Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Saxo Bank

Good Morning

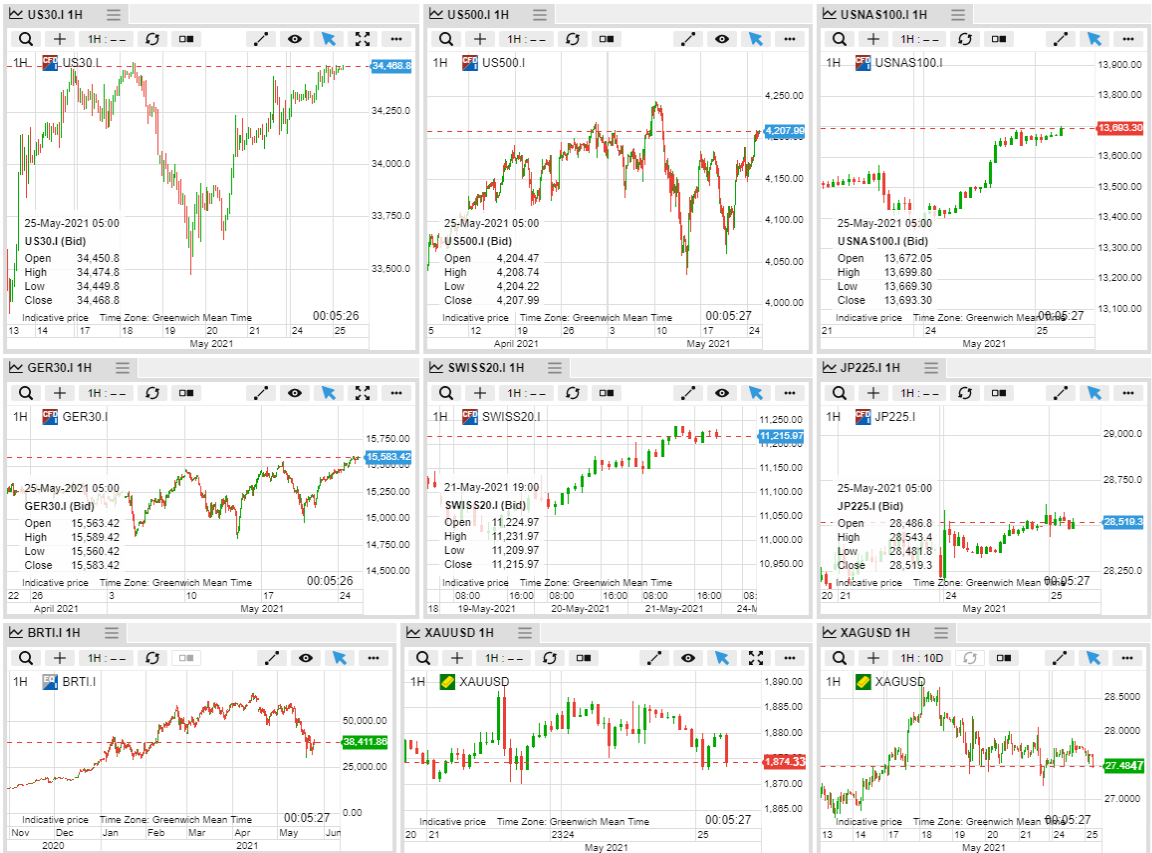

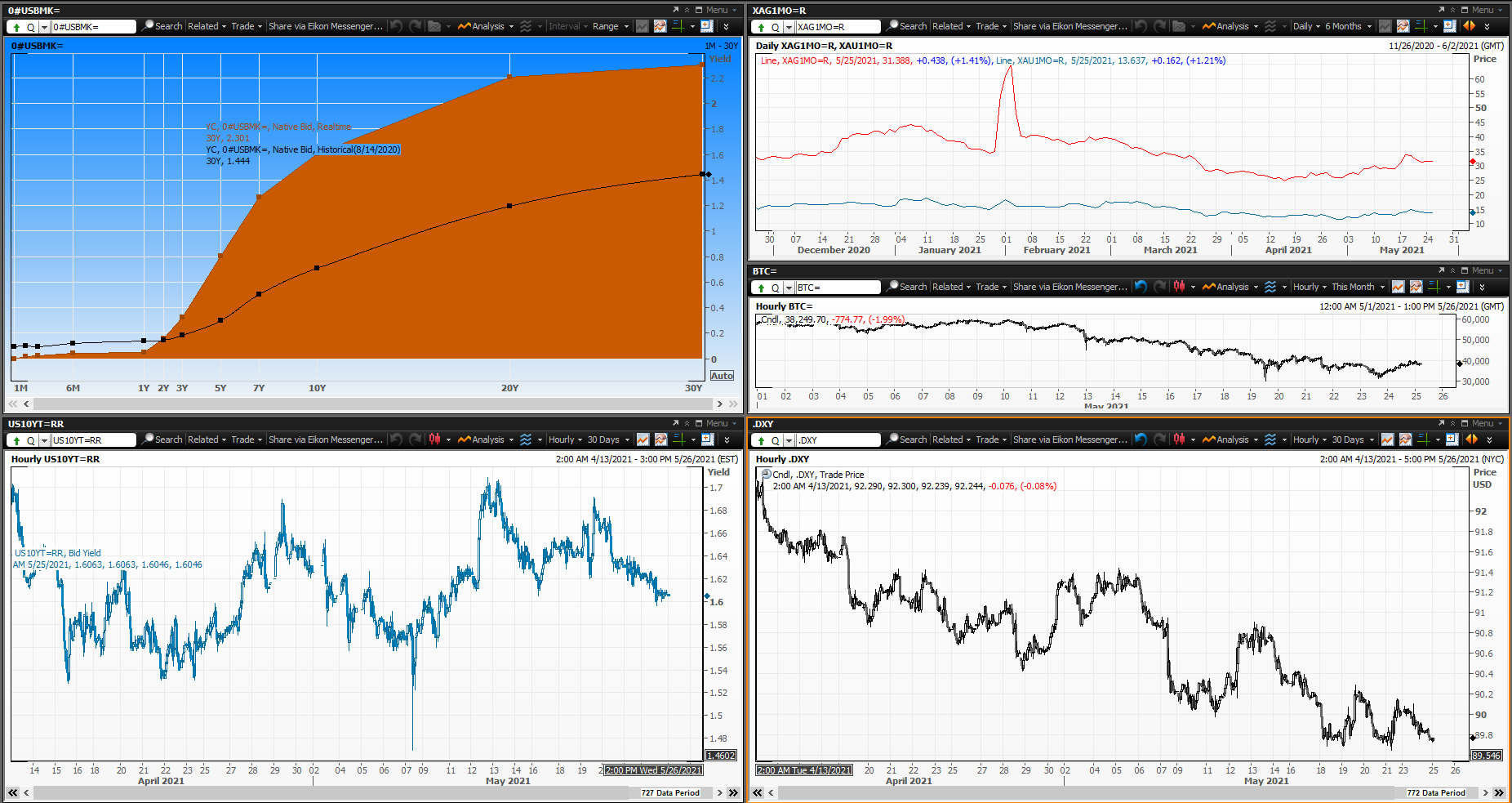

Equities continue their recovery, receding inflation worries are being cited as the driver, also the Fed Balance sheet keeps expanding. Several Fed speakers mention that they see rising inflation as transitory and not lasting.

Gold remains stronger than silver with Gold at 1875, near the recent highs and silver at 27.50. the USD Index is near recent lows, 89.66 is the level to watch. Treasury Yields remain under pressure, the 10 year is at 1.6063

Bitcoin has stabilized and remains heavily disputed on social media, currently near 38,000.

Singapore GDP Rose grew 1.3% YoY in the first quarter, vs 0.9% expected

The US says it expects strong backing from the G7 for it`s proposed 15%-plus global minimum corporate tax.

Vonovia is looking to take over Deutsche Wohnen, this would create one of the largest global real estate companies.

German GDP as well as US Consumer Confidence and New Home sales are the key events today.

Economic Events for the next few days:

Date | Time CET | Country/Region | Relevance | Indicator Name | Period | Reuters Poll |

25 May 2021 | 02:00 | Singapore | High | GDP Final YY | Q1 | 0.9% |

25 May 2021 | 08:00 | Germany | High | GDP Detailed QQ SA | Q1 | -1.7% |

25 May 2021 | 08:00 | Germany | High | GDP Detailed YY NSA | Q1 | -3.3% |

25 May 2021 | 09:00 | Indonesia | High | 7-Day Reverse Repo | May | 3.50% |

25 May 2021 | 09:00 | Indonesia | High | Deposit Facility Rate | May | 2.75% |

25 May 2021 | 09:00 | Indonesia | High | Lending Facility Rate | May | 4.25% |

25 May 2021 | 10:00 | Germany | High | Ifo Business Climate New | May | 98.2 |

25 May 2021 | 10:00 | Germany | High | Ifo Curr Conditions New | May | 95.5 |

25 May 2021 | 10:00 | Germany | High | Ifo Expectations New | May | 101.4 |

24 May 2021 | 13:00 | Ghana | High | Prime Interest Rate | May | 14.50% |

25 May 2021 | 14:00 | Brazil | High | IPCA-15 Mid-Month CPI | May | 0.55% |

25 May 2021 | 14:00 | Hungary | High | Hungary Base Rate | May | 0.60% |

25 May 2021 | 14:00 | Hungary | High | O/N Deposit Rate | May | -0.05% |

18 May 2021 | 14:30 | Chile | High | GDP YY | Q1 | 0.5% |

17 May 2021 | 15:00 | Russia | High | Unemployment Rate | Apr | 5.4% |

25 May 2021 | 16:00 | United States | High | Consumer Confidence | May | 119.4 |

25 May 2021 | 16:00 | United States | High | New Home Sales-Units | Apr | 0.970M |

25 May 2021 | 18:00 | Russia | High | Industrial Output | Apr | 6.5% |

24 May 2021 | 18:00 | Nigeria | High | Interest Rate | 25 May | 11.50% |

26 May 2021 | 04:00 | New Zealand | High | Cash Rate | 26 May | 0.25% |

26 May 2021 | 08:45 | France | High | Business Climate Mfg | May | 106 |

26 May 2021 | 15:30 | Kenya | High | Central Bank Rate | May | 7.00% |

27 May 2021 | 03:00 | South Korea | High | Bank of Korea Base Rate | May | 0.50% |

27 May 2021 | 03:30 | Australia | High | Capital Expenditure | Q1 | 2.0% |

27 May 2021 | 14:30 | United States | High | Durable Goods | Apr | 0.7% |

27 May 2021 | 14:30 | United States | High | GDP 2nd Estimate | Q1 | 6.5% |

27 May 2021 | 14:30 | United States | High | Initial Jobless Clm | 22 May, w/e | 425k |

28 May 2021 | 01:30 | Japan | High | CPI Tokyo Ex fresh food YY | May | -0.2% |

28 May 2021 | 01:30 | Japan | High | CPI, Overall Tokyo | May | |

28 May 2021 | 01:30 | Japan | High | Jobs/Applicants Ratio | Apr | 1.10 |

28 May 2021 | 01:30 | Japan | High | Unemployment Rate | Apr | 2.7% |

28 May 2021 | 08:45 | France | High | GDP QQ Final | Q1 | 0.4% |

28 May 2021 | 08:45 | France | High | GDP QQ Final | Q1 | 0.4% |

28 May 2021 | 08:45 | France | High | CPI (EU Norm) Prelim YY | May | 1.8% |

28 May 2021 | 09:00 | Switzerland | High | KOF Indicator | May | 136.0 |

28 May 2021 | 11:00 | Euro Zone | High | Consumer Confid. Final | May | -5.1 |

28 May 2021 | 13:00 | Brazil | High | IGP-M Inflation Index | May | 4.00% |

28 May 2021 | 13:00 | Angola | High | Interest Rate | 31 May | |

28 May 2021 | 14:30 | United States | High | Consumption, Adjusted MM | Apr | 0.5% |

28 May 2021 | 16:00 | United States | High | U Mich Sentiment Final | May | 82.9 |

28 May 2021 | 22:00 | Colombia | High | Interest Rate | May | |

31 May 2021 | 01:50 | Japan | High | Industrial O/P Prelim MM SA | Apr | |

31 May 2021 | 03:00 | China (Mainland) | High | NBS Manufacturing PMI | May | |

31 May 2021 | 08:00 | Denmark | High | GDP QQ Prelim | Q1 | |

31 May 2021 | 08:00 | Denmark | High | GDP YY Prelim | Q1 | |

31 May 2021 | 08:00 | Denmark | High | Unemployment Rate | Apr | |

31 May 2021 | 09:00 | Turkey | High | GDP Quarterly YY | Q1 | |

31 May 2021 | 09:00 | Switzerland | High | Official Reserves Assets CHF | Apr |