Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: EZ/German ZEW (Sep), US Retail Sales (Aug), Canadian CPI (Aug), US Industrial Production & Manufacturing Output (Aug), Business Inventories (Jul), NAHB Housing Index (Sep)

Earnings: Ferguson

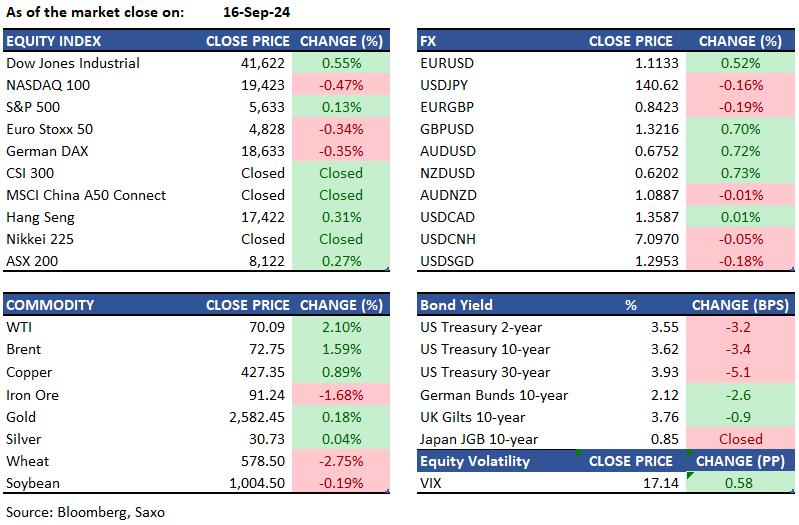

Equities: US stocks had a mixed performance on Monday. The S&P 500 rose 0.1%, the Dow Jones gained 228 points to a new record high, and the Nasdaq fell 0.5%. Investors are cautious ahead of the Federal Reserve's policy meeting on Wednesday, with a 60% chance of a 50-basis-point rate cut. Tech stocks dropped, with Apple down 2.8% and chipmakers like Nvidia and Broadcom falling 2%. Energy and financial sectors outperformed, with Chevron up 1% and JP Morgan rising 1.7%. Traders are on edge, anticipating market shifts based on the Fed's decision. Saxo’s ETF playbook for the Fed’s rate cuts offers a flexible way to adjust your portfolios for the shifting rate environment.

Fixed income: Treasuries advanced with gains concentrated at the long end of the curve, while the front end saw heightened activity ahead of Wednesday’s Fed rate decision. Yields had increased by 2 to 4 basis points across the curve. The 2s10s and 5s30s spreads tightened by 0.8 basis points and 2.5 basis points, respectively. US 10-year yields were around 3.625%, up by 2.5 basis points, outperforming both bunds and gilts for the day. The upcoming Fed announcement continues to influence price movements. Early trading saw the front end of the curve outperform, before gains at the long end led to a flatter curve. A corporate issuance of six names totaling $8 billion was smoothly absorbed. Additionally, traders are paying a premium to borrow 20-year Treasuries in the repurchase agreement market ahead of the $13 billion reopening auction of these securities on Tuesday.

Commodities: Oil climbed for a second session as expectations of a larger Federal Reserve interest-rate cut boosted market sentiment, offsetting signs of weakening demand. West Texas Intermediate traded above $70 a barrel after a 2.1% gain on Monday, while Brent closed near $73. Gold held steady near a record high, trading around $2,580 an ounce after hitting an all-time high on Monday. The market is divided on whether the Fed will cut rates by a quarter or a half-point at the Sept. 17-18 meeting. Lower borrowing costs typically benefit gold. Aluminum futures surged up to 3% on the London Metal Exchange after reports of an incident, raising concerns about another supply disruption in an already tight market.

FX: The US dollar was under pressure as markets continued to increase the odds of a bigger rate cut from the Fed this week after former NY Fed President Bill Dudley reiterated his remarks from last week saying that he thinks the Fed will start off the easing cycle with a 50bp rate cut. The DXY index trades close to its YTD lows that were printed in August, and gains in the Monday session were led by activity currencies. Kiwi dollar, Aussie dollar and British pound were all up 0.7% against the US dollar and the only G10 currency that closed in the red was Canadian dollar. As we highlighted yesterday, Bank of Canada governor appears to be making a case for a bigger rate cut at the October meeting, and a softer Canada CPI due today could be a green flag for such as move. The Japanese yen rose to its highest levels in a year against the USD in thin Asian trading yesterday, but could not sustain these gains. For more on our FX views, read the Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.