Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US CPI (September)

Earnings: Tilray, Delta, Domino’s, Thera, Neogen, Aehr

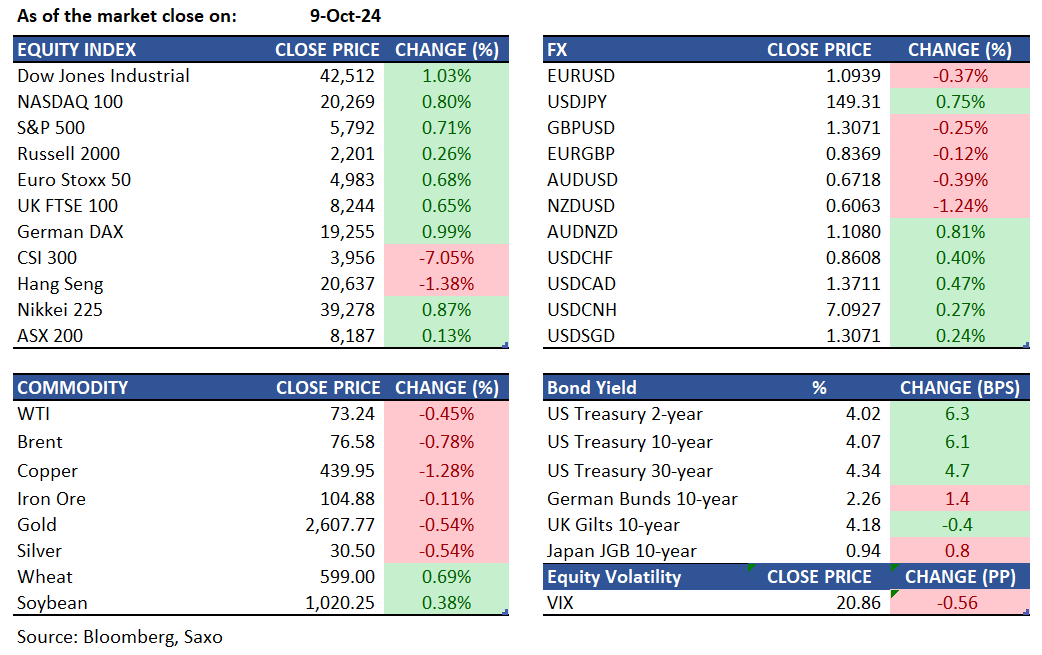

Equities: On Wednesday, both the S&P 500 and Dow Jones reached record highs, rising by 0.7% and 1% respectively, while the Nasdaq 100 rose by 0.8%. Investors were evaluating the latest Federal Reserve minutes and preparing for upcoming key inflation data. The minutes from the Fed's September meeting indicated that a "substantial majority" of officials favored a 50-basis-point rate cut, but future cuts remained uncertain. Both Logan and Daly showed to favour more gradual rate cuts in the next 2 meetings. Futures markets are now pricing an 83% probability that the next cut would be 25bps. Leading the market surge were tech giants such as Apple (up 1.7%), Amazon (up 1.4%), and Microsoft (up 0.7%). The rally helped alleviate concerns over Alphabet, whose shares dropped by 1.5% after the US Department of Justice suggested it might ask a judge to mandate Google to divest key businesses, including its Chrome browser and Android operating system, to address its search monopoly. Looking ahead, we await the key US CPI figure tonight for the month of September.

Fixed income: Treasuries declined as expectations for Federal Reserve policy easing, as reflected in the swaps market for this year and next, continued to fade. The session's lowest points were reached in the US afternoon following a lackluster 10-year note auction. A 30-year bond sale is scheduled for Thursday, coinciding with the release of September's CPI data. US yields had risen by 4 to 6 basis points for the day, with short and intermediate maturities seeing the largest increases, causing the 5s30s spread to flatten by about 1.5 basis points. The front end of the curve underperformed as the swaps market adjusted to reduced expectations for Fed easing, influenced by Michael de Pass, head of rates trading at Citadel Securities, who predicted only one 25 basis point rate cut by the end of the year.

Commodities: Gold prices fell for the sixth consecutive session, dropping below $2607, the lowest in about three weeks, due to a stronger dollar and expectations that the Federal Reserve will not lower interest rates as quickly as previously anticipated. WTI crude oil futures declined by 0.45% to $73.24, following a 4.6% drop the previous day, influenced by weak demand and rising supply. API data revealed a significant increase in US crude inventories, up nearly 11 million barrels, surpassing expectations. The US Energy Information Administration (EIA) also revised its 2025 demand forecast downwards, citing economic slowdowns in China and North America, adding further pressure on oil prices. Brent crude similarly fell by 0.78% to $76.58. Copper futures dropped to around $4.35 per pound, retreating from the three-month high of $4.6 reached on October 2nd, as markets reassessed the impact of Chinese stimulus on base metal demand in the near term.

FX: The dollar maintained its gains after the latest Federal Reserve meeting minutes revealed some resistance to a half-point interest rate cut. Traders are now focusing on the US inflation report due on Thursday. The yen weakened toward the key 150 per US dollar level, while the New Zealand dollar was the worst performer, dropping to its lowest level since August 19. This decline followed the central bank's decision to accelerate easing measures amid increasing concerns about an economic slowdown. The Bloomberg Dollar Spot Index rose by 0.4%, extending its winning streak to an eighth session, the longest since April 2022. The USDJPY 1-month implied volatility decreased by 0.115 vol to 12.67 as the FX pair retreated from the August 15 high of 149.39. The premium for hedging USDJPY downside over the next month compared to its upside narrowed as downside pressure eased.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.