Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

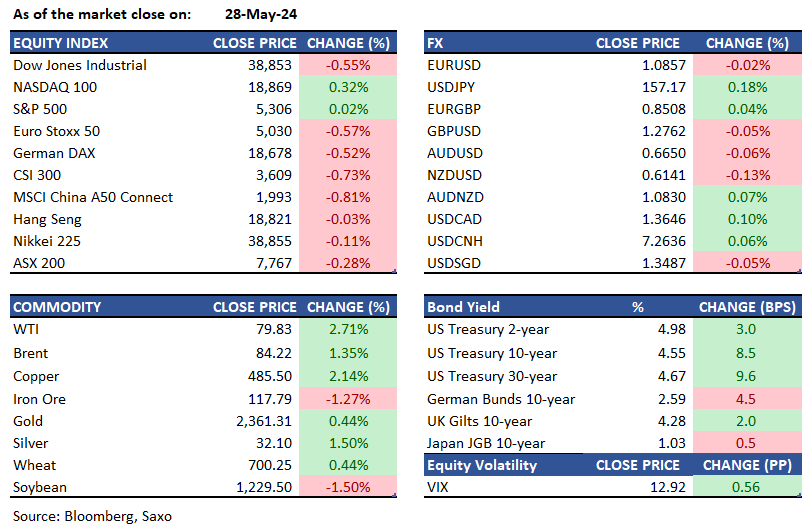

Equities: US stocks experienced minor fluctuations on Tuesday, with investors closely monitoring a week full of economic data to gain insights into inflation trends and the Federal Reserve's approach to monetary policy. The S&P 500 showed minimal movement, while the Nasdaq Composite achieved a historic milestone by closing above 17,000 for the first time. Nvidia Corp. reached a new record high, and the VIX Index, which measures stock-market volatility, remained subdued. Conversely, the S&P 500 Equal Weighted Index saw a notable decline of 0.7%. Hong Kong and Sydney equity benchmark futures pointed to a lower opening, while futures for Tokyo indicated a modest increase.

FX: The US dollar reversed its early losses to close nearly flat as hawkish vibes continued from US data and Fedspeak, as we had highlighted in our Weekly FX note. Higher yields on the back of hot consumer confidence and weak 2-year and 5-year Treasury auctions boosted USDJPY to rise to 157.30. Meanwhile, CHF outperformed, with USDCHF down to sub-0.9090 before higher yields brought the pair back to 0.9120+. AUDUSD was back below 0.6650 from highs of 0.6680 earlier in the session, and April CPI today is expected to ease to 3.4% YoY from 3.5% in March but that is unlikely to be reason enough for RBA to consider rate cuts. EURUSD saw sharp gains to 1.0890 earlier but reversed back to 1.0850 subsequently and Germany CPI will be on the radar today. GBPUSD also unable to break above 1.28.

Commodities: Gold rose by 0.44% to $2,361, with the increase being attributed to dip buying, central bank diversification, and a decline in the value of the Dollar. Silver surged by 1.5% to surpass $32, maintaining its outperformance compared to benchmark gold prices, driven by the favorable macroeconomic conditions for precious metals and increased physical silver purchasing for industrial applications. WTI crude futures also had a strong session, rising by 2.71% to over $79, while Brent enjoyed its third consecutive day of gains, increasing by 1.35% to $84.22. Some of the WTI gains were due to catch-up buying in response to Brent's gains the previous day. The market was also supported by a slightly weaker Dollar, trader speculation about OPEC+ extending current production quotas at the upcoming meeting, ongoing geopolitical factors, and expectations for a strong summer driving and travel season. Cocoa futures rose 5.98% and Coffee futures jumped 5.18%.

Fixed income: The yield on the US 10-year Treasury note rose by nearly 10 basis points to 4.54% following a selloff triggered by disappointing results from the 5-year and 2-year auctions. The US sold $70 billion of five-year notes at 4.553%, slightly above the pre-auction level. An earlier offering of $69 billion in two-year notes also saw weak demand. Prior to the auctions, bond prices were already under pressure due to unexpected growth in US consumer confidence in May, which reduced expectations of interest rate cuts. Additionally, investors considered comments from Minneapolis Federal Reserve President Neel Kashkari, who acknowledged that the current policy stance is restrictive but indicated that officials have not ruled out the possibility of further rate hikes.

Macro:

Macro events: Australian CPI (Apr), German Flash CPI (May), US Richmond Fed (May), South African Election, Fed’s Beige Book. Speakers: Fed’s Bostic

Earnings: Abercrombie & Fitch, Chewy, Dick’s Sporting Goods, Advance Auto Parts, Nordic American Tankers, Bank of Montreal, CollPlant, Columbus McKinnon, Mediwound, Allott, Salesforce, C3.ai, UiPath, Okta, Nutanix, Purestorage, HP, Agilent Technologies, American Eagle Outfitters, AMSC

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.