Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Global Macro Strategist

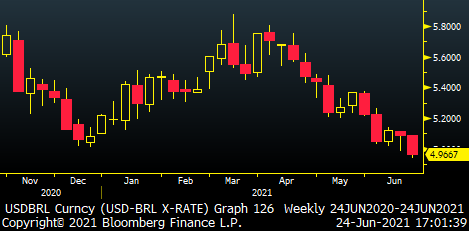

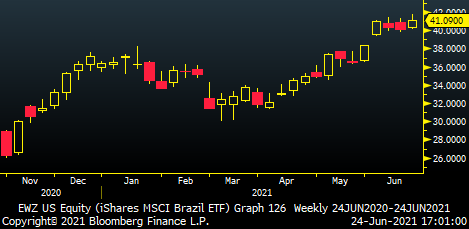

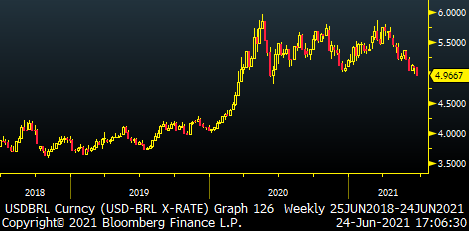

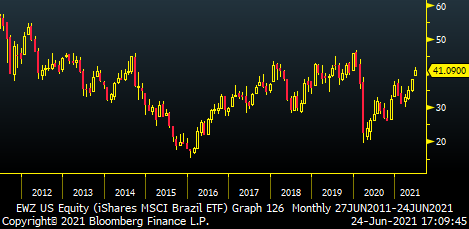

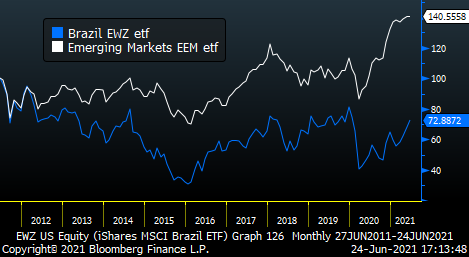

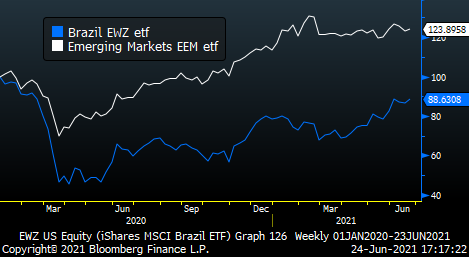

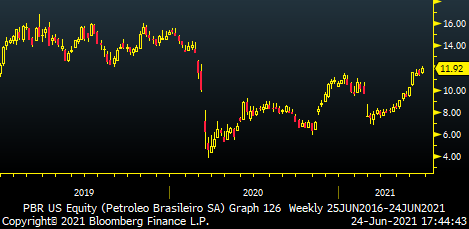

Summary: In this latest edition of Macro Reflections, KVP revisits his long contrarian bullish play on Brazil from late 2020, early 2021. This was a miss on the currency, yet a hit on the equities. We tune back in to an accelerating Hawkish Brazilian central bank in the BCB, that just hiked by +75bp last wk to 4.25%. Inflation is on fire (+8%) as the country faces its worst drought in close to 100yrs. We also take a look at the underperformance of Brazilian Equities (EWZ) vs. the rest of the Emerging Markets (EEM) and touch on the potential complications of Covid, as well as the 2022 presidential elections. VALE & PBR are also touched on.

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP