Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

The addition of China A shares is symbolic of China’s increased liberalisation of financial markets and represents a new era where China is a true player in global markets as institutional investors globally gain confidence in China’s markets

On June 20, 2017 MSCI announced the partial inclusion of China A shares in the MSCI China Index, the MSCI Emerging Markets Index and the MSCI ACWI Index. The MSCI Emerging Markets benchmark is tracked by $12 trillion of institutional funds globally, predominantly through passive allocation. This is highly representative of China finally obtaining the long desired global recognition of their financial markets.

MSCI's inclusion of more than 230 mainland China A-shares welcomes China to the world stage. The addition will significantly increase global investment into mainland Chinese equities as passive inflows of up to $6 billion could be seen purely from portfolio adjustments to avoid deviations from the MSCI EM benchmark index.

Furthermore, the active allocation should generate far greater inflows – these are likely to be in excess of $20 billion as institutional investors will have more confidence in the mainland equity market which is growing approximately twice as fast as that of the US.

In fact, the Shanghai and Shenzhen Stock Connect flows show the last three consecutive trading days haveseen a net inflow into the A-shares of approximately $342.9 million daily.

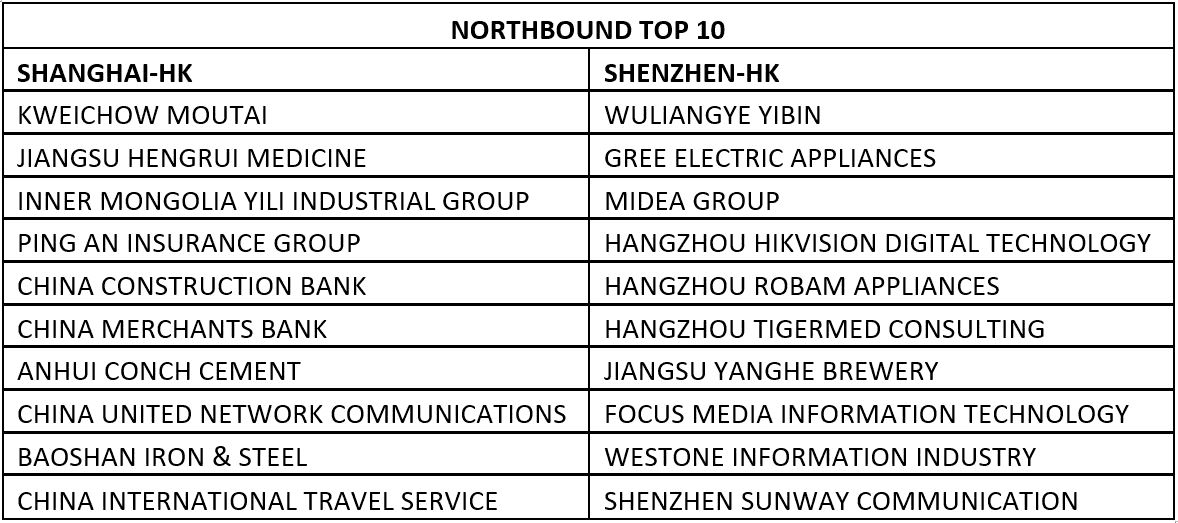

Throughout April 2018, Northbound flow was the highest since Stock Connect's inception, and this could be attributed to foreign investors ramping up purchases of Chinese stocks before the upcoming MSCI inclusion. Among the top stocks traded Northbound are liquor giant Kweichow Moutai, Ping An Insurance, and Gree Electric Appliances.

Northbound flows

The chart below tracks quarterly net Northbound flows from Hong Kong to China through the Stock Connect and illustrates that since the June 2017 announcement to include A shares in MSCI EM index quarterly net flows have been singularly positive, a stark indicator of the volume of fund inflows to the mainland markets.

According to data disclosed by MSCI in March 2018, the constituent stocks have been adjusted to 235 (subsequently reduced to 234). Based on the 5% Index Inclusion Factor (IIF), these A-shares will account for approximately 0.73% of the MSCI Emerging Markets Index. The final list of constituents for the MSCI China Index post the inclusion of Chinese A-shares was announced on May 14, 2018.

Northbound favourites (Shanghai/Shenzhen listed stocks with highest daily turnover through the Stock Connect):

Despite the FIF and IIF adjustments I believe that China Bluechip investment euphoria will continue by way of passive investment and exposure at the point of inclusion into the MSCI in excess of $20 billion. Furthermore, with index adjustments relaxed over the medium term through expected policy change, a heavier weighted value-add should be seen toward direct general China investment and exposure to mid-cap Chinese equities. This will be achieved through greater alignment with international market accessibility standards, the resilience of the Stock Connect programme, further relaxation of daily trading limits, continued progress on trading suspensions, and further loosening of restrictions on the creation of index linked investment vehicles.

The China inclusion could grow from 0.73% weighting to as high as 14%. The timing of this will come down to the motivation of policy makers China and the overall demand of consumers for the MSCI to increase the China weighting. Furthermore, following MSCI’s addition as confidence in China’s capital markets strengthens, other index providers such as FTSE Russell will likely follow suit. This is not a matter of if, but when.

Overall the addition of the China A-shares to the MSCI EM Index, together with China’s yuan-denominated crude oil futures and allowing foreign investors to trade domestic iron ore futures is symbolic of China’s increased liberalisation of its financial markets and represents a new era where China is a true player in global markets as institutional investors globally gain confidence in China’s markets.

China A-shares will be available to trade via the Hong Kong Stock Connect across Saxo’s entire platform suite June 18.