Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US ADP National Employment (Sep), EZ Unemployment Rate (Sep), Mainland China market holiday

Earnings: RPM, Conagra, Levi’s

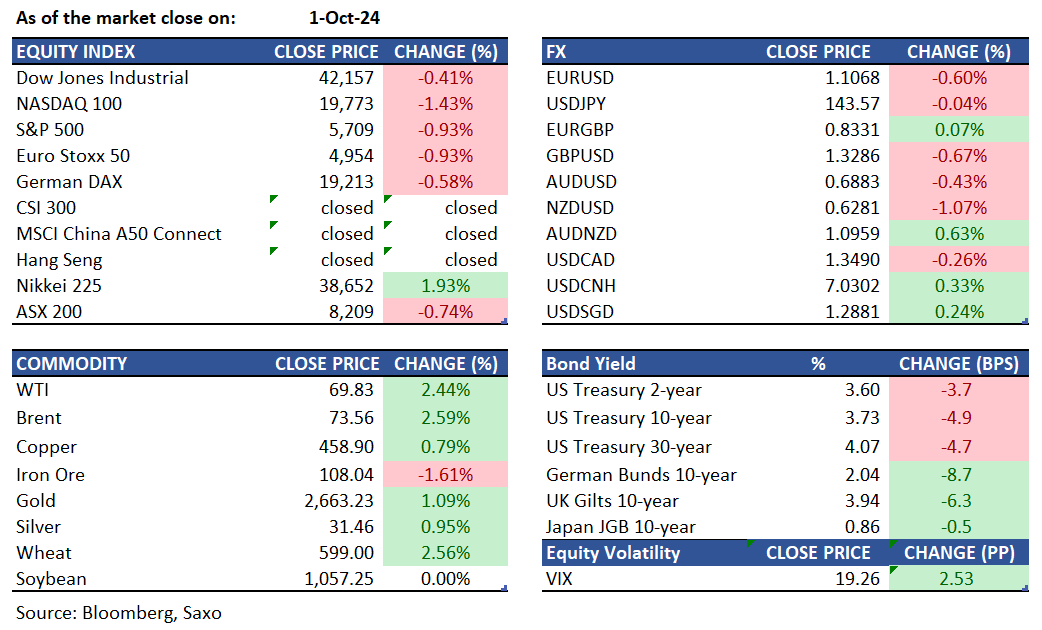

Equities: U.S. stocks fell on Tuesday afternoon due to Iran's missile strikes against Israel and various economic reports. The S&P 500 dropped 0.9%, the Nasdaq 100 fell 1.5%, and the Dow was down 0.4%. Iran's attack was in response to Israel's invasion of southern Lebanon, raising regional tensions. On the economic front, job openings in August unexpectedly increased to 8.04 million from 7.71 million in July, indicating a slow cooling of the labor market. U.S. manufacturing activity remained unchanged in September, with the ISM manufacturing PMI steady at 47.2, showing continued contraction. Investors are also watching Federal Reserve policy, as Chair Jerome Powell indicated no immediate plans to cut interest rates. Tech stocks were hit hardest, with Apple and Nvidia both dropping more than 3%.

Fixed income: Treasuries rose spurred by broad gains in European rates after euro-area inflation fell below the European Central Bank’s 2% target for the first time since 2021. The rally continued due to safe-haven demand amid escalating Middle East tensions. However, gains were slightly reversed during a quiet US afternoon session after Israel reported intercepting numerous Iranian missiles without causing any known injuries. Despite this, Treasury yields ended the session richer by 2.5 to 4.5 basis points across the curve, with intermediates and the long end slightly outperforming the front end. US 10-year yields closed around 3.74%, richer by 4 basis points on the day, after dipping to as low as 3.694% at the peak of the risk-off rally. Most of the gains in Treasuries occurred after a senior White House official indicated that Iran was preparing to imminently launch a ballistic missile attack against Israel. Futures volumes surged to their highest of the day amid the safe-haven bid, as WTI futures reached session highs.

Commodities: WTI crude oil futures increased by 2.44% to over $69.83, and Brent Crude futures climbed 2.59% to $73.56 following Iran's missile attack on Israel, which has raised concerns about a wider regional conflict in the Middle East. Israel's Defense Forces intercepted many of the missiles and reported no immediate aerial threats from Iran, allowing civilians to leave shelters. The conflict has intensified, with Israel escalating airstrikes on Hezbollah, resulting in the death of its leader, Hassan Nasrallah. Additionally, Israel has deployed ground forces into southern Lebanon. The oil market's reaction will largely depend on the extent and impact of any further Iranian attacks, which could influence Israel's response and further destabilize the region. Previously, oil prices were lower due to concerns about oversupply after Libya announced plans to resume oil production, which had been halted since late August following an agreement on a new central bank head. In response to the rising tensions, gold prices increased by 1.09% to over $2,660, and silver prices rose by 0.95% to $31.46, driven by safe-haven demand.

FX: The US dollar saw steady gains overnight on the back of Fed Chair Powell’s pushback to market expectations of the rate cuts, but the greenback also got a safe-haven bid as Mideast tensions rose. Only the Canadian dollar rose against the US dollar amid a jump higher in oil prices, while safe havens like Japanese yen and Swiss franc remained resilient but did not gain considerably. Activity currencies were at the bottom of the performance table, with kiwi dollar down over 1% as expectations of a large rate cuts from the Reserve Bank of New Zealand increased amid falling GDP and a cooling jobs market. The euro was back below 1.11 against the US dollar, and sterling back below 1.33, amid flaring geopolitical tensions. The former was also pressured by softening Euro-area inflation which cemented expectations of an ECB rate cut in October.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.