintenance Margin | Product/Instrument |

|---|---|---|

| 20% | 10% | German Government 5 year Bobl German Government 2 year Schatz |

| 20% | 10% | German Government 10 year Bund |

| 20% | 10% | French Government 10 year OAT |

| 20% | 10% | Italian Government 10 year BTP |

By default retail margins will apply. As a client regulated under ESMA (European Securities and Markets Authority) and based on a specific set of eligibility criteria you can apply to reclassify as an elective professional. Margin rates for elective professional clients differ from retail clients. You can find more information about margin rates and eligibility criteria here.

To get an overview of the margin information for elective professionals please click here.

The margin requirement applicable to opening and maintaining a margin position consists of two elements:

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

Read more about Initial and Maintenance margin here.

To find the rating and collateral value, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Saxo operates two client margin profiles related to trading listed options1:

- Basic profile: the client can buy (hold) listed options

- Advanced profile: the client can buy (hold) and sell (write) listed options. The client will receive margin benefits when trading an option strategy and/or a portfolio of listed products, i.e. a combination of listed options and/or underlying instruments.

The client is set up on the basic profile by default, and therefore is not able to sell (write) listed options. Writing listed options requires the client fulfil the following requirements, in order to activate the advanced profile.

- The client must have a minimum account value of 5,000 USD, or equivalent

- The client must provide written acknowledgement of the risks involved with short selling (writing) options

| Strategy | Initial & maintenance margin |

|---|---|

Long straddle | None |

| Out-of-the-money naked calls | Stock OptionsCall Price + Maximum((X%* Underlying Price) - Out of the Money Amount), (Y% * Underlying Price)) Out-of-the-Money Amount in case of a Call option equals: Max (0, Option Strike Price - Underlying Price) Example: Short 1 DTE jan14 12.50 Call at 0.08 Underlying price at 12.30

|

| Uncovered put write | Stock OptionsPut Price + Maximum((X%* Underlying Price) - Out of the Money Amount), (Y% * Strike Price)) Example: Short 1 DTE Jan14 12 Put at 0.06 Underlying price at 12.30

|

| Bull Call Spread | Maximum ((Strike Long Call - Strike Short Call), 0) Example: Long DTE Jan14 12.5 Call at 0.10 and short DTE Jan14 13.5 Call at 0.02

|

Bull Put Spread | (Strike Short Put - Strike Long Put) – (Short Put price – Long Put price) Example: Short DTE Jan14 Put 12 Put at 0.08 and long DTE Jan14 11 Put at 0.02

|

Short straddle | If Initial Margin Short Put > Initial Short Call, then |

Short option positions in American Style Options can be combined with long option positions or covering positions in the underlying deliverable to offset the high risk exposure. As such, the margin charges can be reduced or even waived. We will provide margin reduction on the following position combinations:

- Covered Call

- Call/Put Spread

- Short Straddle

Covered Call

A short call position can be offset with a long position in the underlying stock.

Call / Put Spread

A spread position allows a long option position to cover for a short option position of an option of the same type, and same underlying deliverable. When the long option is deeper in the money compared to the short option (debit spread), the value of the long option is used up to the value of the short option for coverage with no additional margin to be required.

When the short leg is deeper in the money compared to the long leg (credit spread), the full value of the long option is used for coverage plus an additional margin equal to the strike difference.

Note: To trade out of a spread position, it is recommended to first close the short leg before closing the long leg to avoid the high margin charge of the naked short option position. However, as the spread margin reservation might not be sufficient to cover the cash amount required to buy back the short option position, a client might find himself locked into a position that he cannot trade out of without additional funds being made available.

Short Straddle / Strangle

The short straddle / strangle rule is different compared to the Covered and Spread rules as the legs of the short straddle do not provide coverage for each other. A short straddle / strangle combines a short call with a short put. Since the exposure of the short call and short put are opposite in regard to market direction, only the additional margin of the leg with the highest margin charge is required.

When the call leg of the strangle position is assigned, the client needs to deliver the underlying stock. Vice versa, when the put is assigned, the client needs to take delivery of the underlying Stock. The long Stock can be combined with the remaining call leg of the original strangle, resulting in a covered call.

For certain instruments, including Stock Options, we require a margin charge to cover potential losses involved on holding a position in the instrument. Stock Options are treated as full premium style options.

Full premium example:

When acquiring a long position in a full premium option, the premium amount is deducted from the client’s cash balance. The value from an open long option position will not be available for margin trading other than indicated in the margin reduction schemes.

In the following example, a client buys one Apple Inc. DEC 2013 530 Call @ $25 (Apple Inc. stock is trading at $529.85. One option equal 100 shares, buy/sell commissions $6.00 per lot and exchange fee is $0.30. With a cash balance of $10,000.00, his account summary will show:

| Cash and Position Summary | ||

|---|---|---|

| Position Value | 1 * 25 * 100 shares = | $2,500.00 |

| Unrealized Profit/Loss | -- | |

| Cost to Close | - 1* ($6 + $0.30) = | - $6.30 |

| Unrealised Value of Positions | $2,493.70 | |

| Cash Balance | $10,000.00 | |

| Transactions not Booked | - ($2,500 + $6.30) = | - $2,506.30 |

| Account Value | $9,987.40 | |

| Not Available as Margin Collateral | - 1 * 25 * 100 shares = | - $2,500.00 |

| Used for Margin Requirement | -- | |

| Available for Margin Trading | $7,487.40 | |

In case of a full premium option, the transactions not booked will be added to the client’s cash balance in overnight processing. The next day, when the options market has moved to $41 (spot at 556.50), the account summary will show:

| Cash and Position Summary | ||

|---|---|---|

| Position Value | 1 * 41 * 100 shares = | $4,100.00 |

| Unrealised Profit/Loss | -- | |

| Cost to Close | - 1*($6+$0.30) = | -$6.30 |

| Unrealised Value of Positions | $4,093.70 | |

| Cash Balance | $7,493.70 | |

| Transactions not Booked | -- | |

| Account Value | $11,587.40 | |

| Not Available as Margin Collateral | - 1 * 41 * 100 shares = | -$4,100.00 |

| Used for Margin Requirement | -- | |

| Available for Margin Trading | $7,487.40 | |

Position Value: Increased due to the price of the option being higher.

Unrealised Value of Positions: Increased due to the price of the option being higher.

Cash Balance: Reduced by the price of the option. ‘Transactions not Booked’ is now zero.

Account Value: Increased due to the price of the option being higher.

Not Available as Margin Collateral: Increased due to the new value of the position.

Short Option Margin

A short option position exposes the holder of that position to being assigned to deliver the underlying proceeds when another market participant who holds a long position exercises his option right. Losses on a short option position can be substantial when the market moves against the position. We will therefore charge premium margin to ensure that sufficient account value is available to close the short position and additional margin to cover overnight shifts in the underlying value. The margin charges are monitored in real-time for changes in market values and a stop out can be triggered when the total margin charge for all margined positions exceeds the client’s margin call profile.

The generic formula for the short option margin charge is:

- Short Option Margin = Premium Margin + Additional Margin

The premium margin ensures that the short option position can be closed at current market prices and equals the current Ask Price at which the option can be acquired during trading hours. The additional margin serves to cover overnight price changes in the underlying value when the option position cannot be closed because of limited trading hours.

Stock Options

For options on Stocks, the additional margin equals a percentage of the underlying reference value minus a discount for the amount that the option is out-of-the-money.

- Additional Margin Call = Max (X% * Underlying Spot) – Out-of-the-Money Amount, Y% * Underlying Spot)

- Additional Margin Put = Max (X% * Underlying Spot) – Out-of-the-Money Amount, Y% * Strike Price)

The margin percentages are set by Saxo and are subject to change. The actual values can vary per option contract and are configurable in the margin profiles. Clients can see the applicable values in the trading conditions of the contract.

The out-of-the-money amount for a call option equals:

- Max (0, Option Strike – Underlying Spot)

The out-of-the-money amount for a put option equals:

- Max (0, Underlying Spot Price – Option Strike)

To get the currency amount involved, the acquired values need to be multiplied with the trading unit (100 shares).

Example:Let’s suppose FORM applied an X margin of 15% and a Y margin of 10% on Apple stocks.

A Client shorts an Apple DEC 2013 535 Call at $1.90 (Apple stock at 523.74). The option figure value is 100 shares. The OTM amount is 11.26 stock points (535 – 523.74), resulting in an additional margin of 67.30 stock points ($6,730). In the account summary, the premium margin is taken out of the position value:

| Cash and Position Summary | ||

|---|---|---|

| Position Value | - 1 * $1.90 * 100 shares = | - $190.00 |

| Unrealized Profit/Loss | -- | |

| Cost to Close | - (6 + $0.30) = | - $6.30 |

| Unrealized Value of Positions | - $196.30 | |

| Cash Balance | $10,000.00 | |

| Transactions not Booked | $190 - ($6 + $0.30) = | $183.70 |

| Account Value | $9,987.40 | |

| Not Available as Margin Collateral | -- | |

| Used for Margin Requirement | - 100 shares *( (0.15 * 523.74) – 11.26) | - $6,730.00 |

| Available for Margin Trading | $3,257.40 | |

The option seller (writer) is obliged to sell (in the case of a call) or buy (in the case of a put) the underlying instrument to (or from) the option buyer (holder) at the specified price upon the buyers’ request.

A short option position may lead to extensive losses if the market moves against the position. Saxo charge a premium to ensure that the client account has sufficient funds available to close the short option position, and an additional margin to cover any overnight price changes in the value of the underlying instrument.

The generic formula for the short option margin charge is: Short option margin = Premium margin + Additional margin.

The margin requirement is monitored in real-time. If the client losses exceed the margin utilisation, automatic margin close-out may occur, meaning that Saxo will seek to immediately terminate, cancel and close-out all or part of any open positions.

Trading on margin carries a high level of risk that may lead to extensive losses exceeding the cash and/or approved collateral held on the client account.

Trading on margin is not suitable for everyone. Please ensure that the risks involved are fully understood and seek independent advice if necessary.

Collateral rates for margin trading

(Professional clients only)

Saxo allows a percentage of the investment in certain Stocks and ETFs to be used as collateral for margin trading activities. The collateral value of a stock or ETF position depends on the rating of the individual stocks or ETFs – please see conversion table below.

| Rating | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Collateral value of position | 75% | 50% | 50% | 25% | 0% | 0% |

Example: 75% of the value of a position in a Stock or ETF with Rating 1 can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs, Futures and Options. Please note that Saxo reserves the right to decrease or remove the use of Stock or ETF investment as collateral for large position sizes, or stock portfolios considered to be of very high risk.

To find the rating and collateral value, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Saxo allows Professional clients to use a percentage of certain bond investments as collateral for margin trading activities.

The collateral value of a bond position depends on the rating of the individual bond, as outlined below:

| Rating definition* | Collateral percentage |

|---|---|

| Highest Rating (AAA) | 95% |

| Very High Quality (AA) | 90% |

| High Quality (A) | 80% |

Example: 80% of the market value of a bond position with an A rating can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs or Futures and Options.

Please note that Saxo Group reserves the right to decrease or remove the use of bond positions as collateral.

For further guidance or to request the rating and collateral treatment of a specific or potential bond position, please send an email to fixedincome@saxobank.com or contact your account executive.

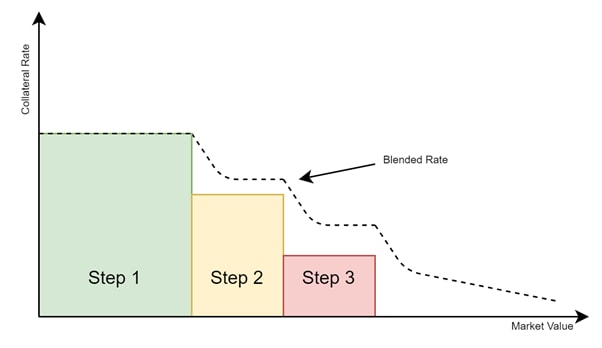

Collateral rates differ by instrument and depend on the market value of the given instruments. Collateral tiers may be subject to regulatory mandated maximums and may be subject to change according to the underlying liquidity and volatility of the instrument. For this reason, the most liquid instruments in most cases provide higher collateral rates.

Saxo offers the tiered collateral methodology as a mechanism to manage gap and liquidity risk. With tiered collateral, the average collateral rate (‘Blended collateral rate’) decreases with the market value of the instrument. The opposite is also true; as the market value of the instrument decreases the average collateral rate increases. This concept is illustrated below:

The different market values (or tiers) are defined as an absolute number of U.S. Dollars. (USD) across all instruments. Each instrument has a specific collateral rate in each tier.

Please note that the collateral rate may be changed without prior notice.

Saxo reserves the right to reduce the collateral rate for large positions sizes, including client portfolios considered to be of high risk.