Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

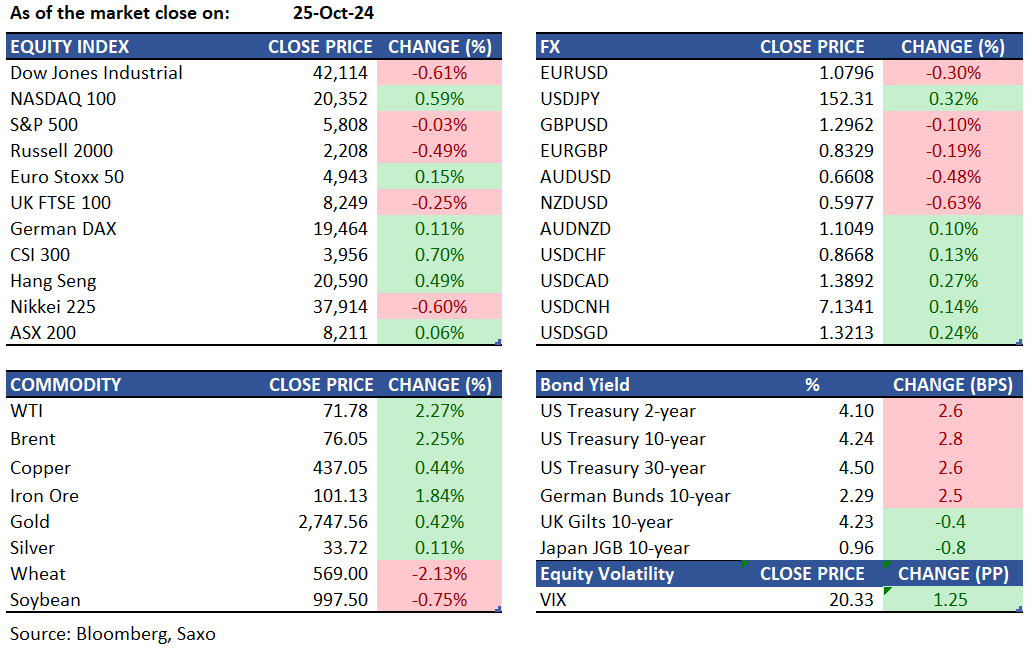

Macro:

Equities:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.