Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Global Macro Strategist

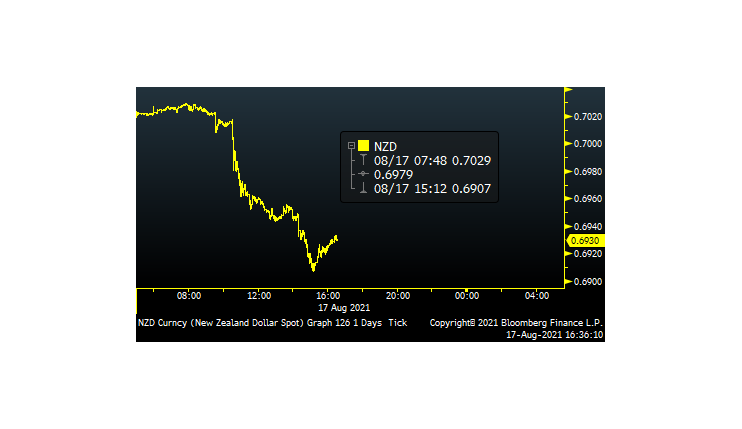

Summary: This Macro Dragon Strike piece was sent yest, yet still very pivotal given RBNZ expected rate hike decision to 0.50% from 0.25%, which would make them the first G10 central bank to hike. For a lot of currency traders its been a tough year, and being long kiwi crosses looked (until the Covid case & shutdown news on Tue) like one of the few signals in an ocean of noise. We could be in for some binary moves in NZDUSD, NZDJPY & AUDNZD based on both RBNZ decision, outlook & of course NZ government on the covid front.

-

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP